Economy

Economy

|

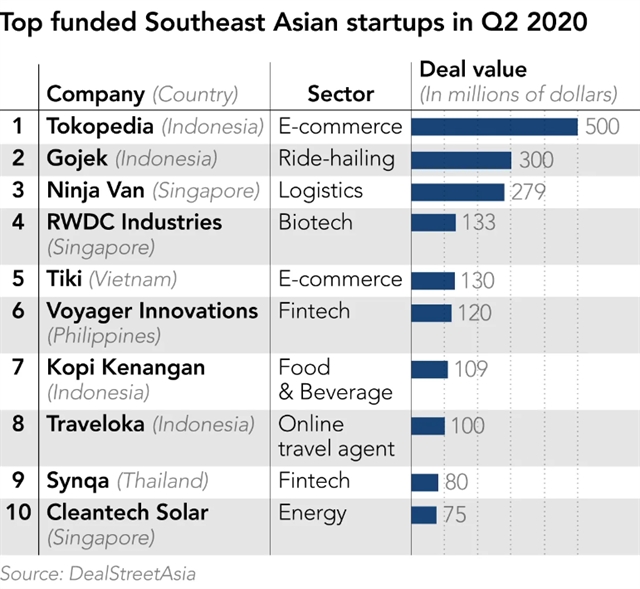

HÀ NỘI — Investment in start-ups in Southeast Asia soared in the second quarter of this year despite the COVID-19 pandemic, led by e-commerce and fintech companies.

Data from Singapore-based start-up information platform DealStreetAsia showed the value of fundraising deals in Southeast Asia rose 91 per cent on the year to US$2.7 billion in the second quarter of this year, while the number of transactions increased by 59 per cent to 184 compared to the same period last year.

Of these, Indonesia topped in deal value, accounting for 45.6 per cent.

Singapore ranked second, followed by Việt Nam, the Philippines and Myanmar.

E-commerce topped the chart by raising $691 million, followed by logistics with $360 million and fintech at $496 million.

Tokopedia, an Indonesian e-commerce unicorn, attracted the most capital at $500 million.

Vietnamese e-commerce company Tiki raised $130 million in a deal led by the Northstar Group, the fifth-biggest deal in the region in the first six months.

Ngô Hoàng Gia Khánh, Tiki’s vice president of business development, said that the company recorded significant growth in customers' shopping needs during the pandemic, especially masks, handwash and necessities.

Using a nationwide network of order fulfilment centres and an express delivery service called TikiNow, Tiki made a difference from domestic and regional rivals, said Khánh.

It also offers free installation for heavy and bulky goods.

The growing demand for online shopping in Southeast Asia has also heated up the logistics and delivery sector.

Singapore's Ninja Van announced a $279 million fundraising round in May.

Fintech is also rising and Voyager Innovations, the company behind Philippine mobile payment app Paymaya, raised $120 million in April. — VNS