Economy

Economy

To make your long-term financial objectives a reality, you must harness the power of compound interest/returns. Here, “Outside Looking In” explains why compounding really is magic – particularly for Vietnamese investors putting their money to work in the stock market.

|

| Brian Spence |

Brian Spence*

To make your long-term financial objectives a reality, you must harness the power of compound interest/returns. Here, “Outside Looking In” explains why compounding really is magic – particularly for Vietnamese investors putting their money to work in the stock market.

Albert Einstein famously called compound interest “the eighth wonder of the world” – and this is no overstatement. So, what is compounding, why is it so powerful and how can Vietnamese investors really maximise its magic?

What is compounding and what drives it?

Put simply, compounding interest (or returns) is the process whereby money earned from an investment builds upon itself over periods of time, as illustrated in the simple savings account example below:

· You place some money on deposit in a savings account

· You earn some interest on that deposit

· Next year, you earn interest on that interest (along with retaining the original deposit)

· The year after, you earn interest on the interest on the interest, and so on…

Compound returns are driven by two factors: the rate of return being earned and the length of time your money is working for.

Why you must secure the best possible rate of return?

The rate of return determines how rapidly and by how much your initial investment grows. The higher the rate, the more powerfully – and the faster – your money will grow.

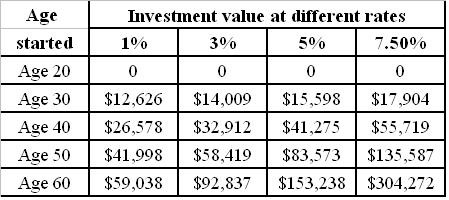

The chart below shows how an investment of $100 each month can build up to very significant sums over time.

|

Make no mistake, 5% is quite a modest return target, as long as you are prepared to dip a toe in the stock market – and you really should be.The chart also highlights how - because compounding causes exponential growth - even small differences in the rate of return can have a huge impact on the total amount earned. For example, securing a return just 2 percentage points higher and making the jump from 3% to 5% results in a difference of over $60,000 after thirty years.

The first reason is that few stock markets even come close the record pace set by Việt Nam’s in recent times. The country’s shares have delivered over 200% in the past five years and are generally held to have even more room to grow.

But the second reason is just as important, and very much easier to miss. This is the way that inflation erodes wealth over time. If current interest rates hover around the 3% market while inflation is running at around 7%. Your money needs to grow at least in line with inflation or its real purchasing power will be seriously reduced.

Amid low interest rates, regularly investing into the Vietnamese stock market (or other international markets with strong prospects) will help you achieve real positive returns, rather than negative returns at the bank.

A robust investment strategy can provide very attractive returns, even for those who are fairly risk-averse. If you can afford to put in a few or several hundred pounds a month, then generating a substantial investment pot can be very achievable indeed.

Make sure time is on your side

Maximising the amount of time your money is invested is also incredibly important.

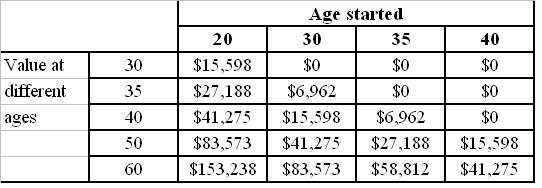

The chart below illustrates how an investment appreciates over time, showing a comparison of a 5% return over different periods.

|

While it is never too late to get proactive about putting your money to work, it is never too early either. Whatever your age, make getting proactive about your financial health a priority.Although you should aim to get a head-start, definitely don’t be put off if you are in a later stage of life as you can still build up a nest egg for your future very effectively.

How much should I put aside?

The short answer to this question is, as much as possible. We’ve used a figure of $100 for our examples, but don’t be put off if you can’t afford as much. Small sums soon build into bigger ones, and you can look at increasing the amount each year in line with your earning potential.

The trick, as we’ve said, is to start early and invest steadily in order to get the magic of compound interest working for you.

* Brian Spence is Managing Partner of S&P Investments. He has over 35 years’ experience in the UK financial services industry as an investment manager, financial planner, and M&A specialist. He is a regular contributor in the UK financial press and has a deep understanding of the financial services community. Brian’s column will reflect on all the challenges and opportunities within the Vietnamese market, bringing a fresh perspective to today’s hottest issues.