Brandinfo

Brandinfo

Vietnam International Bank (VIB) held the 2022 Annual General Meeting (AGM) in HCM City on March 16.

During the event, the bank’s shareholders approved the plan to distribute bonus shares to existing shareholders at 35 per cent and increase the charter capital to more than VND 21,000 billion. They also approved a profit of VND 10,500 billion set for 2022.

|

VIB’s business performance leads the industry in the first phase of strategic transformation (2017–2021)

During the first five years of the 10-year transformation journey between 2017 and 2026, VIB focused on building a strong, high-growth and sustainable management system, maintaining its leading position in core business segments.

With a solid foundation, VIB stands out in the banking industry in terms of growth rate, business market share and outstanding business results.

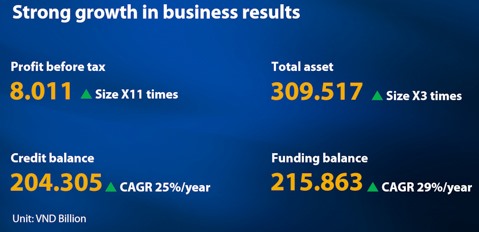

From 2017 to 2021, VIB's profit increased 11-fold to surpass VND 8 trillion in 2021. Its total asset tripled, from about VND 100 trillion in 2016 to nearly VND 310 trillion in 2021. Compound annual growth rate (CAGR) of credit and deposit stood at 25 per cent and 29 percent, respectively, for five consecutive years.

|

VIB's strong business results in the first phase of transformation (2017-2021)

According to VIB leaders, the bank’s strong growth has been fueled by three core business segments: retail banking, corporate banking, capital resources, and foreign exchange.

The retail banking segment has particularly been considered by VIB as the top priority for investment to make it the leading retail bank in Việt Nam in terms of quality and scale.

Currently, VIB leads the market with a retail lending ratio accounting for nearly 90 per cent of the credit portfolio, compared to the industry average of 40 per cent. In which nearly 95 per cent of the portfolio is collateral.

In terms of scale, VIB ranks among four leading private commercial joint stock banks with the largest retail segment and continuously leads the market share in key business areas such as auto loans, life insurance, and credit cards.

The outstanding development of digital banking is also one of the remarkable achievements the bank has made over the past five years, with 97 per cent of transactions conducted on the digital platform by its customers.

An effective listed firm offers increasing benefits for shareholders

After more than one year of listing on the Ho Chi Minh Stock Exchange (HoSE), VIB’s market capitalization and the value of its shares have also marked important milestones in addition to the impressive and sustainable growth in business results.

As of December 31, 2021, VIB's market capitalization reached more than VND 70 trillion, 2.4 times higher than the first day listed on HoSE. It was also recognized as one of the top 5 private commercial joint stock banks and placed 19th position among enterprises with the largest market capitalization. Besides, VIB's stock increased strongly and ranked in the top 3 in the banking industry, bringing high profits for investors. VIB stock also ranked 12th in contribution to the VN-Index in 2021.

Thanks to its outstanding results in 2021, the bank received many prestigious awards such as Top 50 best-listed companies in Viet Nam voted by Forbes and Top 10 prestigious and effective public companies selected by Vietnam Report.

AGM greenlights business plan in 2022

The AGM of VIB approved the plan to raise the charter capital to over VND 21,000 billion in 2022, up 35.7 per cent year-on-year. In which, the bank will distribute bonus shares of 35 per cent to existing shareholders and 0.7 per cent to employees from equity.

This plan comes from the bank's capital needs for investment projects in technology systems, networks, and credit extension, meeting the capital adequacy ratio in business in accordance with the provisions of the Law.

In addition, the bank’s Employee Stock Ownership Plan (ESOP) policy is expected to facilitate the development of the quality personnel resource, serving its business and operation activities.

VIB sets sustainable growth targets in the next period, pioneers a strong governance foundation, and leads in digitalization. It is also consistent with becoming the country’s leading retail bank in quality and scale.

VIB is striving to at least 30 per cent compound annual profit growth for 2022-26, the customer base to be nearly tripled, and market capitalization to grow impressively.

In 2022, the bank expects its main growth indicators in total assets, credit scale, mobilization and profit before tax to increase at least 30 per cent. In which profit is estimated at VND 10,500 billion, helping VIB maintain its position as the leading bank in the market with a return on equity (ROE) rate of 30 per cent.

|

VIB’s 2022 profit plan

Meanwhile, the bank also sets out a strategy to continuously develop and perfect its products and services to bring optimal benefits to customers.

In addition, it will facilitate the application of leading technologies such as automation, artificial intelligence, machine learning, Big Data, and cloud computing to meet the needs of customers and business partners better.

In the near future, MyVIB 2.0, website and digital platforms for business will remain as major technology projects of VIB to maintain its position as No 1 bank in terms of digital banking experience in Viet Nam.

Besides Basel II, Basel III, IFRS, which are international governance standards that VIB has pioneered and successfully applied in Viet Nam over the years, the bank will continue to position itself as a leader in applying the best international standards in design, operation, business control as well as risk management.

A strong business foundation with professional and sufficient investment in retail, technology and management are expected to help VIB make good use of the market's potential, continue to make breakthroughs, and affirm its position as the leading retail bank in terms of scale and quality in Viet Nam in the future.