Economy

Economy

|

| Investors monitor stock market movements at MB Securities Joint Stock Company (MBS). — Photo Bnews.vn |

HÀ NỘI — Việt Nam's stock market is expected to maintain its recovery momentum next week as several supportive factors are gradually aligning.

Experts forecast that the VN-Index could retest the 1,240–1,241-point range in the early sessions, and should it break through this level, the index could advance towards the 1,260–1,270 range.

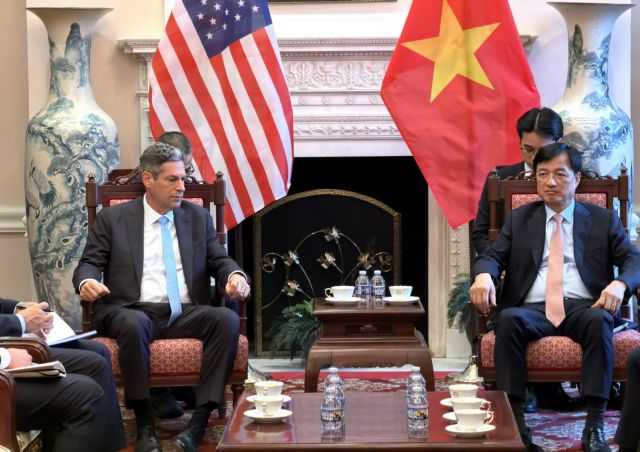

The key drivers include expectations of positive first-quarter business results from listed companies, the official launch of the new KRX trading system on May 5, and encouraging signals from the international environment, such as progress in US-China and US-Việt Nam trade negotiations.

The Head of Macro and Market Strategy at VNDirect, Đinh Quang Hinh, noted that in addition to positive corporate earnings, the operation of the KRX system would not only pave the way for new product development, but also help Việt Nam move closer to its goal of being upgraded from frontier to emerging market status under FTSE and MSCI standards.

Against this backdrop, investors are advised to maintain a balanced portfolio, prioritising sectors expected to post positive first-quarter results and a bright second-quarter outlook, such as banking, retail, seafood, electricity and public investment.

However, brokerage firms also caution that market volatility remains high due to unresolved tariff risks. Investors are advised to limit the use of financial leverage and wait for clearer market signals before increasing stock exposure.

Looking back at the trading week from April 21–25, the VN-Index experienced strong fluctuations, at one point falling sharply to 1,137 points on April 23, before staging an impressive rebound to close the week at 1,229.23 points, up about 10 points from the previous week.

Experts from CSI Securities assessed that timely bottom-fishing demand helped the market successfully reverse its course, despite earlier concerns over the impact of new US tax policies.

Notably, real estate stocks, led by VIC and VHM, played a key role in the recovery, while the banking sector continued to underperform. Liquidity improved, with matching order value up 41.7 per cent compared to the 20-week average, indicating a stabilising investor sentiment. Foreign investors also returned to net buying after 11 consecutive weeks of net selling, recording a net inflow of VNĐ466 billion, mainly into stocks like HPG, MWG, and VRE.

According to Saigon – Hanoi Securities (SHS), the VN-Index is currently establishing a consolidation zone around 1,200 points, which is also the five-year average price level and the peak of 2018. The market is expected to continue consolidating within the 1,210–1,230-point range before attempting to test resistance at 1,250 points, with the nearest support level around 1,195 points.

Nevertheless, organisations such as KIS Việt Nam Securities and VCBS have warned of lingering cautious sentiment, evidenced by a decline in liquidity during the final session of the week compared to the average. They advised investors to monitor the market closely, especially given the upcoming long public holiday, and to only increase stock exposure if the VN-Index corrects back to the 1,180–1,200-point support range. — VNS