HCM CITY One of the 10 countries with the fastest ageing population in the world, Vietnam has an estimated 30 years within the “golden population structure” period, considerably shorter than many neighboring countries. The rapid ageing rate and low ratio of independent seniority is expected to entail pressures and burdens on social security.

The risk of "growing old before becoming rich"

Vietnam is amidst the golden population structure period, the most balanced development stage of each country when the proportion of labor force is double the number of dependents. 75 per cent of the population is of working age, making a crucial contribution to driving Vietnam's GDP growth – the fastest in Southeast Asia. However, this optimism will not last for long. From 2040, Vietnam will transition into an undesirable stage: a period of ageing population.

|

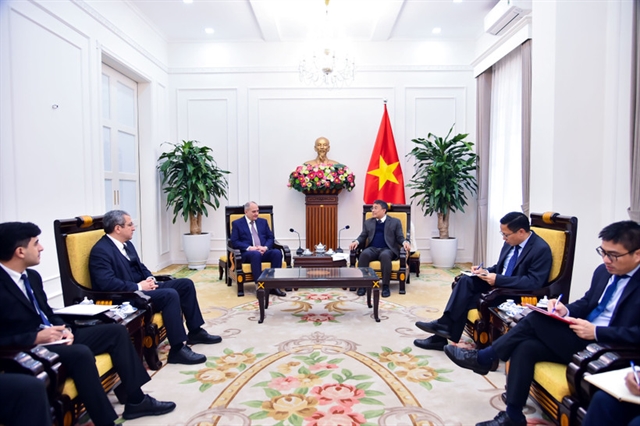

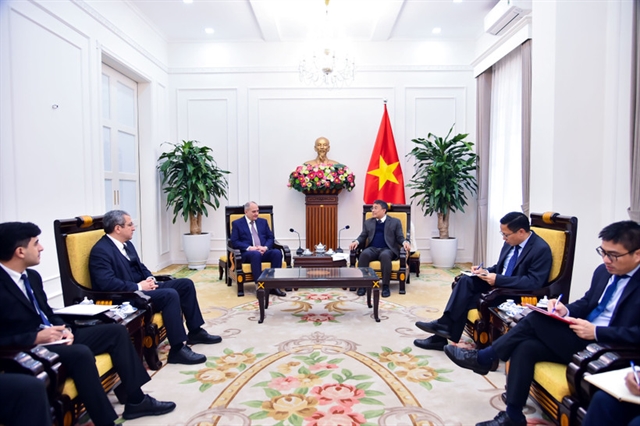

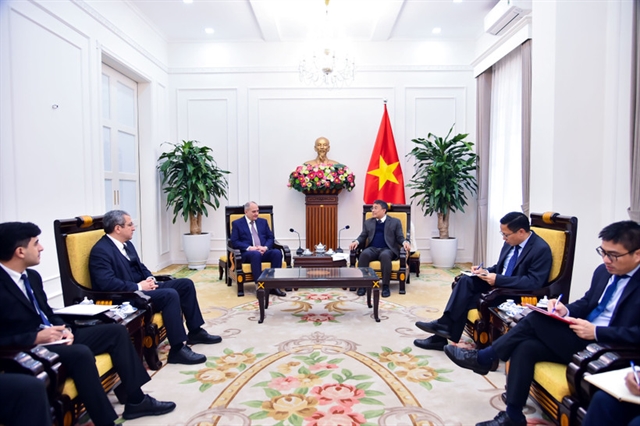

Mr. Phuong Tien Minh, CEO of Prudential Vietnam

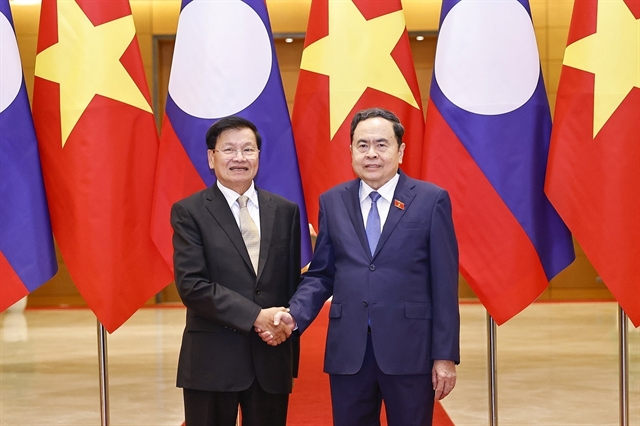

Putting the situation of an ageing population in the context of low per capita income, Mr. Le Van Thanh, Deputy Prime Minister of Labour, War Invalids and Social Affairs, identifies the risk of many Vietnamese people “growing old before becoming rich”.

Where are the senior citizens in the big picture?

The expansion of urban areas has attracted a wave of young migrants seeking jobs, leaving behind nearly 30 per cent of senior citizens living alone in rural areas. Mr. Nguyen Xuan Truong, Director General of Population Structure and Quality, said that 70 per cent of old adults in Vietnam are making their own living with the offspring’s support; only 25.5 per cent of them live on pensions and social benefits.

Dr. Giang Thanh Long, Associate Professor of the National Economics University, also estimated that the current government’s support policies only cover about 8 per cent of the senior group. Meanwhile, it is forecast that by 2049, the medical needs of this group will increase by 2.5 times compared to today. Consequently, when Việt Nam enters the ageing population period, it will not only place many financial pressures on the young generation but also create a burden on social security.

Early action, early financial freedom

According to Associate Professor Giang Thanh Long, many developed countries have successfully prepared for its ageing population period based on three pillars: economic, health, and social preparedness. He said that insurance organizations, banks, and the like should be encouraged to actively participate in the provision of life insurance-related services. This diversity not only supports middle-income earners and above, but also creates income safety nets and protects the health of low-income people.

Mr. Phuong Tien Minh, CEO of Prudential Vietnam, said that an ageing population is a challenge. While governors must resolve the macro problem, everyone can actively participate by preparing a personal financial plan. “People have different perceptions of finance per life stage. The earlier you prepare, the easier it is to achieve financial freedom and independent seniority,” said Mr. Minh.

Brandinfo

Brandinfo