Economy

Economy

We have been through more than 30 years of Đổi mới (Renewal) and it almost as many years since the Law on Foreign Direct Investment (FDI) was issued. Since then, the FDI sector has affirmed the major role it plays in the Vietnamese economy.

|

Võ Trí Thành*

We have been through more than 30 years of Đổi mới (Renewal) and it almost as many years since the Law on Foreign Direct Investment (FDI) was issued. Since then, the FDI sector has affirmed the major role it plays in the Vietnamese economy.

Statistics from the Ministry of Planning and Investment (MPI) show that from pledged and disbursed FDI of US$1.56 billion and $262.5 million, respectively, in the 1988-1990 period, the 30th anniversary of the FDI law in 2017 saw the figures hit record highs of $35.88 billion and $17.5 billion.

|

| Võ Trí Thành |

The FDI sector has contributed 20 per cent to GDP growth, 50 per cent to industrial output, 70 per cent to export turnover, and created 13 million direct and indirect jobs. The Government’s affirmation that the success of FDI is also the success of Việt Nam is testament to the importance the sector is accorded.

However, this success has been accompanied by a growing concern that the Vietnamese economy relies too much on foreign investors and that some FDI projects have had major negative impacts on the environment.

While the concern is rational, an attitude of blaming foreign investors would be ill advised, as it could diminish our competitiveness and our international integration process. Instead, we should learn from the past and grow in the future.

Now, let’s take a look at the most interesting aspects of the FDI impacts and the useful lessons we can draw from them.

First, with hundreds of billions of dollars invested in tens of thousands of projects, FDI has been a huge capital resource for Việt Nam, and instrumental in getting the country out of the vicious circle of poverty, characterised by low income, low savings and low investment. However, now that the domestic private sector is getting bigger, we need a supportive, fair, competitive environment that matches international commitments to promote its development.

Secondly, many FDI projects have done business effectively and generated jobs. However, many studies have pointed out that technology transfer has not happened to the extent expected, that its spread has been limited, and the transfer of skills from the FDI sector to other fields is still weak. One reason is that some industries have been protected for too long, limiting their competitiveness and participation in the production network and global value chain. Another reason is that most local private companies are of small scale, thus their ability to receive positive influences from FDI is still very limited. This is the biggest problem in attracting FDI. Việt Nam can only benefit if, and only if, it is able to draw maximum possible positive benefits.

Thirdly, FDI projects can either bring in high technology and skills and advanced business practices linked to sustainable development, or come with old, less environmentally friendly technology. It is a fact that Việt Nam has had to pay a dear environmental price for several FDI projects. The main reason for this is inadequate assessment of the impact of the projects, an excessive focus on growth target and vested interests that exacerbate both the risks and the actual negative effects of FDI.

Fourthly, too much foreign capital inflow can also trigger macroeconomic instability. For example, right before and after Việt Nam joined the WTO, FDI and other capital flooded into the country, making it difficult to issue and implement proper monetary policies, generated inflationary pressures, as well as stock market and real estate volatility. The implications of this are serious: macro-economic instability, even a full blown crisis, especially in the absence of appropriate macro-economic policies.

Looking forward: new context, new way

We can safely say that 30 years of attracting FDI has taught Việt Nam many valuable policy lessons. But in the new context, when Việt Nam is at a landmark stage in its development, it needs strong institutional reforms and a private sector capable of competing and growing.

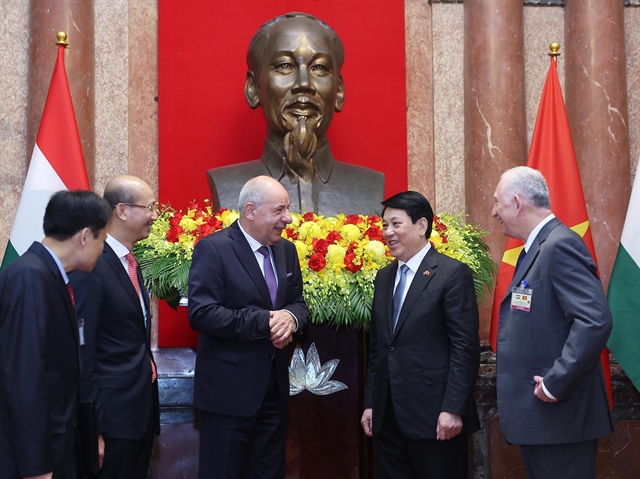

Việt Nam has been integrating widely and deeply, by joining Free Trade Agreements (FTAs) and establishing comprehensive and/or strategic partnerships with key partners. The world, meanwhile, has also been transforming extensively, especially in interactions between regions and large countries, and under the influence of the Fourth Industrial Revolution (Industry 4.0).

