Life & Style

Life & Style

|

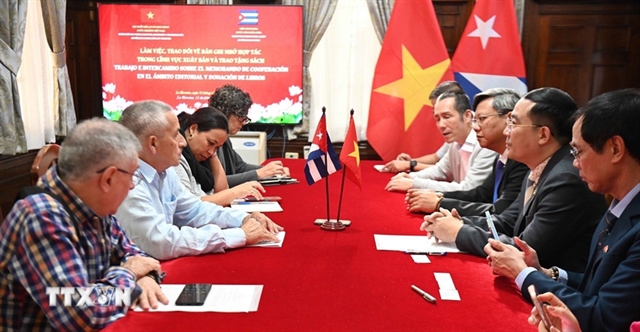

| Tourism authorities, developers, hotels owners and senior industry professionals discuss the outlook for Việt Nam’s hospitality industry. VNS Photo Thu Hằng |

HCM CITY — Next year is expected to remain a challenging year for the hospitality market, with local demand never being more important as the key source of business, industry experts have said.

Nguyễn Trùng Khánh, general director of the Việt Nam National Administration of Tourism, said by the end of March, international tourism activities had mostly stopped in the country due to the COVID-19 pandemic.

Khánh spoke at a conference held on Thursday in HCM City.

Last year, the country welcomed more than 18 million international visitors and served 85 million domestic travellers, contributing around US$32.8 billion to the economy, equivalent to 9.2 per cent of GDP.

The growth rates and positive outcomes lasted until February this year.

The Government has in recent months created stimulus packages and changed administrative procedures to create favourable conditions for experts and investors to enter Việt Nam for working, investing and seeking business cooperation opportunities.

Domestic tourism activities have gradually recovered over the last three or four months, starting in May under the promotion campaigns “Vietnamese People Travel in Việt Nam” and “Việt Nam - a Safe and Attractive Destination.”

The number of domestic tourists increased by 20 per cent compared with the same period last year.

The Việt Nam National Administration of Tourism is planning to launch a new domestic stimulus campaign entitled “Việt Nam - Travel to Experience" in an effort to boost domestic travel demand and facilitate the recovery of tourism industry, Khánh said.

Mauro Gasparotti, director of Savills Hotels Asia Pacific, said: “As with just about everywhere else around the world, hospitality has suffered in Việt Nam, with many properties running at single digit occupancy.”

The second Covid-19 wave hitting Đà Nẵng City in July further dropped national occupancy levels with most destinations receiving cancellations just as travel sentiment was returning.

In August, the average national occupancy for upscale properties was under 20 per cent, down 75 per cent over the same period last year, with HCM City recording a 14 per cent occupancy rate and Hà Nội 24 per cent, according to Savills.

Average occupancy rates also dropped by 10 per cent in the first eight months of the year compared to last year.

However, thanks to effective pandemic containment by the Government, local sentiment for travel has been recovering.

“Hotels and resorts receiving increased bookings over September and October means that we have turned the corner,” Gasparotti said. “We are at the start of our road to recovery for the second time.”

“Even when borders reopen to selected countries, we should not expect international demand to immediately rebound,” he added.

There may be some initial “revenge demand” from single travellers or small groups, eager to spend a weekend overseas, but the larger overseas tourist base of groups or family travellers may take months to recover, he said.

The lodging industry slowdown and related-sector shutdowns is likely to affect recovery potential even if demand rebounds.

“We firmly believe Việt Nam will recover faster than other countries because of its affordability, safety and proximity to larger tourism sources.”

“This may even be an opportunity for Việt Nam, given that local travellers here accounted for such a large proportion of the total travellers, almost 82.5 per cent, last year,” Gasparotti said.

The domestic market, especially millennials and Gen Z, have powered experiential travel growth in recent years.

Luxury properties, staycations, boutique hotels, wellness resorts, food experiences and getaway destinations are all under growing demand.

The conference was hosted by Savills Hotels Asia Pacific, with the participation of tourism authorities, developers, hotels owners and senior industry professionals. It covered the latest news on distressed assets, travel demand, second homes, megatrends, industry challenges, and the outlook for Việt Nam’s hospitality sector. —VNS