Economy

Economy

|

| Customers at an HDBank branch in HCM City. Moody's Investors Service has confirmed HDBank’s B1 long-term foreign and local currency bank deposits and issuer ratings. — Photo courtesy of the bank |

HCM CITY — Moody's Investors Service has confirmed HDBank’s B1 long-term foreign and local currency bank deposits and issuer ratings.

It also confirmed the lender’s B1 ratings for long-term foreign and local currency counterparty risk, long-term counterparty risk assessment, foreign and local currency issuer, and foreign and local currency bank deposits.

Moody’s said: “The confirmation of HDBank's long-term ratings and BCA (Baseline Credit Assessment) reflects the bank's broadly stable credit profile through the cycle, underpinned by its granular loan book, strong profitability and capital retention.”

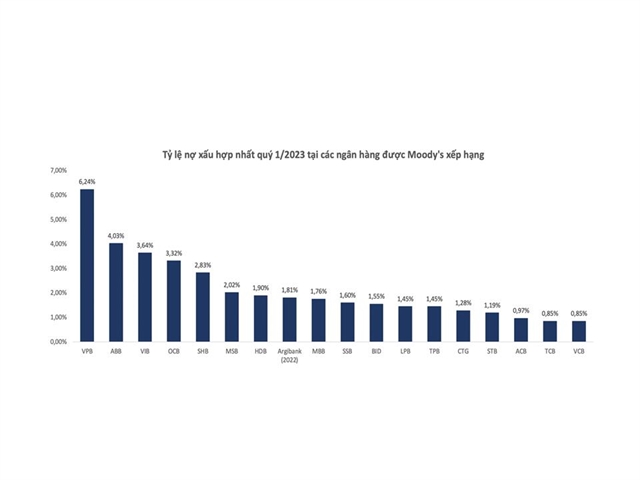

According to its assessment, as of March 2023 HDBank's nonperforming loan ratio was at 1.9 per cent, lower than the average of 2.3 per cent for Moody's rated peers in Việt Nam.

The bank's focus on retail and small and medium-sized enterprise borrowers has resulted in low concentration risk and reduces the risk of a spike in nonperforming loans, it said.

|

| The table shows non-performing loan ratios at banks rated by Moody's. |

HDBank has strong profitability, Moody’s said.

For the first three months of 2023 its annualized return on assets was 2.4 per cent, higher than the average of 1.7 per cent for Moody's rated peers.

Moody's has changed the rating outlooks, where applicable, to negative from ratings under review, reflecting its expectation that persistently high loan growth and HDBank's planned acquisition of a weak bank will strain the bank's credit profile.

Phạm Quốc Thanh, general director of HDBank, said while it is understandable for Moody's to have a cautious view on HDBank’s rating outlook, the bank has strategies for this acquisition.

As for the growth in outstanding loans, HDBank is proud of its very good asset quality thanks to its lending strategy that focuses on agricultural and rural development and supply chain financing, he said.

In the first quarter of 2023 HDBank’s business results exceeded expectations, with pre-tax profit reaching VNĐ2.74 trillion ($116.4 million). Notably, capital adequacy, NPL and profitability ratios continued to remain at good levels vis-à-vis the industry.

Its capital adequacy ratio based on to Basel II norms is 12.5 per cent, of which tier 1 capital accounted for 10 per cent.

The consolidated NPL ratio was 1.9 per cent and the standalone NPL ratio was 1.5 per cent, lower than the industry’s average (of around 2.9 per cent as of the end of February 2023).

Operating expenses were effectively managed, with an expense/income ratio of 34.6 per cent, a sharp improvement from the 39.3 per cent at the end of 2022. — VNS