Business Beat

Business Beat

Compiled by Thu Hà

|

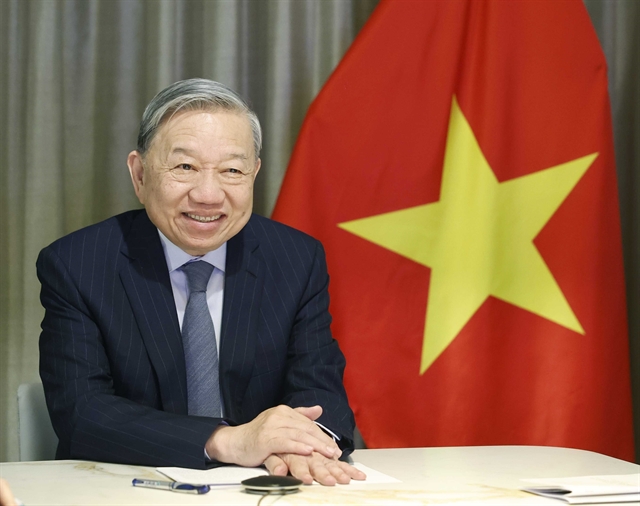

| A production line of a garment company in HCM City. Both order and sale price of garment firms have decreased by 20-30 per cent. VNA/VNS Photo |

HÀ NỘI — Firms are more concerned about weak consumption demand than interest rates, so they hesitate to borrow to expand production and business despite the rate cut.

The State Bank of Vietnam last week cut its policy rates for the third time this year to prop up economic growth. Accordingly, the bank cut its refinance rates from 5.5 to 5.0 per cent and its overnight electronic interbank rate from 6.0 to 5.5 per cent.

The SBV’s move was made in the context of economic and business difficulties.

Chairman of the National Assembly (NA)’s Economic Committee Vũ Hồng Thanh said the socio-economic situation in the first four months of 2023 saw difficulties and challenges that continued from the fourth quarter of 2022. It, therefore, put great pressure on macroeconomic management and the ability to meet the growth target for the whole of 2023.

Việt Nam’s GDP growth in the first quarter of 2023 was very low. The country’s main industrial production and export centres saw a decrease or insignificant increase, which means it is extremely difficult to meet the full-year growth target. The weak aggregate demand has directly affected the total supply of the economy. Some key drivers of the country’s growth such as exports, foreign direct investment, and industrial production all recorded declines.

According to the General Department of Customs, in the first four months of 2023, exports to major markets all declined. Specifically, exports to the US - the largest market - decreased by 21.6 per cent while shipments to China, Europe and ASEAN also dropped by 12.9 per cent, 8.9 per cent and 3.6 per cent, respectively.

During the period, exports of staples recorded a sharp decline for the first time in many years. Wood and timber products hit the deepest decline of 30.6 per cent, followed by aquatic products at 29.3 per cent, textiles and garments at 18.1 per cent and footwear at 15.5 per cent.

Regarding garment products in particular, at the Banking Forum 2023 held recently, Trương Văn Cẩm, vice chairman and general secretary of the Vietnam Textile and Apparel Association (Vitas) talked about what has never happened to Việt Nam’s textile industry before.

According to Cẩm, the gloomy economic situation is having a great impact on consumer demand and business orders. Since the end of the third quarter of 2022, the textile and garment industry has begun to absorb the blows of inflation and the global economic recession, which has caused both order and price to decrease by 20-30 per cent on average, and some even reporting a decline of up to 40-50 per cent.

Cẩm forecast the decline in orders and export turnover of the textile and garment industry could last until the third quarter before gradually recovering in the fourth quarter.

Bạch Thăng Long, permanent deputy general director of the Garment 10 Corporation, said at present, clothing enterprises did not have the right to choose. They would accept all orders, regardless of high-end or low-end goods. The important thing now would be to maintain produce and retain workers to wait for the market to recover.

Market shrinks

In the context of such weak demand and despite the interest rate cut, there is a question that what will businesses borrow for when there is no consumption demand?

This issue was mentioned by Nguyễn Ngọc Hòa, chairman of the HCM City Business Association (HUBA) when he talked to the press on the sidelines of the HCM City Economic Forum held in early May.

According to Hòa, the economic situation is changing too quickly. Enterprises cannot export goods, and both domestic and foreign demand are narrowed.

At the end of last year and even at the beginning of this year, firms kept complaining that it was difficult to access loans. However, now it is on the contrary as it is not difficult to access capital but firms do not know how to use bank loans effectively due to low consumption demand. Therefore, they do not have the need to borrow money yet.

In the opposite direction, banks also need to pump capital into the economy. If they hold a lot of money, they will be stuck. The bank is forced to lower interest rates.

Talking about firms in HCM City in particular, Hòa said about 50 per cent of firms in the city were facing difficulties. They have to cut production and operate moderately.

On the side of experts, Dr. Đinh Trọng Thịnh said firms would borrow as long as the interest rates are cheap enough for them to make a profit.

In addition, it should be noted the current high lending rate is partly because banks mobilised a large amount of capital with high costs from the second half of last year. When the cost of the mobilised capital gradually becomes cheaper, the lending interest rate would also gradually decrease to support more actively for individuals and firms, Thịnh said.

Referring to the difficulties of the export market, on the sideline of the National Assembly’s meeting on May 23, Trần Hoàng Ngân, member of the Prime Minister's Advisory Group and secretary of the HCM City’s Party Committee, said the foreign market was very precarious when the world economy was on the decline, export firms, therefore, needed to take into account the domestic market with 100 million people.

According to Ngân, in the world, countries with populations from a few tens of millions to more than 100 million people often have to control economic openness moderately. Meanwhile, Việt Nam has a population of about 100 million people, but the openness of the economy is up to 200 per cent, double GDP. Ngân considers this a dangerous and risky factor.

Ngân believes that the global world has many uncertainties. Large openness will make Việt Nam wobble with the world fluctuations. It is necessary to seriously consider controlling openness if the country wants to build an independent and self-reliant economy.

Ngân suggested the Government pay attention to the social security support package, which would help reduce difficulties for workers with job cuts, disadvantaged households, and families under preferential treatment policies. Moreover, the package would help stimulate demand and increase aggregate demand for the economy.

At an NA meeting on Wednesday, Finance Minister Hồ Đức Phớc on behalf of the Government reported a Government’s proposal to continually implement the 2 per cent value-added tax (VAT) reduction policy.

Specifically, the Government proposes to reduce the value added tax (VAT) by 2 per cent for some groups of goods and services, which are currently applying the 10 per cent VAT rate, from July 1 to December 31 this year.

The VAT reduction policy, which was also implemented in 2022, is expected to be approved to stimulate domestic aggregate demand and partially offset the drop in export demand. — VNS