(HÀ NỘI) Banks are racing to attract more amount of current account savings account (CASA) as this reflects the effectiveness of attracting customers to use digital banking services.

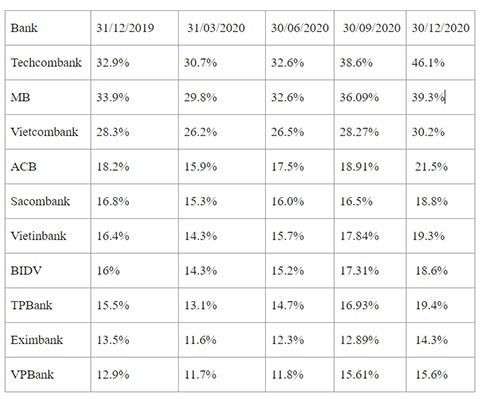

In 2020, the CASA champion was Techcombank, with a record rate of 46.1 per cent.

|

Top 3 CASA 2020: Techcombank, MB and Vietcombank

In the XIII National Party Congress on January 27, Governor of the State Bank (SBV) Nguyễn Thị Hồng said that in the 2016-2020 period, non-cash payments were promoted, digital transformation, digital banking products and services were developed strongly.

Cashless payments ratios also grew impressively. By the end of 2020, it had grown by 344.2 per cent in quantity and 96.1 per cent in value over the same period in 2016. Mobile phone payments also grow by more than 100 per cent per year over a number of years.

Third quarter survey results in commercial banks showed up to 13 out of a total 23 commercial banks reported a decline in CASA rate. Up to 13 out of 23 banks also recorded CASA ratio at a low level, below 15 per cent.

During the two years 2018-2019, Vietcombank, MB and Techcombank often reported a CASA rate of around 30 per cent. But in 2020, Techcombank surprisingly outpaced the other two, with a CASA rate of 46.1 per cent. In second place, MB continued to show its strong CASA rate as it surpassed 39 per cent and Vietcombank ranked third with about 30 per cent.

Techcombank's CASA rate surprised the market as there has never been a case in the past where the rate exceeded 45 per cent.

The COVID-19 pandemic created the need for more and more customers to drop traditional banking methods and switch to online transactions.

Techcombank grasped advantages in the race by pioneering in digital transformation.

Why the race to attract CASA is getting fierce

For banks, attracting a high demand deposit ratio (CASA ratio) really matters as it helps lower their funding cost. Normally, demand deposit interest rate is significantly lower than that of term deposits, usually at around 0.2%/annum. The higher the CASA ratio, the better the Net Interest Margin (NIM), enabling banks to offer more competitive lending rates to the market. A higher CASA ratio also reflects a bank’s strength in having a comprehensive product suit as many value-added products and services are linked to customers’ current accounts.

At Techcombank’s Q4/2020 Analyst Presentation held recently, Mr. Hung Phung – Deputy CEO said that the Bank’s impressive CASA ratio of 46% is the result of a major shift in deposit mix towards low-cost funding (demand deposit). “Techcombank has been very consistent in offering a comprehensive product suit that caters to the demand of our target customer segments, making Techcombank their primary bank, hence increasing our CASA ratio. Our present ratio of 46% is a competitive advantage that allows us to sustain growth over the long term”.

As explained by Techcombank’s executive team, the high CASA ratio is also part of the strategic transformation in retail banking in order to acquire and retain customers by using a strong digital platform and constantly enhancing customer experience. In 2020, Techcombank has brought a lot of its products and services online, from everyday banking to issuance of pre-approved credit cards, financial management and trading of investment products. These solutions are effective and convenient as they help customers to save time and cost, and choose Techcombank as their primary bank.

This is why retail customers transaction volume via online channels in 2020 reached 383 million (up by 108.8% year-on-year), while transaction value reached 5 zillion VND (up by 84.2% year-on-year). Techcombank has on-boarded around 1.1 million new customers, increasing the number of customers to nearly 8.4 million. In the same year, Techcombank was awarded “Best Payments Bank in Vietnam” by The Asian Banker thanks to its reputable brand and the capacity to process a large transaction volume during the day.

"What is most important for Techcombank is to really understand our customers and make us their primary bank. We do this by investing in and enhancing our design capability, and pushing stronger forward with digitalization,” emphasized Mr. Hung Phung.

Casa ratios of banks in 2020

|

.jpg)