Since 2015-16 Ricons Construction Investment JSC has been forecast to become a "new star" in the construction sector, thanks to its solid foundation and rapid development profile.

Ricons has turned this forecast into reality after experiencing both the prosperous and gloomy periods in the real estate market.

A shining star…

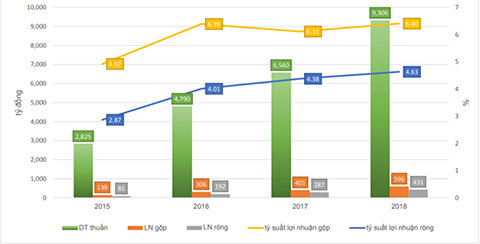

Ricons achieved outstanding business results in the 2013-18 period, with compounded annual growth rates of 48.4 per cent and 72.6 per cent in net sales and net income.

In 2018 Ricons achieved VNĐ9,305 billion (US$401.9 million) in net revenues and VNĐ431.3 billion ($18.6 million) in profit after-tax, a year-on-year increase of 42 per cent and 50.2 per cent, respectively giving it a basic EPS of VNĐ13,077 after bonus and welfare.

Some financial indicators of Ricons for the period 2015 – 2018:

|

In the first nine months of 2019, Ricons sustained its growth rate despite unfavourable market conditions, partly thanks to its excellent performance in the third quarter.

In that quarter its revenues grew by 13.8 per cent to VNĐ2,613 billion ($112.88 million). Its net operating profit increased by 20 per cent year-on-year to VNĐ125 billion ($5.4 million). Profit after tax attributed to parent company’s shareholders was VNĐ103 billion ($4.42 million), up 17 per cent year-on-year.

In the first nine months, though revenues dropped by 2.6 per cent to VNĐ5,186 billion ($224.2 million), gross profit was up by 11.6 per cent to VNĐ330 billion ($14.2 million). The gross profit margin improved to 6.37 per cent from 5.56 per cent a year earlier, while operating costs did not see much change.

Ricons' construction business is more diversified than that of other players in the industry, and includes distribution of construction materials, real estate lease and factory construction. It has won bids for many large factory projects this year.

The gross profit margin of its construction business in 2018 reached a high of 6.6 per cent compared to 6.2 per cent in 2017 and 5.9 per cent in 2013-17.

This impressive result is due to many factors.

According to Bảo Việt Securities JSC, Ricons enjoys a number of competitive advantages. Firstly, it boasts great prestige and outstanding construction capabilities and optimise its closed construction value chain from providing construction materials and equipment to consulting, design, construction, real estate brokerage, and real estate management services.

Secondly, it has good relationships with customers in the residential development segment, including major players such as Vingroup, Novaland, An Gia, Khang Dien, and Gamuda, and in the factory segment from China and Taiwan.

Thirdly, its abundant finances allow it to invest in real estate projects, which brings more contracts and increases revenue, minimises competition and creates additional sources of profits.

Thus, Ricons does not have to depend on bank credit to finance receivables because of its stable cash flows and numerous short-term investments.

As of September 30 the company's cash and cash equivalents were worth VNĐ458.8 billion ($19.8 million), up 241.1 per cent from a year earlier.

… in the gloom

According to data from Vietstock, 21 construction firms suffered losses in the first nine months of the year, an increase of six from a year earlier.

This clearly shows that 2019 was not a favourable year for construction businesses due to the downturn in the real estate market. Construction firms have faced many difficulties, with even major players struggling to cope with them.

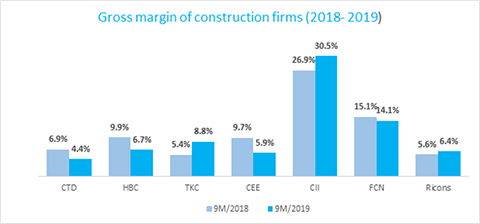

For instance, the leader in the construction sector, Coteccons (CTD), saw year-on-year falls of 22 per cent and 60 per cent in revenues and after-tax profit to VNĐ16,262 billion ($702.77 million) and VNĐ478 billion ($20.65 million).

In fact, Coteccons has shown signs of slowing down since 2018 with revenues increasing by only 5.2 per cent and net income falling by 8.7 per cent last year.

In the past the company had seen revenues rise by more than 40 per cent annually on average, climbing from VNĐ4,477 billion ($193.46 million) in 2012 to VNĐ27,153 billion ($1.17 billion) in 2017.

Another major construction company, Ho Chi Minh City Infrastructure Investment Join Stock Company (CII), saw revenues decrease by 33 per cent in the first nine months of 2019 to VNĐ1,471 billion ($63.55 million). Profit after tax of the parent company quintupled to VNĐ453 billion ($19.56 million), but mainly because of financial investment and liquidation of subsidiaries.

Besides, CII is the largest borrower in the sector, with total loans (including convertible bonds) of VNĐ13,545 billion ($584.8 million) as of September 30, up 10.95 per cent from the beginning of the year. This means CII has the highest interest liability in the sector of nearly VNĐ2 billion ($86,000) per day.

Refrigeration Electrical Engineering (REE) Corporation sustained its profits in the first nine months of 2019, though at VNĐ1,189 billion ($51.37 million) it was down nearly 4 per cent year-on-year.

Its revenues in the first nine months were VNĐ3,565 billion ($154.1 million), up 2.87 per cent. In the context of the current difficult market, most construction giants such as HBC, VCG, CII, and ROS have reported a sharp increase in receivables. REE’s short-term receivables increased to 70.8 per cent to VNĐ3,357 billion (145.04 million).

Hòa Bình Construction Group (HBC) saw its revenues increase by 6.88 per cent in the first nine months of 2019 to VNĐ13,646 billion ($589.6 million), but profit after tax of the parent company plunged by almost 54 per cent to VNĐ233.87 billion ($10.1 million).

In the gloom that shrouds the construction market currently, Ricons has shown its strength with solid results in contrast to the large companies in the industry.

Its profit margin has consistently improved over the years to reach 6.4 per cent in the first nine month of 2019 -- while Coteccons' profit margin decreased to 4.37 per cent.

|

Acknowledging the difficulties in the market in 2019, most construction enterprises set lower targets for the year than in 2018. For instance, Coteccons’ revenue and consolidated profit targets were 5.5 per cent and 14 per cent lower than in 2018, marking negative growth for the second year in a row.

But Ricons targeted 18.2 per cent growth in revenues and 10.2 per cent growth in consolidated profit after tax.

In a difficult market, Ricons is proving its dynamism, seizing market opportunities, while many big players in the industry are struggling to seek motivation for growth.

.jpg)

.jpg)