Although capital and competition for capital among economies is of much interest, cheap manpower will still a comparative advantage for Việt Nam over the next few years, and some resources may still need to be exploited (in a new way), but the most critical problem for Việt Nam is the "low labour cost trap", "middle income trap”, and the challenge is to create a new momentum for productivity-based growth that is sustainable.

Therefore, the nation’s primary aim must be to maximise efficiency in attracting FDI, rather than attract big volumes. This task is much more complicated.

First, Việt Nam should continue its efforts to create a modern market economy that is in line with best standards and practices.

The role and function of the State should be reshaped. The "stronger" market, the wider integration means a reduction in the ability to use traditional interventions. The State must shift its focus to: creating a transparent, competitive, predictable business environment; promoting entrepreneurship that encourages investment and technology transfer/innovation; and improving infrastructure and the quality of human resources.

Report 2035 (MPI and World Bank 2016) points out that protecting Intellectual Property Rights, increasing access to production factors, and reducing transaction costs for businesses are key issues in facilitating the development of Vietnamese enterprises, especially small and medium enterprises (SMEs). These issues are directly related to the improvement of the legal framework, the administrative process and the construction of a professional and accountable State apparatus. Such measures are much more important than tax incentives. Many studies in Việt Nam also show that tax incentives are not a significant factor in luring FDI, and in many cases, they might also cause unnecessary trouble.

The second is to create a focal point in institutional reforms. Việt Nam has plans to develop special economic zones like Phú Quốc and Vân Đồn. In order to call for more investment, the management regulations set for the special zones must serve the freedom of movement of goods, services and resources; facilitate decision making and enforcement in a timely and convenient manner; and a preferential system that is effective in the long run.

Another point is to take advantage of the technological renovation to catch up with and go along with the Industry 4.0 era. A national innovation system must be set up with businesses and startups being considered its centerpiece.

Thirdly, sustainability, the spillover effect of technology and skills, and the connection with Vietnamese enterprises in the value chain must be seen as key elements in seeking and evaluating FDI. We must have policy incentives to encourage multinational corporations and pioneering enterprises to commit and transfer advanced technology, and participate in training and R&D activities.

Fourthly, FDI attraction should be linked closely to the nation’s global integration process. Việt Nam has engaged in different levels of integration which are different in terms of both partners and scope of commitment. The challenge for the country is to harmonise benefits brought by different integration levels to make best use of development opportunities and minimise distortions in resource allocation and implementation costs.

Last but not least, seeking capital from abroad, including FDI must not cause macro-economic instability. It is extremely necessary to ensure consistency in macro-economic policy (money supply, exchange rates, interest rates policies) in order to reduce speculation and risk of crisis. In addition, there should be a policy of supporting enterprises and vulnerable groups reduce regulatory and compliance costs when promoting integration. This can take the form of training/retraining, information provision and legal support.

FDI has been and will remain an important part of the Vietnamese economy and its development process. However, in the new context, Việt Nam needs to rethink, redesign and rebuild its FDI attraction. It is worth remembering that foreign enterprises come to Việt Nam to do business, not engage in charity; so we must know how to take advantage of them, rather than relying too heavily on them. — VNS

* Võ Trí Thành is a senior economist at the Central Institute for Economic Management (CIEM) and a member of the National Financial and Monetary Policy Advisory Council. A doctorate holder in economics from the Australian National University, Thành mainly undertakes research and provides consultation on issues related to macroeconomic policies, trade liberalisation and international economic integration. Other areas of interest include institutional reforms and financial systems.