Economy

Economy

Prime Minister Nguyễn Xuân Phúc on Wednesday told the State Bank of Việt Nam (SBV) to take measures to ensure macro-economic stability, inflation control and growth in 2019.

|

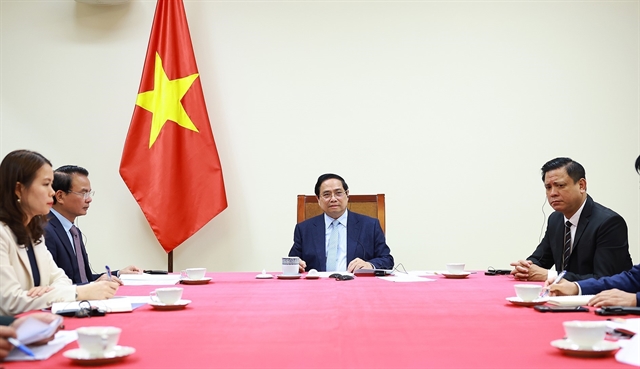

| Prime Minister Nguyễn Xuân Phúc speaks at the conference of the State Bank of Việt Nam. — Photo chinhphu.vn |

HÀ NỘI — Prime Minister Nguyễn Xuân Phúc on Wednesday told the State Bank of Việt Nam (SBV) to take measures to ensure macro-economic stability, inflation control and growth in 2019.

Addressing a conference held in Hà Nội to review the operations of the banking sector in 2018 and set tasks for 2019, PM Phúc said the targets were tough and would require effective and timely management from the central bank.

“SBV must continue making its monetary policy in a flexible, cautious and effective manner, and enhance measures to limit adverse impacts due to worldwide uncertainty,” Phúc noted, adding the monetary policy should be balanced with other macro-economic policies.

The Prime Minister also directed the banking sector to take the lead in the Fourth Industrial Revolution by embracing e-payment, a move that would boost the whole economy.

The SBV must also submit a plan to the Prime Minister to increase the charter capital of State-owned banks so that they would be able to meet Basel II capital requirements by 2020 as planned, the PM said. He added that the central bank also needed to speed up the restructuring of credit institutions that handle bad debts.

According to Phúc, the banking sector’s settlement of non-performing loans (NPLs) has been largely successful, helping reduce the NPL ratio to 1.89 per cent of outstanding loans from 2.46 per cent in 2016.

PM Phúc also instructed the central bank to control credit growth at a reasonable rate and focus lending in the Government’s priority areas of agriculture businesses, firms producing goods for export, small- and medium-sized enterprises, enterprises operating in auxiliary industries and high-tech enterprises including start-ups.

At the meeting, SBV Governor Lê Minh Hưng reported SBV net purchased more than US$6 billion in 2018 to build the nation’s foreign reserve.

He said the SBV’s proactive and flexible steering of the daily reference exchange rate, liquidity and Vietnamese đồng interest rate helped keep the USD/VNĐ exchange rate relatively steady. As of the end of 2018, the daily reference exchange rate was up 1.7-1.8 per cent while the inter-bank rate had hiked 2.16 per cent from the previous year. Hưng also reported the central bank last year took measures to control inflation, stabilise the economy, support growth and ensure the safe operation of credit institutions.

"The monetary policy has been carried out in harmony with other macro-policies, particularly the fiscal and price management ones, helping to keep average inflation below the ceiling target of 4 per cent,” Hưng said, adding that interest rates have also been kept stable in spite of the upward trend around the world.

SBV Deputy Governor Đào Minh Tú said the central bank would continue keeping a close watch on the macro-economy and the financial market in Việt Nam and the world this year so as to make active and prudent moves to ensure the stability of the monetary and forex markets. It will also consolidate the forex reserves, curb dollarisation and enhance trust in the đồng.

Credit institution restructuring and bad debt settlement will be strictly monitored, and the SBV will work to improve credit quality, Tú said. — VNS