Talk Around Town

Talk Around Town

|

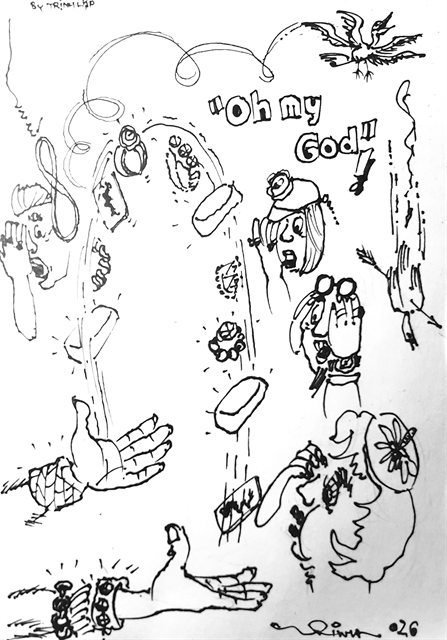

| Illustration by Trịnh Lập |

by Nguyễn Mỹ Hà

It blew my mind when I recently went to the pharmacy to pick up a doctor-prescribed medication. The imported drug was not available, so the pharmacist suggested an alternative, a local medicine with the same ingredients and similar effects at an amazingly affordable cost: VNĐ5,000 for 10 blistered tablets.

The 5,000 đồng note is not the smallest currency note, but it is enough to buy a chicken egg or two, a package of instant noodles, or a small baguette. If you suggested buying a house with savings of 5,000 đồng notes, people would soon smirk at your madness.

It sounds absurd, but students and lecturers at southern Việt Nam's Đồng Tháp University, which celebrated its 20th anniversary in January this year, have made it a reality. Seventy-three houses were presented to 73 students in eight different provinces from the donation of 5,000 đồng of each student each month.

Starting in 2010 as an initiative of the Communist Youth Union chapter of the university, each student and lecturers initially donated VNĐ30,000 (US$1.20) each month to a fund to raise VNĐ 20 million ($850) to build a house. The money was used to buy materials, but the labour was voluntarily contributed by fellow students.

Over time, inflation and other costs increased the price of the house. In 2022, a 5,000 Đồng House cost VNĐ50 million ($2,120).

More than 1,200 working days have been contributed over the past 12 years. With this amount of free working time, the costs of these houses became affordable. A total sum of VNĐ2.37 billion has been mobilised and turned into 73 houses in eight provinces in the Mekong Delta: Đồng Tháp, Long An, Tiền Giang, Vĩnh Long, An Giang, Bến Tre, Cà Mau, and Cần Thơ City.

The initiative has been going on for 12 years and was recognised by the Vietnam Records Association as one of the country's school records. The name of the programme has been changed a few times due to inflation and the minimum donated amount, which grew from initial VNĐ2,000 to the current VNĐ5,000.

Having been initiated in a university, the programme was well-known outside Đồng Tháp, though it received donations from local philanthropists to help reduce poverty in the region. Students study in Đồng Tháp, but the houses have been built for their families scattered around the greater Mekong Delta region.

This successful youth-generated initiative reflected the core nature of a Vietnamese saying, "Tích tiểu thành đại" or "Many a little makes a mickle". The saving plan of this nature works not only for such an ambitious project like the housing programme, but also for personal financial savings.

A thrifty piggy bank could have worked for you as a kid, and it may work again for you as an adult, especially if you cannot get hold of your spending and are inclined to throw a few extra bucks out the window.

On a larger scale, as a country, the more you save, the better prepared you will be for a financial crisis. Common sense suggests the more you make, the more you save. But even if you cannot make as much as you wish, putting away a certain amount of cash each month, gives you a chance to make better use of it when needed.

Taking a look at the World Bank data for countries' gross saving. The 2021 figures show that Qatar, Brunei and Vanuatu, respectively, saved 51, 50 and 48 per cent of their income. China, Singapore and Zambia came next with 45, 44 and 43 per cent, respectively. Việt Nam saves pretty well at 33 per cent.

A handful of countries could not save, and their savings were even negative as Timor Leste, at minus 6 and Lebanon at minus 3 per cent.

The reasons to save (or not to) can be as diverse as the countries and cultures involved. And as the World Bank's latest report Global Economic Prospects shows, global growth is reducing sharply due to elevated inflation, higher interest rates, reduced investment and disruption in the world manufacturing chain.

According to the report, the global economy is projected to grow by 1.7 per cent in 2023 and 2.7 per cent in 2024. The sharp downturn in growth is expected to be widespread, with forecasts in 2023 revised down for 95 per cent of advanced economies and nearly 70 per cent of emerging markets and developing economies.

"The crisis facing development is intensifying as the global growth outlook deteriorates," World Bank Group President David Malpass said in the bank's report.

"Emerging and developing countries are facing a multi-year period of slow growth driven by heavy debt burdens and weak investment as global capital is absorbed by advanced economies faced with extremely high government debt levels and rising interest rates.

This is a timely warning for an emerging market and developing economy like Việt Nam for the coming years.

In the past, Việt Nam has performed pretty well in education, above its financial means when compared to other developing countries on the same level.

An IMF report by Anja Baum in 2019 with perspectives until 2030 on achieving Sustainable Development Goals (SDG) stated that Việt Nam achieved impressive progress on these goals, ranking in the top quarter of SDG performance across emerging market economies. The government has shown strong determination in implementing its 2030 agenda.

The report has also indicated that education has been a national priority since the đổi mới reforms in 1986, with government budget spending on education became relatively higher than other countries with similar economic conditions.

As major economic forecasts for the near future do not look bright, a self-initiative of mutual help and a lot of voluntary work to assist disadvantaged students spread a positive and encouraging message across the country.

Every VNĐ5,000 đồng note counts, not only when it comes to helping students in need, but when saving for any rainy or stormy days ahead. VNS