Society

Society

|

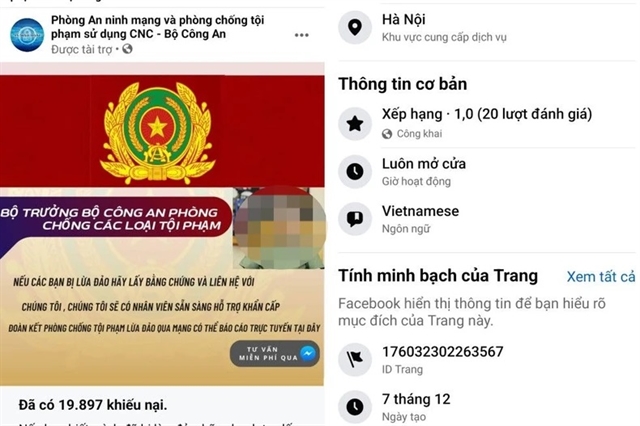

| The interface of a fake Facebook page claiming to be the Cybersecurity and High-tech Crime Prevention Unit. — VNA/VNS Photo |

HCM CITY — The growing threat of online scams in Việt Nam has prompted experts to warn citizens about the significant financial losses they could face, urging stricter security measures to protect individuals from falling victim to the schemes.

Major General Nguyễn Văn Giang, deputy director of the Cybersecurity and High-Tech Crime Prevention Department, highlighted the increasing prevalence of online scams in the country as technology continues to advance.

“Scammers are constantly finding new ways to deceive people, ranging from fake job postings to phishing emails, all aimed at stealing hard-earned money,” he said.

Financial matters are at the forefront of common online scams in Việt Nam, with scammers utilising deceptive messages, emails, and phone calls on social media and mobile phones to target individuals.

To carry out these scams, fraudsters often use methods such as brand counterfeiting, account hijacking, online job scams, love scams, and online lending to gain the trust of their victims.

Phishing email scams are among the prevalent tactics used by scammers, where they impersonate reputable companies or organisations to trick individuals into providing personal information such as bank account details or social security numbers.

Last year, citizens in Việt Nam lost some VNĐ10 trillion (US$394 million) to various online scams, up 50 per cent from 2022, according to Giang.

With the anonymity the Internet provides, tracking down perpetrators of these scams is challenging, allowing high-tech criminals to create networks both domestically and internationally to continue evolving their fraudulent activities, experts said.

In response, the central bank has announced they are working with platforms such as Google and Facebook to enhance policies that protect personal data and prevent fraudulent activities from occurring.

The central bank has lately directed credit institutions to implement biometric verification for transactions above VNĐ10 million starting next month.

By requiring biometric authentication such as fingerprints and facial recognition for transactions of this amount or more, the central bank aims to add an extra layer of security to protect account owners’ funds and prevent fraudulent transactions.

Experts recommended unified awareness and action from all agencies, organisations, and individuals to combat online fraud in Việt Nam.

They recommended individuals remain vigilant and cautious when engaging in online activities, as scammers often use fake websites and phishing emails to steal sensitive information.

Individuals are also urged to verify the legitimacy of websites before making transactions, and be cautious when sharing personal information online.

They are also advised to regularly update security software on computers and mobile devices to protect against malware and other online threats. — VNS