Opinion

Opinion

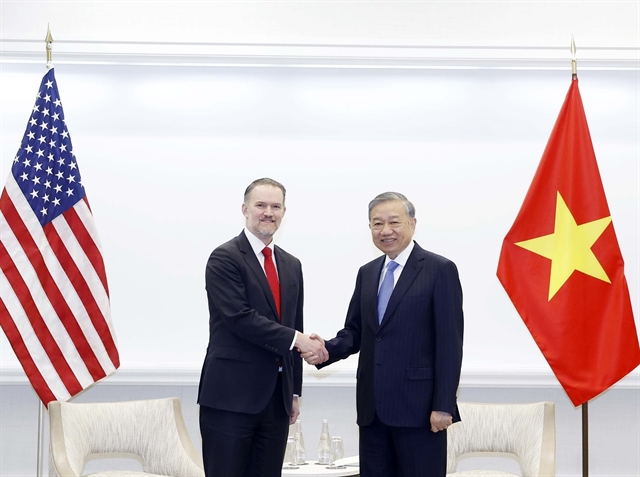

.jpg) |

| Phan Đức Hiếu, permanent member of the National Assembly’s Economic Committee. — Photo baodautu.vn |

In an interview with Đầu Tư (Investment) newspaper, Phan Đức Hiếu, a permanent member of the National Assembly’s Economic Committee, suggested that to achieve GDP growth of 8 per cent or more, a targeted investment stimulus package should be introduced to drive production, business and consumption, with swift and effective implementation this year.

At the weekend, delegates discussed the draft socio-economic development plan for 2025, which sets a growth target of at least 8 per cent. What is your opinion on this proposal?

First and foremost, it is important to highlight that the proposal reflects the Government's strong commitment to achieving the ambitious target of 8 per cent growth, or even higher, this year.

By putting forward this proposal, the Government is demonstrating its resolve to mobilise all available resources towards reaching this goal, not merely aiming for it. This also suggests that bold, transformative solutions will be required.

In the proposal presented to the National Assembly, the Government has outlined several key measures, including refining the institutional and legal framework, unlocking and efficiently utilising public investment, fostering private investment alongside the processing and manufacturing sectors, stimulating consumption and diversifying export markets.

It is crucial to acknowledge that the solutions already put forward by the National Assembly and Government to achieve GDP growth of 6.5-7 per cent, with an ambition of 7.5 per cent, remain fully relevant. However, with the updated scenario, the Government has introduced additional measures to help achieve a further 1 per cent growth. In my view, these solutions need to be specific, clear, and, above all, effective and efficient within this year.

Drawing from the experience of other countries, accelerating growth typically requires stimulus packages to boost investment, production, business and consumption.

In Việt Nam's current context, it may be prudent to consider a growth stimulus package, clearly defined and implemented promptly, ensuring immediate impact without exerting inflationary pressure.

In your view, which priority areas should the growth stimulus policy package focus on at this time?

First, boosting income and savings for the population is vital to stimulating consumption. From a policy standpoint, it may be necessary to fast-track amendments to the Personal Income Tax Law, particularly by increasing family deductions, which would provide individuals with greater opportunities to save.

Second, it’s crucial to continue reviewing tax policies to support businesses. During this period, tax increases should be avoided unless absolutely necessary, as imposing additional burdens on businesses could hinder competitiveness. If tax laws must be amended, the focus should be on long-term objectives, with a potential extension of the implementation timeline by two to three years.

Moreover, policies regarding fees, charges and exemptions should be revisited to either extend existing measures or introduce new ones. For example, the reduction in land use fees should be prolonged and possibly increased, given the rising costs of land.

Third, urgent revisions are needed for regulations that raise costs for businesses. For instance, the requirement for companies to deposit 20 per cent of the value for each shipment of imported scrap paper for production is placing a significant strain on businesses, especially when there have been few violations. A possible solution could be to shift towards a risk-based approach, rather than applying uniform requirements to all shipments, or to consider a general reduction for businesses. This would free up more capital for production and enhance capital efficiency.

Finally, the procedures for tax refunds should be streamlined further to prevent unnecessary delays for businesses.

But these solutions are already well-known?

That’s true, but the real challenge here lies in policy delays, the speed of implementation, and the effectiveness of the measures.

Since 2024, significant strides have been made in institutional reform, as demonstrated by the National Assembly’s approval of amendments to numerous laws and resolutions aimed at resolving legal hurdles and speeding up investment projects at the end of the eighth session. Nevertheless, obstacles remain.

It’s essential to focus on reducing these delays and creating more opportunities for faster, more equitable business growth. Local authorities have been given the power to make decisions, take action, and bear responsibility. Now, it’s crucial to quickly translate policies into tangible actions and get things moving without hesitation.

What sets this year apart is that growth targets have been tailored to each locality, industry, and sector, rather than being a blanket target. This ensures that the Government, local authorities and ministries all recognise their specific responsibilities and demonstrate real determination.

What’s needed now more than ever is clear, decisive action. While solutions are in place, the focus must be on implementing them quickly and efficiently. Perhaps this year, the speed of processing procedures and the level of support for businesses should be considered key performance indicators, alongside the quality of execution.

The Government’s proposal suggests that, if necessary, the budget deficit could be raised to around 4-4.5 per cent of GDP to mobilise resources for development investment. It also indicates that public debt, government debt and foreign debt could reach or exceed the warning threshold of approximately 5 per cent of GDP. In your opinion, could this impact macroeconomic stability?

Raising the targets by adjusting the ceiling does not imply that achieving those levels is compulsory. Instead, it suggests that, if necessary, a careful balance must be struck between fostering growth and maintaining macroeconomic stability, controlling inflation and ensuring the key balances of the economy are upheld.

This approach has consistently been a cornerstone of the Government’s economic management in recent years, even though the emphasis on growth, specifically on accelerating it, has now become the top priority. — VNS

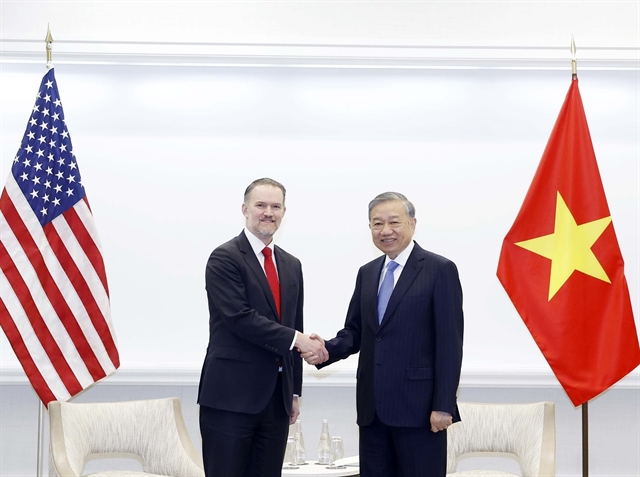

.jpg)