Economy

Economy

|

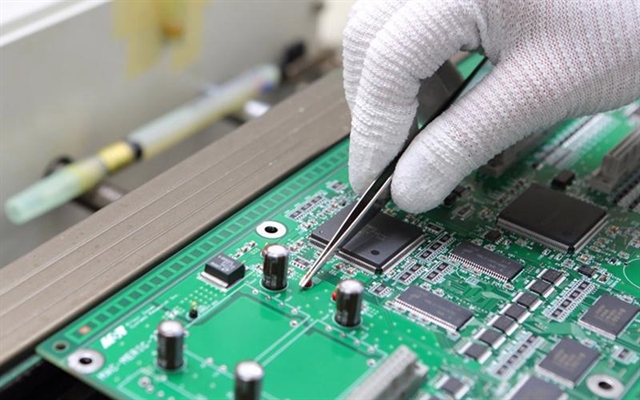

| A circut board is being manufactured. The electronics industry is among industries that GDT keeps a close watch on to prevent tax avoidance. — Photo vneconomy.vn |

HÀ NỘI — The General Department of Taxation (GDT) said it will tighten oversight of firms operating in certain industries, including agriculture and electronics, to curb tax avoidance.

In the first nine months of 2022, tax authorities nationwide handled 2,998 requests for value-added tax refund. They found that a large number of claimants were unqualified for the refund, thereby withholding a total amount of VNĐ1.87 trillion.

"Total withheld refund in the nine months amounts to VNĐ1.87 trillion," said GDT.

GDT also said the tax authorities carried out 4,646 post-refund inspections during the period. After the inspections, they took back VNĐ321.9 billion of tax refund from unqualified claimants and imposed a total fine of VNĐ92.5 billion on them.

The inspections also uncovered some cases of tax fraud among electronics firms, which have made false declarations of prices to illegally reduce their tax liability.

Several agricultural exporters, meanwhile, have their own way of tax avoidance. They buy agricultural produce from local sellers and export the produce to 'shell companies' in China, Laos and Cambodia, whose existence is on paper only, to claim a VAT refund.

"When Vietnamese tax authorities contact their counterparts in those countries to verify the exporters' invoices, the counterparts said they are unable to either find any trace of the importers or get in contact with them," said GDT.

GDT underlined the use of fraudulent invoices as another common way to dodge taxation. Under this scheme, firms use the invoices generated by 'mobile' firms, which frequently move their business location from place to place, to claim VAT refund.

"Those invoice buyers purchase no goods, own no warehouses and use no vehicles. They buy invoices only to validate their claim for VAT refund," said GDT.

Vũ Mạnh Cường, director of the Tax Audit and Inspection Department, GDT, revealed that the general department will step up inspections in the short term to fight tax fraud. It will also stick to five other measures to keep illegal practices in check.

The first measure involves the use of Criteria for Handling Requests for VAT Refund and the selection of high-risk firms for post-refund inspections.

The second measure is to establish an invoice-verifying support system at every tax authority to make the process faster. The third measure requires the widespread use of e-invoices among firms. In fact, e-invoices have become the norm since July 1, 2022.

The fourth measure highlights the need for frequent inspections of firms operating in high-risk industries. The fifth measure points to close cooperation between tax authorities and other relevant agencies in the prevention of tax loss.

For example, customs authorities could assist tax authorities in verifying the activities of tax refund-claiming exporters and send them a list of high-risk firms that should come under intense scrutiny. —VNS