Economy

Economy

|

| A logo of VIB seen at a building in HCM City. — Photos courtesy of VIB |

HÀ NỘI — Vietnam International Bank (VIB) has announced its business performance for the first half of 2025, reporting a profit before tax of exceeding VNĐ5 trillion (US$192 million), up 9 per cent year-on-year compared to 2024.

The bank's credit growth reached 10 per cent in during the period, contributing to total assets surpassing VNĐ500 trillion, with well-managed and optimal asset quality.

Resilient and prudent balance sheet

As of June 30, 2025, VIB reported total assets exceeding VNĐ530 trillion, marking an 8 per cent increase year-to-date.

Total credit reached over VNĐ356 trillion, up 10 per cent. This growth was driven by solid performance across retail banking, small- and medium-sized enterprises (SMEs), corporate clients and financial institutions.

Retail banking remained a standout segment, fueled by VIB’s flexible loan offerings, accelerated digital transformation and a customer-centric strategy.

The bank has also introduced a VNĐ45 trillion home loan package designed to make homeownership more attainable for young customers. A standout feature of the offer is the “borrow VNĐ1 billion, repay VNĐ1 million in principal per month for the first five years” option, easing early financial pressure on borrowers.

The package includes a competitive fixed interest rate starting from 5.9 per cent, flexible repayment terms, no early repayment penalties and instant approval powered by AI technology — enhancing both accessibility and convenience for applicants.

In the SME and corporate and institutional banking segments, VIB maintained a selective credit expansion strategy, prioritising working capital and business financing needs amid a low-interest environment.

Meanwhile, the bank reported a 10 per cent year-to-date growth in customer deposits, reaching more than VNĐ304 trillion. Notably, Current Account Savings Account (CASA) and the newly launched Super Account recorded a 51 per cent increase, underscoring the effectiveness of VIB’s funding strategy aimed at optimising idle cash flow.

Since its launch in early 2025, the Super Account has attracted over 500,000 active users, significantly broadening VIB’s base of high-potential customers and boosting engagement across its banking products and services.

Aligned with its vision to become a smart financial partner, VIB continues to accelerate digital transformation and introduce flexible, customer-centric solutions to enhance service efficiency and support sustainable deposit growth.

According to VIB, asset quality continued to show improvement in H1. The non-performing loan (NPL) ratio declined to 2.54 per cent, down 0.14 percentage points from the end of Q1, reflecting the effectiveness of VIB’s prudent credit policies and focus on high-quality customers.

VIB’s loan portfolio remains highly secured, with over 75 per cent of outstanding loans in retail and SME segments, more than 90 per cent of retail loans are backed by fully legal real estate assets, primarily located in major urban areas.

In the second quarter of 2025, the bank successfully completed the distribution of a 7 per cent cash dividend, as approved at its Annual General Meeting earlier this year.

Key risk indicators remained well within regulatory thresholds, highlighting the bank’s solid financial foundation. VIB's capital adequacy ratio (CAR) under Basel II stood at 12 per cent, significantly above the 8 per cent regulatory minimum. The loan-to-deposit ratio (LDR) was maintained at 77 per cent, below the 85 per cent cap, while the ratio of short-term funding used for medium- and long-term loans was kept at 23 per cent, under the 30 per cent regulatory limit. Additionally, the Net Stable Funding Ratio (NSFR) under Basel III reached 111 per cent, exceeding the 100 per cent standard.

Posting 9 per cent profit growth in H1, strengthens income diversification

|

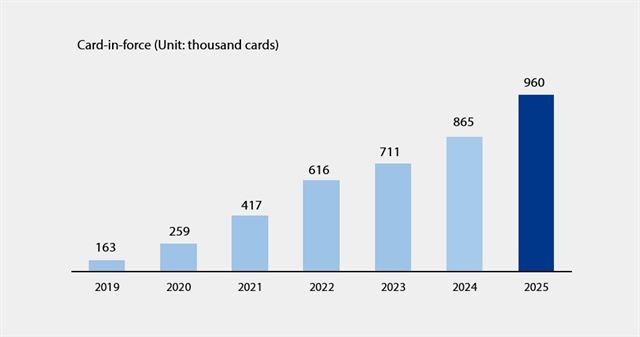

| A chart shows the number of card-in-force at VIB from 2019 to H1 2025. — Photo courtesy of VIB |

By mid-2025, VIB posted total operating income of over VNĐ9.7 trillion and a pre-tax profit exceeding VNĐ5 trillion, marking a 9 per cent year-on-year increase. Net interest income (NII) remained the primary revenue driver, reaching more than VNĐ7.7 trillion, supported by the bank’s strong emphasis on retail lending with competitive rates and a focus on high-quality, well-collateralised borrowers.

Aligned with Government directives to support credit rates, VIB kept lending rates at reasonable levels, contributing to Việt Nam’s ongoing economic recovery. The bank’s net interest margin (NIM) held steady at 3.4 per cent, ensuring sustainable profitability.

Non-interest income contributed significantly to VIB’s total operating income, accounting for approximately 21 per cent, largely fuelled by fee- and service-based activities. As of June 30, 2025, the bank had nearly one million active cards in circulation, with total card spending exceeding VNĐ67.9 trillion in the first half of the year, a 15 per cent year-on-year increase.

Additionally, VIB’s newly launched digital banking services, including bill payments, international transfers, tuition and insurance payments, along with customised solutions for corporate clients, have played a key role in boosting fee and service income.

The bank reported a 1 per cent year-on-year reduction in operating expenses in the first half of 2025, driven by ongoing process optimisation and effective cost management efforts. At the same time, credit risk provisions fell sharply by 49 per cent compared to H1 2024, supported by a robust provisioning buffer prudently established in prior quarters.

Advancing digital ecosystem to boost customer engagement

|

| VIB's ultimate personalised financial ecosystems. — Photo courtesy of VIB |

Continuing the technology pioneer strategy and personalised financial ecosystems, VIB recently launched two breakthrough products: Super Pay – an intelligent payment solution and Super Cash – a flexible lending solution. These two key offerings are important components in completing VIB’s personalised financial super ecosystem, empowering users to manage their finances in a smart, safe and efficient way.

VIB’s Super Pay empowers users to manage spending through three innovative features integrated within the MyVIB app: PayFlex – flexible selection of payment sources, PayEase – on-demand installment conversion and PaySafe –proactive transaction authentication for added security.

Meanwhile, Super Cash offers a flexible credit solution that enables customers to transfer up to VNĐ1 billion in credit limits between their credit card and cash loan seamlessly. The entire process is completed online via the Max by VIB app, featuring a streamlined application process, transparent interest rates and no early repayment fees.

With its suite of offerings, including Super Pay, Super Cash, Super Account and Super Card, VIB is steadily realising its vision of creating a comprehensive digital financial ecosystem that empowers customers with greater control over their finances in today’s digital era.

The bank’s strong first-half performance underscores the effectiveness of its strategic focus on operational efficiency, robust risk management and accelerated digital transformation. Backed by a solid financial foundation, a high-quality loan portfolio and an increasingly integrated digital ecosystem, VIB is well-positioned to accelerate growth in the second half of 2025, delivering sustainable value to customers, shareholders and the broader economy. — VNS