Economy

Economy

|

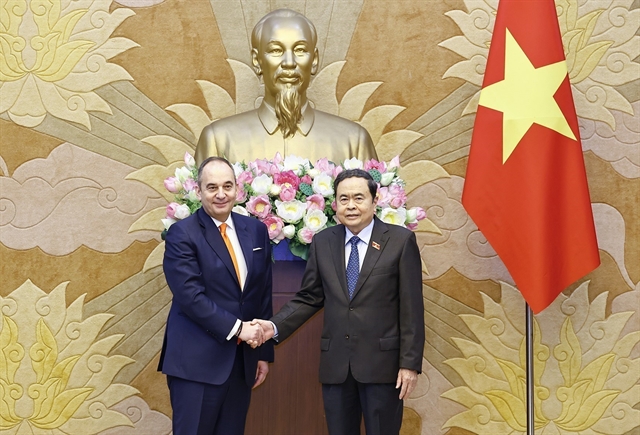

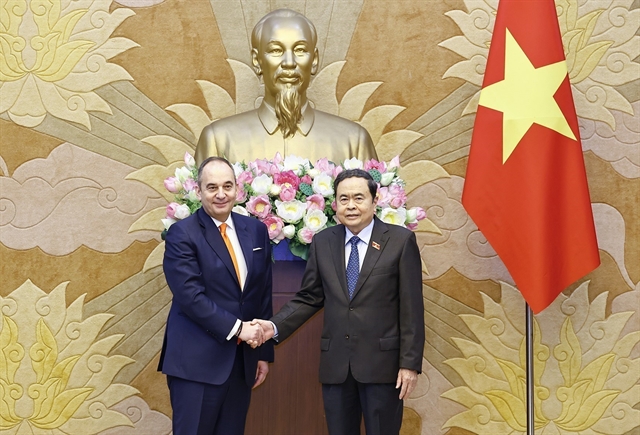

| The State Bank will re-assess the role of Decree 24/2012/NĐ-CP to determine its effectiveness and propose necessary changes. VNA/VNS Photo |

Compiled by Linh Anh

HÀ NỘI - Decree 24/2012/NĐ-CP, which governs the management of gold import and export activities by the State Bank of Việt Nam, is being revised to address the changing dynamics in the gold market.

Since 2014, no licences have been issued for gold imports for the production of gold bars, resulting in limited raw material supply. This has led to fluctuations in domestic gold prices, a significant price disparity between SJC-branded gold and other brands, and potential instability in the financial market and currency.

Therefore, there is a need to amend Decree 24/2012/NĐ-CP to ensure effective management of the gold market while maintaining its integrity.

Recognising the necessity for revision, Deputy Governor of the State Bank of Việt Nam, Đào Minh Tú, has acknowledged that Decree 24/2012/NĐ-CP should have been amended earlier to adapt to the current state of the gold market. The aim is to align supply and demand and consider alternative approaches to gold market management.

Under the current decree, the State Bank of Việt Nam holds a monopoly on gold bar production, while gold jewelry and art are managed by relevant authorities. The State Bank, therefore, will re-assess the role of Decree 24/2012/NĐ-CP to determine its effectiveness and propose necessary changes.

The deputy governor said: "Many experts also believe that it is time to reconsider SJC gold in comparison to other types and brands of gold. The ultimate goal is to manage the gold market without affecting the macroeconomy and safeguarding the interests of 100 million people."

Nguyễn Đức Anh, Deputy General Director of Bảo Tín Mạnh Hải Joint Stock Company, suggests allowing qualified enterprises to participate in gold bar production. This would contribute to stabilising the prices of SJC gold and gold bars, reducing the price difference compared to the global gold market as witnessed recently.

Shaokai Fan, regional director for Asia-Pacific (excluding China), and head of Central Banks at the World Gold Council, expresses the need to carefully consider various options in amending Decree 24/2012/NĐ-CP without disrupting the gold market. Any new regulation allowing gold imports will help narrow the price gap between domestic and international gold prices, ensuring the rights of investors.

The policy restricting gold imports is identified as the primary factor causing a considerable disparity between domestic and global gold prices in Việt Nam and Prime Minister Phạm Minh Chính has provided directives to address this issue, Shaokai Fan tells Đầu Tư (Investment) Newspaper.

Many experts and businesses hope that the gold market will experience greater liberalisation in the future. Any new regulations permitting gold imports will help narrow the price gap between domestic and international gold, safeguarding the rights of investors.

Observing global practices, it is evident that several countries effectively manage their gold markets by considering gold as a financial product rather than a mere physical commodity. Việt Nam can learn from the gold market management models adopted by countries such as China, India, and Turkey. Despite relying primarily on gold imports without domestic production, these nations successfully meet their domestic gold demand, according to Shaokai Fan.

In a regular government meeting in February, Prime Minister Phạm Minh Chính instructed the State Bank to promptly propose amendments to Decree 24/2012/NĐ-CP on gold business management. The Prime Minister's Directive No 06/CT-TTg on February 15, 2024, also urged the State Bank to expedite the review of the Decree and propose effective solutions for gold market management in the first quarter of 2024.

According to Đào Xuân Tuấn, Head of the Foreign Exchange Management Department under the State Bank, the State Bank, in collaboration with relevant ministries and agencies, is actively reviewing Decree 24/2012/NĐ-CP and considering all existing issues.

The objective is to ensure effective gold price management while preserving market integrity. The State Bank continues to monitor the gold market closely and is prepared to implement measures to stabilise the market as needed, he said. VNS