.jfif) Opinion

Opinion

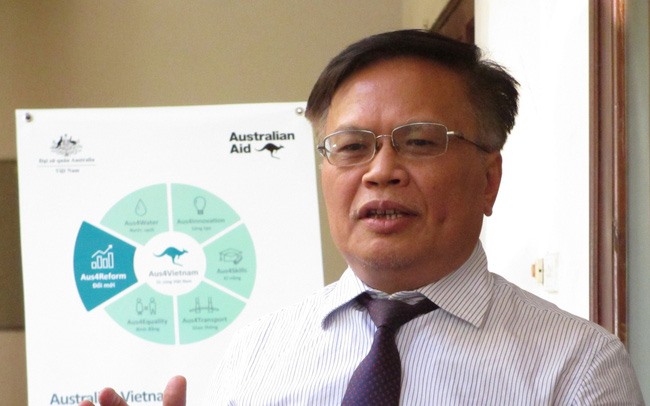

Nguyễn Đình Cung, director general of the Central Institute of Economic Management, speaks to the Nhân dân (People) newspaper on the need to the make the best use of the State budget in State-owned enterprises following their equitisation

|

| Nguyễn Đình Cung. — Photo cafef.vn |

Nguyễn Đình Cung, director general of the Central Institute of Economic Management, speaks to the Nhân dân (People) newspaper on the need to the make the best use of the State budget in State-owned enterprises following their equitisation

What is the key reason equitising State-owned enterprises is such a slow process?

It is not the time for Việt Nam to focus on the equitisation of State-owned enterprises, particularly economic groups or State corporations. My argument is based on the three reasons as follow;

First, the majority of enterprises/economic groups in the list are the big ones with a large scale operation. As a result it will be very difficult to define their value and it will take a lot of time to do so.

Second, recently the reputation of quite many State-owned enterprises is not very good and as a result it makes the investors hesitate over their decision. Another reason, I should mention are the changes in the revised Decree 32/2018/ND-CP compared to the Government’s Decree 91/2015/ND-CP in defining the value of the enterprises in the course of equitisation, particularly the land value, intellectual property rights, cultural value and others.

And third is the psychological issue of many enterprises. They just want to wait and see what will be the changes in Government’s reform policy of the State-owned enterprises or SOEs.

In March, 2018, the Government issued a resolution on the establishment of the State Capital Management Committee in enterprises and all the SOEs will be put under the management of the State Capital Management Committee. But until now every thing remains in paper only. In September it is expected the Decree on the functions, missions, rights and organisational structure of the State Capital Management Committee in enterprises will be officially issued.

What should the Government do to encourage the SOEs to come up with their own production strategy instead of waiting for the Government to order them what to do?

As I mentioned above, the Decree on the functions, missions, rights and organisational structure of the State Capital Management Committee in enterprises will be issued in September. That document will list the names of SOEs to be subjected to the direct management of the State Capital Management Committee.

What needs to be done to speed up the process of the equitisation of SOEs?

There are two things needed to be done immediately. First, the State Capital Management Committee in enterprises should start to work as soon as possible. Second, it’s essential to improve the enterprise’s management and raise the enterprise’s production in line with the principle of market economy.

They must also lay down their performance objectives and a set of tools to collect data and set up the data collection for enterprises. All these activities will see them operate with more transparency and efficiency.

What are your expectations from the State Capital Management Committee when it actually becomes a part and parcel of the enterprise?

The establishment of the State Capital Management Committee (SCMC) is a step forward in the course of market economy. However, to make this committee operate effectively the SCMC should play its role in enterprises as a working tool, yet be given certain power and motivation with the ultimate goal, of raising the State-owned enterprise productivity and the State capital in that enterprise. — VNS