Economy

Economy

|

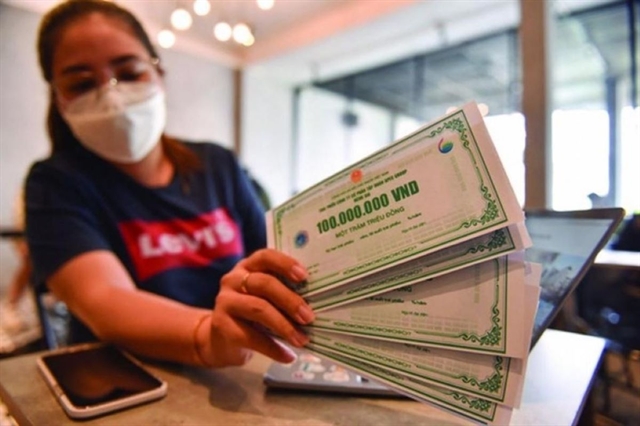

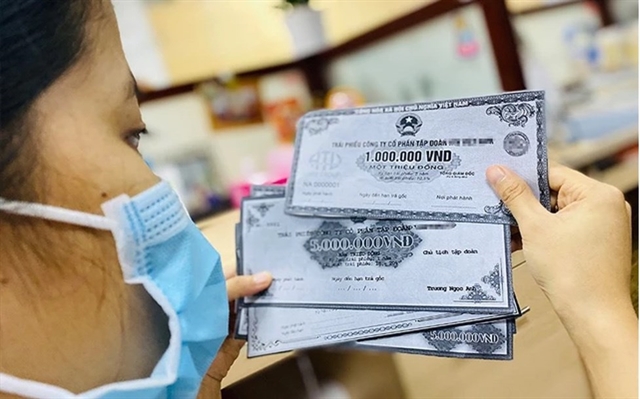

| Businesses have been struggling to come up with the cash to meet their bond obligations. VNA/VNS Photo |

HÀ NỘI — Businesses facing significant cash pressure during the remaining months of 2024 as corporate bonds mature at the end of the year, may be forced to look elsewhere to secure funding, said market analysts and experts.

In a recent development, bondholders of a major property developer have insisted the issuer add additional collaterals for their bonds, saying current collaterals were no longer sufficient as the issuer’s stock price has plummeted since the beginning of the year by nearly 40 per cent. The bonds, valued at VNĐ1 trillion, were issued in September 2021, maturing in March 2023, with an agreement to extend it to March 2025 at a higher interest rate, from 10.5 per cent to 11.5 per cent.

Many issuers, particularly in the property market, have been facing the same difficulty in coming up with the cash to meet bond obligations. Meanwhile, new issuances have not been popular among investors. Since the beginning of this month, several businesses have announced delays in interest and principal repayments.

To make matters worse, the total value of bonds maturing in October was reported at VNĐ15.3 trillion, significantly lower than September at VNĐ24.5 trillion, according to credit rating agency VIS Ratings. The rating agency said the majority of high-risk issuers have been struggling with poor financial performance and most have experienced delays in paying their debt before.

Debt refinancing activities have declined significantly, except for banks. According to statistics from Maybank Securities, non-bank businesses issued over VNĐ10 trillion in bonds in September, a 24 per cent decrease from August and a 17 per cent decrease year-over-year.

Similarly, corporate bond buyback activities in the first nine months of the year dropped by 22.7 per cent year-over-year, reaching VNĐ138 trillion, primarily from banks, accounting for 77 per cent, according to data from FiinRatings.

Notably, non-bank businesses largely reduced buyback activities in the third quarter compared to earlier in the year. This is a sign that they have not been successful in coming up with the cash, meaning the end-of-year maturity pressure will likely be greater, said experts.

Payment delays have been frequent as 18.9 per cent of businesses fail to pay, with most problematic bonds in 2024 belonging to companies that already faced delays in previous years, according to FiinRatings.

Nguyễn Thanh Lâm, head of Customer Research and Analysis at Maybank Securities said weak investors’ confidence and stricter regulations have slowed down activities in the corporate bond market.

According to the third-quarter 2024 report by the Vietnam Bond Market Association, VNĐ79.86 trillion worth of bonds are to mature in the last three months of the year, with 44 per cent from the property sector and 10.6 per cent from banks.

“The data shows that maturity pressure will decrease significantly in October compared to September but will rise again and peak in December,” he said.

The property sector was said to face a difficult outlook over the next 12 months, according to VIS Ratings. Around VNĐ42,000 trillion worth of bonds maturing is at risk of principal payment delays, with 47 per cent from the residential property sector.

Maybank's statistics indicated in this quarter, issuers plan to buy back about VNĐ2 trillion in bonds before maturity, while the amount maturing is around VNĐ3.5 trillion, which included VNĐ2.3 trillion in overdue and not including VNĐ4.8 trillion in extended maturity.

“We believe that part of this gap is covered by bank credit, asset sales... as well as fundraising through the stock market,” Lâm added.

The size of the corporate bond market has been shrinking relative to the economy. As of the end of the third quarter of 2024, the market size relative to GDP was about 10.9 per cent, down from its peak of 17 per cent in 2020. Banks remain the backbone of capital for the economy and the main players in the current bond market. — VNS

.jpg)