|

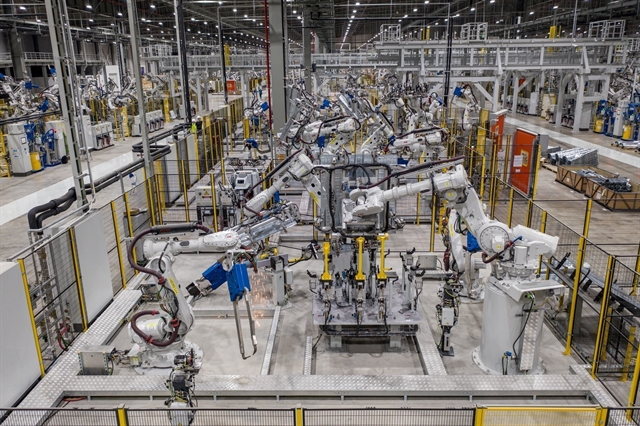

| Production line at Thái Nguyên Iron and Steel Corporation in northern Thái Nguyên Province. Three Vietnamese enterprises have been levied zero tax instead of the mandated 113 per cent, after answering DOC’s questionnaires on anti-dumping. -- VNA/VNS Hoàng Nguyên |

HÀ NỘI – Three Vietnamese steel firms will pay zero tax after answering the anti-dumping questionnaire of the US Commerce Department (DOC). But other Vietnamese exporters of steel pipes will pay the maximum tax of 113 per cent.

The Việt Nam Competition Authority (VCA) said on Wednesday that the US had made its preliminary decision on anti-dumping investigations of carbon welded steel pipe imports into the US market.

Hòa Phát Steel Pipe Ltd. participated as a voluntary respondent in the investigation and was levied an individual tax rate of 0.38 per cent.

Two other respondents, Seah Steel Vina Corporation and Việt Nam Hải Phòng Hongyuan Machinery Manufactory Ltd., were levied a tax rate of zero per cent and 1.19 per cent, respectively.

Meanwhile, the anti-dumping duty levied nationwide on other exporters from Việt Nam who failed to respond to the DOC was 113.18 per cent, the highest among the countries affected by the decision.

On November 18, 2015, the DOC issued a notice initiating anti-dumping investigations into carbon steel pipe products of Việt Nam and four other countries.

On June 1, the DOC announced preliminary determinations in the anti-dumping (AD) duty investigations of imports of circular welded carbon quality steel pipe (CWP) from Oman (7.86 per cent), Pakistan (11.8 per cent), United Arab Emirates (6.1-7.86 per cent), and Việt Nam (113.18 per cent).

A final DOC ruling is expected within 135 days.

Under US tax law provisions, any rate lower than 2 per cent is implemented as a rate of zero per cent.

Việt Nam’s 2014 carbon welded steel pipe exports to the United State were valued at some US$60.6 million, the highest among the four countries probed, according to the VCA. -- VNS