Economy

Economy

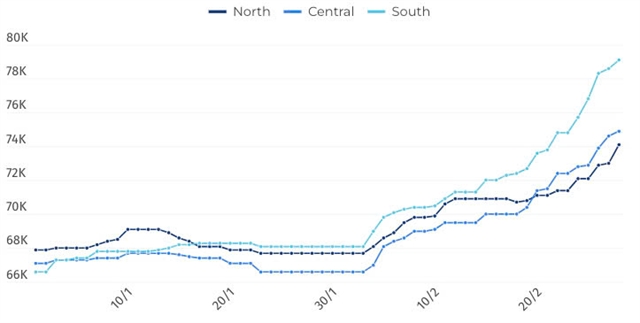

HÀ NỘI — Việt Nam’s livestock market has experienced significant fluctuations in recent weeks, with soaring live hog prices driving a surge in the stock values of major industry players.

Since early February, the domestic live hog and pork retail prices have steadily climbed due to supply shortages. By March 6, prices in southern Việt Nam reached the highest levels nationwide, while northern and central regions also saw substantial increases.

|

| Live hog prices since the beginning of the year. — Graphic: Ly Ly Cao |

Data compiled by Việt Nam News showed that the average live hog price across the country rose by 9.5 - 16 per cent - all within just over a month.

The sharp price hikes have directly impacted the business performance of livestock enterprises, leading to a bullish trend for their stocks.

Key market players, including Dabaco (DBC), BAF Vietnam (BAF), Hoàng Anh Gia Lai (HAG) and Masan MeatLife (MML), all witnessed notable stock price increases.

Since early February, DBC’s stock surged over 22 per cent, reclaiming its historic peak and pushing its market capitalisation beyond VNĐ10 trillion (US$391.7 million).

BAF's share price similarly soared by 22 per cent, reaching a new high, doubling in value compared to six months ago. Meanwhile, HAG rose by 6 per cent and MML climbed 20 per cent, showing positive recovery momentum despite remaining below their all-time highs.

According to Vietcombank Securities (VCBS), livestock stocks are poised to benefit further from the ongoing rise in hog prices.

Supply constraints, the impact of the new Livestock Law and lingering disease outbreaks have forced many small-scale farmers to exit the market.

Additionally, the prices of grains, a primary component in animal feed, have shown signs of increasing, adding more pressure to production costs.

|

| A farmer feeding pigs at a farm in Đồng Nai Province. — VNA/VNS Photo |

VCBS expected live hog prices will climb around 18 per cent throughout 2025, with tight supply conditions in the early months sustaining elevated prices through the first half of the year. However, as larger enterprises scale up operations, supply could rebound by year-end, potentially leading to a slight price correction.

Notably, the new Livestock Law, set to take effect in 2025, is expected to accelerate the market shift from smallholder farms to large-scale corporations, especially those with robust financial resources and expansive land reserves.

The complexities of disease control and rising feed costs have already reduced the smallholder market share from 70 per cent to 49 per cent by the end of 2024, and many small farmers have opted to liquidate their herds ahead of the law's implementation.

Amid this transition, major livestock firms are seizing opportunities to expand their market presence and enhance production efficiency.

Dabaco, the leading industry player, has developed an in-house vaccine slated for commercial rollout in the first quarter of 2025. This vaccine is expected to stabilise herd health, minimise disease-related losses and generate a new revenue stream.

VCBS forecasts Dabaco’s initial production capacity at 200 million doses annually, with 2.4 million doses reserved for internal use. The remaining supply could drive an estimated VNĐ1.18 trillion in revenue and VNĐ59.2 billion in profit for the company in 2025.

The company plans to expand its operations with new large-scale farms in Thanh Hoá, Quảng Trị, Quảng Ninh and Thái Nguyên provinces from 2026 to 2027. Each farm is designed to house 3,000–5,000 sows and 50,000–70,000 market hogs.

It is also set to launch a soybean oil extraction and refining plant in 2025, aiming to boost production efficiency and reduce input costs.

Other major players are also intensifying their expansion strategies. BAF Việt Nam is investing heavily in high-tech farming systems to improve productivity and product quality.

Hoàng Anh Gia Lai, after a restructuring period, has refocused on livestock farming and achieved encouraging results. Meanwhile, Masan MeatLife, a subsidiary of Masan Group, continues scaling up production to meet rising consumer demand. — BIZHUB/VNS