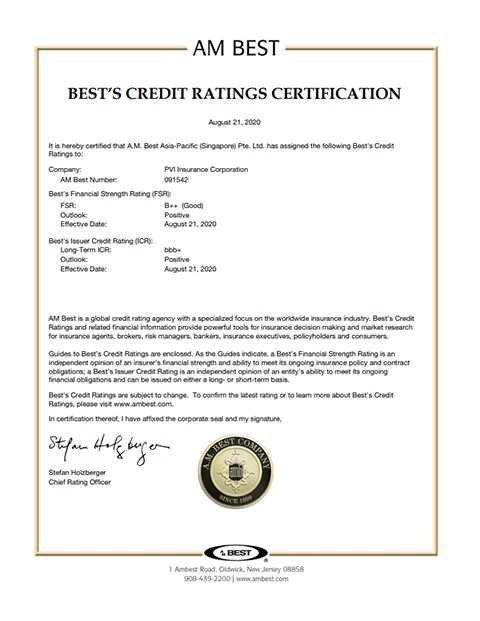

Global credit rating agency AM Best has revised the outlook for PVI Insurance Corporation to positive from stable and kept ratings unchanged at B++ (Good) for Financial Strength Rating and bbb+ for Long-Term Issuer Credit Rating.

|

HCM CITY – Global credit rating agency AM Best has revised the outlook for PVI Insurance Corporation to positive from stable and kept ratings unchanged at B++ (Good) for Financial Strength Rating and bbb+ for Long-Term Issuer Credit Rating.

The ratings reflect PVI Insurance’s balance sheet strength, which AM Best categorises as very strong as well as its adequate operating performance, neutral business profile and appropriate enterprise risk management.

|

PVI Insurance also benefits from rating enhancement from HDI Global SE.

The revised outlooks reflect operating performance metrics that have strengthened in recent years and now compare favorably with industry peers and global benchmarks.

Underwriting performance has shown good stability over time, supported by robust earnings from profitable commercial and industrial business achieved through an ongoing focus on risk selection and expense control.

While other major lines of businesses, including personal accident and motor insurance, have seen high competition leading to elevated loss ratios, the company has undertaken portfolio remediation measures, which include tighter underwriting controls, more refined performance monitoring, non-renewal of unprofitable accounts, and centralisation of claims management processes.

The underwriting performance has shown further positive development in the first half of fiscal year 2020, particularly in motor, health and personal accident lines as a result of COVID-19-induced community lockdown and mobility restriction measures.

However, risks to the commercial and industrial insurance segments, including premium contractions due to economic uncertainty, remain over the near term.

The ratings also reflect the implicit support PVI Insurance gets from HDI in various areas of business.

Although PVI Insurance’s operations account for a small portion of HDI’s overall revenues and earnings, it is viewed as a strategic component of the latter’s international expansion plans.

PVI Insurance’s balance sheet strength assessment is underpinned by risk-adjusted capitalisation that remains at the strongest level, as measured by Best’s Capital Adequacy Ratio (BCAR).

Good financial flexibility was demonstrated by a history of capital injections, including a most recent round of VND500 billion (US$ 22 million) from PVI Holdings - its parent company, in second quarter 2020.

The company has maintained a high dividend payout ratio in recent years, while retained earnings combined with periodic capital contributions have been sufficient to underpin business growth.

An offsetting balance sheet factor continues to be the company’s high reinsurance usage and dependence to enable the underwriting of large commercial property, energy and engineering risks.

PVI Insurance’s business profile is assessed as neutral. PVI Insurance is the second largest insurer in Việt Nam’s non-life market by gross premium written last year, and has a strong market position in commercial and industrial lines of business, including property, engineering, marine, aviation, and energy insurance.

The company benefits from business sourced from the other huge shareholder, PetroVietnam group (PVN), the state-owned oil and gas corporation.

The company’s ultimate majority ownership by HDI is expected to strengthen its position in the regional industrial risks insurance market.

In the future, AM Best expects PVI Insurance to benefit further from HDI group’s international product expertise in areas of risk selection, pricing and reserving, as well as its oversight and support in respect of risk management.