Politics & Law

Politics & Law

Vietnamese lawmakers remain at odds over measures to deal with officials’ unexplained wealth included in the draft revised Law on Anti-Corruption.

|

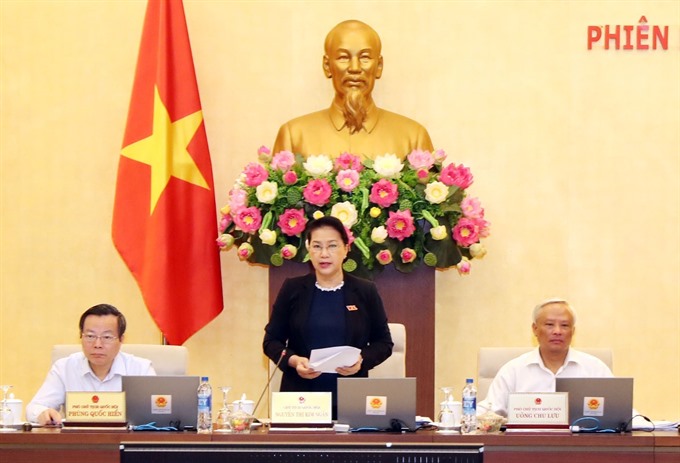

| National Assembly Chairwoman Nguyễn Thị Kim Ngân the 26th session of the NA Standing Committee. — VNA/VNS Photo Trọng Đức |

HÀ NỘI — Vietnamese lawmakers remain at odds over measures to deal with officials’ unexplained wealth included in the draft revised Law on Anti-Corruption.

During the 27th sitting of the National Assembly (NA) Standing Committee that opened on September 10, Chairman of the NA Justice Committee Lê Thị Nga said that the NA Standing Committee had reached consensus on the majority of notable issues in the draft law, but disagreements remained.

Many deputies have been calling for suspected officials to be brought to justice so that the courts can review the evidence and deliver a verdict, either issuing orders for assets to be recovered or dismissing the case.

Those in favour of this option said this was a standard practice in many countries, and would show the State’s hard-line stance against illicit enrichment and ensure “objectiveness, transparency, and the interests of the parties involved”.

Other deputies, however, are leaning towards imposing taxes on unexplained increases in wealth if State’s agencies are unable prove the illegitimacy of questionable incomes, which they said was faster and “less strenuous” on those required to account for their incomes compared to appearing in court. However, this option was criticised as it could “legitimise potentially corrupt assets” since tax should only be levied on lawful assets and property.

It was also considered to be unnecessarily lenient and wanting in transparency, compared to taking these matters to court, which the NA Justice Committee and the drafter of the revised law are more inclined.

NA deputy chairman Phùng Quốc Hiển, presiding over the session, said that the law should also focus more on ‘prevention’.

Hiển was also a proponent of the taxation approach, saying that heavy tax could possibly “recover more than the value of the unexplained riches”.

NA Chairwoman Nguyễn Thị Kim Ngân said the reports on the pros and cons of the two options would be submitted to the Politburo for review.

26th sitting agenda

Also the same day, the NA Standing Committee examined a plan to organise a vote of confidence for persons holding positions elected and approved by the NA at the 6th NA session.

The session, to last until September 20, will give opinions on four bills which were discussed at the fifth session of the NA, namely the draft revised Law on Anti-Corruption law, the draft revised Law on Education, the draft law adjusting and supplementing a number of articles of the Law on Higher Education, and the draft law adjusting and supplementing laws related to the Law on Planning.

The committee will also consider four other bills, to be submitted for first-time discussion at the sixth NA session, which are the draft laws adjusting and supplementing a number of articles of the Laws on Execution of Criminal Judgements and on Public Investment; the draft revised Law on Tax Management, and the draft Law on Public Administration.

Several reports will be tabled for examination, including one by the Government on the implementation of the Constitution, Laws and the NA’s resolutions, and another on the handling of complaints and petitions in 2018, among others.

The draft working agenda for the 6th NA session, slated to begin on October 22, will also be under consideration by the NA Standing Committee, along with several issues related to foreign relations and the State budget. — VNS