Economy

Economy

|

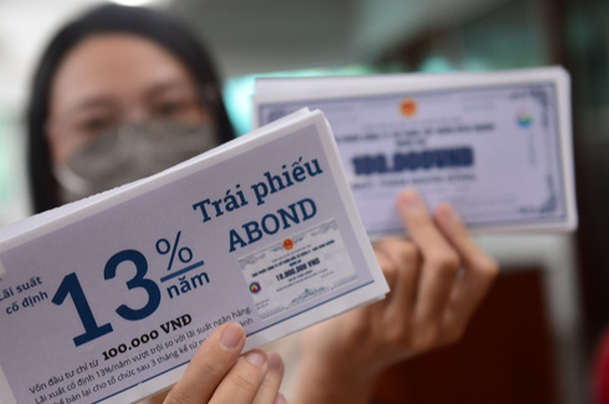

| Bond issuers can negotiate with the bondholder to settle the debts with other assets. — Photo tuoitre.vn |

HÀ NỘI — Many significant changes in the responsibilities of bond issuers are included in a new Government decree amending and supplementing the rules for offering and trading private corporate bonds, which was released on Sunday.

Decree 08, which came into effect on March 5, allows enterprises to extend the term of bonds by up to two years, whereas it was the contrary in the previous regulations. Enterprises have a duty to negotiate to protect the interest of the investor if a bondholder objects to the change.

If the expected outcome of the negotiation is still not achieved, the businesses must fulfill their obligations to the bondholders in accordance with the announced plan for bond issuance.

For a domestically offered bond, if issuers are unable to fully and timely pay the principal and interest according to the announced plan, they can negotiate with the bondholder to settle the debts by swapping the bond debt for other assets.

With this approach, businesses must adhere to the requirement that they obtain the bondholder's consent, disclose unusual information, and be accountable for the legal status of the assets used as payment.

The newly issued decree also temporarily suspends regulations on categorising the status of professional stock investors as individuals. To buy private corporate bonds under the old regulations, individual investors needed to hold a securities portfolio of at least VNĐ2 billion (US$84,370), excluding margin loan value, for 180 days.

Also, the previous rule that stated bond distribution times may not exceed 30 days following the offering announcement has been repealed. The new regulations give businesses additional time to attract investors, improving the likelihood that the offering would succeed.

Prior to Decree 08, Decree 65, which was issued in mid-September 2022, served as a basis for governing bond private placement and trading. Decree 65 is an amended and supplemented version of Decree 153 that was released at the end of 2020 with the expectation of tightening the market following a period of rapid growth in bond issuance and many volatilities being detected.

Decree 65 has more restrictions on investor status, issuance purpose, and principles for using bond capital. For example, an enterprise may only issue bonds to carry out investment projects and restructure its own debts and must clearly state this purpose to investors upon issuance.

The corporate bond market boomed in 2020 and 2021, with an issuance volume of nearly VNĐ462 trillion and VNĐ658 trillion, respectively, as data from the Vietnam Bond Market Association (VBMA) showed.

The booming came from both sides. The supply side stemmed from a sharp increase in capital demand from property developers and banks, while on the other side, the demand to buy bonds to enjoy interest rates higher than savings interest rates was soaring.

However, following arrests and investigation related to the bond issuance and improper use of capital by several major real estate companies in the middle of last year, the bond market suddenly halted. The issuance volume in 2022 was only VNĐ255 trillion. In the first month of 2023, the market only had one successful issuance with a mobilised value of VNĐ110 billion.

On the other hand, aggressive bond issuance a few years ago led to heavy pressure on enterprises as they faced liquidity crises and could not issue new bonds to restructure debt.

VNDirect Securities Corporation estimates the maturity value of corporate bonds this year at nearly VNĐ273 trillion, mainly in the second and third quarters. Many businesses, especially real estate developers, have reported violations of their obligations to pay principal and interest. Many individual investors are looking to sell bonds at a 14-17 per cent discount to get cash back. — VNS