Society

Society

The collection of indirect taxes in Việt Nam is forecasted to increase in the coming time while direct taxes is predicted to account for a smaller proportion, according to a Fair Tax Monitor Index report released by Vietnam Institute for Economic and Policy Research (VEPR) yesterday.

|

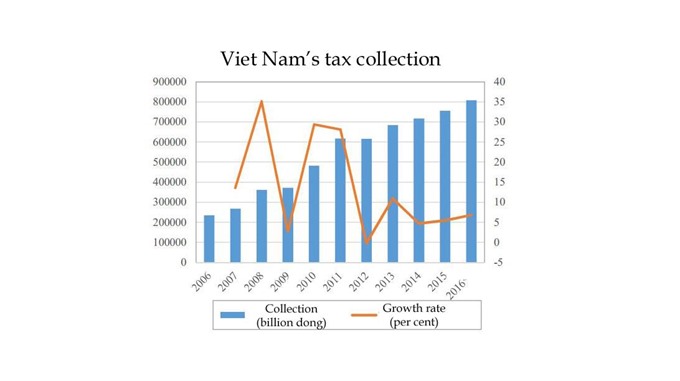

| Source: Finance Ministry and World Development Indicators |

HÀ NỘI — The collection of indirect taxes in Việt Nam is forecast to increase in the future while direct taxes is predicted to account for a smaller proportion, according to a Fair Tax Monitor Index report released by Vietnam Institute for Economic and Policy Research (VEPR) yesterday.

Associate Professor Nguyễn Đức Thành, VEPR head said the report on tax fairness presents a thorough assessment on the country’s State budget collection and spending.

The report pointed out that direct tax, which includes tax paid by individuals, organisations and property tax, made up less than 35 per cent of tax collection in 2016 compared with 65 per cent of indirect taxes. The indirect taxes include value added tax, export-import tax, special consumption tax and environmental protection tax.

Việt Nam’s percentage of direct tax ranks the second lowest among ASEAN-5 group (Việt Nam, Thailand, Indonesia, Malaysia and Philippines) and smaller than that of Organisation for Economic Co-operation and Development (OECD) countries. In contrast, Việt Nam’s indirect taxes rank the second highest in ASEAN-5 group and higher than OECD countries.

There are fears that low income people will have to pay higher income tax than people who earn more if the trend continues.

The fact that direct taxes account for less and less proportion in the tax system shows that Việt Nam’s collection depends much on consumption taxes, said Associate Professor Vũ Sỹ Cường from Academy of Finance, one of the report’s researchers.

Any proposal of increasing consumption taxes should be considered carefully, he said, warning negative impacts of consumption taxes on the balance between collecting and spending.

According to the report, in 2016, tax collection accounted for nearly 25 per cent of Gross Domestic Product (GDP) while budget spending over-exceeded collection, making up nearly 29 per cent of GDP.

The research team from VEPR and Oxfam said that Việt Nam is facing difficulties in how to balance State budget collection and spending. Reduced State budget collection from export-import activities and low crude oil price put pressure on State budget.

In 2017, the finance ministry considered increasing value added tax, however, finance experts were worried that this move would increase percentage of indirect taxes and go against tax system fairness.

To cut down on State budget overspending, the report recommended two measures: increasing collection and reducing spending. The Government should tighten regular spending by streamlining its workforce, re-organising its apparatus and cutting spending of organisations.

Public spending fairness has been also reviewed in the report.

Spending on health care sector remains less than on education. Spending on education was reported to account for 18 to 20 per cent of State budget during 2014-16 compared with about 7 per cent for health in 2016.

The report recommended spending on health care should be lifted up combined with health insurance policy.

Spending on agriculture - the sector with the highest number of poor people in Việt Nam - remains very low (only 6 per cent in 2012). Researchers proposed Government construct more roads and irrigation works in rural areas. — VNS