Economy

Economy

HÀ NỘI — The gold market has captured the attention of investors worldwide in the past week, with prices surging to unprecedented levels.

On March 14, international spot gold reached a record high of US$3,004.86 per ounce, a dramatic increase that has left many investors grappling with the decision to buy or sell.

The surge can be attributed to a combination of factors, including geopolitical tensions, fluctuating economic policies and the ongoing trade conflict, particularly involving the US.

Concerns over potential recession and inflation have prompted investors to seek refuge in gold, traditionally considered a safe-haven asset.

Gold has risen by 14 per cent since early 2025, outpacing most forecasts from major financial institutions.

Previously, predictions from firms like Goldman Sachs had suggested that gold would surpass only the $3,000 mark by the end of the year. However, this milestone was reached within just 2.5 months, indicating a more volatile market than anticipated.

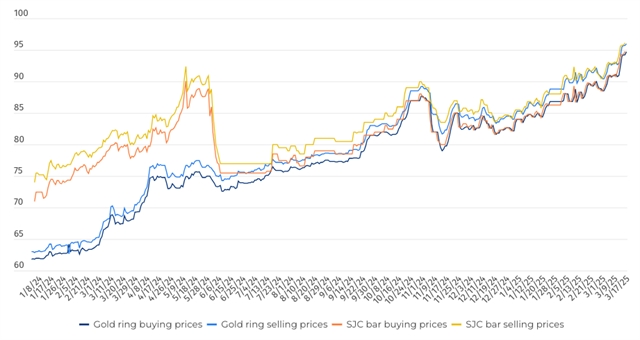

The gold market in Việt Nam has mirrored global trends, with local prices reflecting the soaring international rates.

|

| Vietnamese gold price fluctuations since 2024. — Graphic: Ly Ly Cao |

On Monday morning, the SJC gold bar was priced at VNĐ94.8 million per tael for sellers and VNĐ96.1 million per tael for buyers, the historical high values for the domestic gold bar. Similarly, gold ring prices at Phú Quý Jewelry quoted at record-high levels of VNĐ95.2 million for sellers and VNĐ96.7 million for buyers.

Such fluctuations have resulted in a busy trading environment, with many Vietnamese citizens buying gold amid fears of missing out (FOMO).

FOMO

The phenomenon of FOMO has become increasingly prevalent among investors as gold prices continue to reach new heights.

Many individuals, driven by the fear of missing the opportunity to invest at a lower price, have rushed to purchase gold.

This behaviour has led to a significant increase in demand, further inflating prices.

According to Dr. Nguyễn Hữu Huân, a financial expert at the University of Economics Hồ Chí Minh City, the continuing climb in gold prices has created a psychological barrier for many investors, who fear being left behind in this gold rush.

While such enthusiasm can drive prices even higher in the short term, it also poses significant risks. The gold market is notoriously volatile, and those who enter at peak prices may find themselves vulnerable to substantial losses if a correction occurs.

The dual nature of the market, supportive factors like increased institutional buying juxtaposed with the potential for sharp price adjustments, creates a precarious environment for new investors.

|

| A customer buys SJC gold bar at a Vietcombank branch in Hà Nội. — VNA/VNS Photo |

Navigating risks

Experts warn those considering entering the gold market at this time. The current high prices may present a risky investment landscape for newcomers.

The $3,000 per ounce price level represents a significant psychological barrier for investors. The potential for purchases at this peak could arise at any moment, increasing the investment risk in gold to unprecedented levels.

In fact, on March 15, the spot gold swiftly corrected due to rising selling pressure and closed the week at $2,985 per ounce right after touching nearly $3,005.

Phan Dũng Khánh, an investment consultant, suggests that individuals who have held gold for an extended period may choose to retain their investments or make modest additions. However, for those entirely new to gold investment or those who have previously sold their holdings, now may not be the best time to enter the market again.

Investors should be particularly wary of the psychological barriers that come with investing in a high-demand, high-price environment. The risk of a price correction is heightened as investors who entered the market during the recent price surge may rush to secure profits, leading to increased selling pressure.

This cycle of buying and selling can lead to unpredictable market behavior, making it crucial for investors to have a well-defined strategy.

In light of the current market conditions, financial experts recommend that investors maintain a diversified portfolio. Allocating only a modest percentage of total investments, typically between 5 per cent and 10 per cent, to gold can mitigate risks associated with high volatility. Remaining assets should be distributed among other investment vehicles such as stocks, bonds, and real estate.

Additionally, experts caution against leveraging loans to invest in gold. Using borrowed funds for such investments can amplify risks and lead to significant financial losses, particularly if market conditions shift unexpectedly. — BIZHUB.VN/VNS