Economy

Economy

As of December 31, 2017, the total assets of the Bank for Foreign Trade of Việt Nam (Vietcombank) reached VNĐ1.05 quadrillion (US$46 billion).

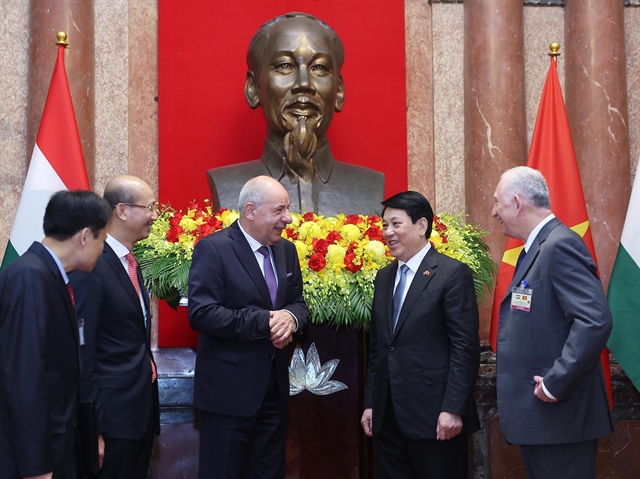

|

| The commercial banking system in Việt Nam has four members reaching over VNĐ1quadrillion in total assets, including Vietcombank, Agribank, BIDV and Vietinbank. — Photo Vneconomy.vn |

HÀ NỘI — As of December 31, 2017, the total assets of the Bank for Foreign Trade of Việt Nam (Vietcombank) reached VNĐ1.05 quadrillion (US$46 billion).

This makes it the fourth bank of Việt Nam possessing total assets exceeding VNĐ1 quadrillion.

Vietcombank is the focal point of purchasing nearly $5 billion in the State capital’s divestment at Saigon Beer, Alcohol and Beverage Corporation (Sabeco) on December 29.

This transaction, equivalent to VNĐ110 trillion, pushed Vietcombank’s total assets to exceed VNĐ1 quadrillion only a few days before the end of 2017, two years earlier than the targeted plan in 2020.

Till date, the commercial banking system in Việt Nam has four members reaching over VNĐ1 quadrillion in total assets, including the Bank for Agriculture and Rural Development (Agribank), Việt Nam Joint Stock Commercial Bank for Industry and Trade (VietinBank), Bank for Investment and Development of Việt Nam (BIDV) and Vietcombank.

This is also the "Big 4" group of State-owned commercial banks, of which, only Agribank has not been equitised yet. This group currently holds around 50 per cent of outstanding loans and deposits of the entire banking system.

Together with the total asset size, this is the first time the local banking system has seen its official membership’s before-tax profit exceeding VNĐ10 trillion.

Specifically, according to 2017’s data, Vietcombank is the first commercial bank to exceed this profit figure, with more than VNĐ10.8 trillion, a year-on-year increase of 32 per cent. The profit, which service segment made up 24 per cent against 20 per cent in 2015-16, is expected to be the highest level in the entire banking system.

Remarkably, this profit was made after Vietcombank continued to increase its provision for risky loans in 2017 to some VNĐ8 trillion, which accounted for some 130 per cent of the bank’s total bad debts.

Last year, although the State Bank raised credit growth target to 18 per cent, Vietcombank increased only some 17.4 per cent.

In the end of 2016, the bank’s retail lending ratio was only 33 per cent; however, in 2017, it had risen to 41 per cent and the trend may surpass 50 per cent in 2018. — VNS