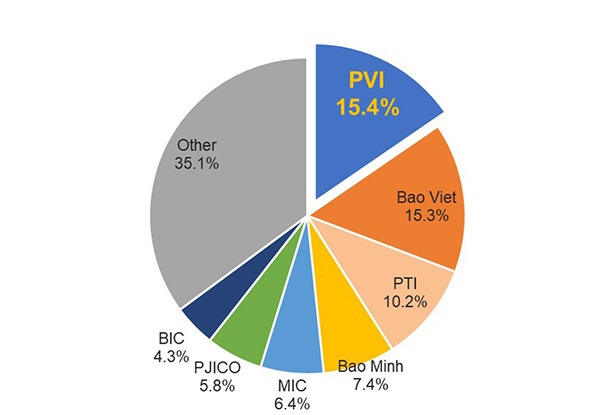

According to the Insurance Association of Vietnam, PVI Insurance accounted for 15.4 per cent of the market share in the first 6 months of 2021, No.1 position in the non-life insurance market, surpassing Bao Viet in second place with 15.3 per cent. This is the second consecutive quarter PVI Insurance has taken the lead in the market in terms of market share.

Extremely complicated developments of Covid-19 pandemic have caused serious impacts on all aspects of social life. In this challenging context, PVI Insurance has still managed to achieve the total revenue of VND 5,445 billion for the first 6 months of 2021, equivalent to 114.4 per cent of the six-month plan and 56.8 per cent of the annual plan, an increase by 12.7 per cent compared to that in the same period last year. PVI Insurance's pre-tax profit reached VND 415 billion, equivalent to 64.2 per cent of the annual plan, an increase by 8.3 per cent compared to that in the same period in 2020. Not only being the leader in terms of original premium revenue, PVI Insurance is also the leader in the non-life insurance market in terms of charter capital, total assets, total revenue, profit by insurance business, pre-tax profit and ROE.

|

Despite the second half of 2021 is even tougher than the first half period, PVI Insurance still targets to reach the 12-month revenue of VND10,000 billion. This is a very ambitious goal, especially maintaining the leading position in terms of efficiency which it has achieved over the years is also a parallelly unchangeable target. By continuing to pursue the appropriate and reasonable business strategy, which is “priority to business efficiency and developing effectively”, and maintaining the flexibility in business policies to respond to market fluctuations, PVI Insurance is confident that it is on the right track and hopes to achieve its goals.

In the coming years, PVI Insurance's goal is to become the leading sustainable insurance company in Vietnam and in Southeast Asia. This is not only the aspirations and will of PVI Insurance’s management and employee, but also its foreign shareholders’ requirement. PVI Insurance is a subsidiary 100 per cent owned by PVI Holdings (stock code: PVI). Currently, HDI Global (Germany) is PVI's largest shareholder holding 45.9 per cent of charter capital, International Finance Company (IFC) is another foreign strategic shareholder holding 6.29 per cent of charter capital.

HDI Global plans to develop its direct insurance in Southeast Asia through PVI Insurance. IFC invested in PVI as a strategic investor with long-term commitment. When investing in PVI, IFC plans to cooperate with HDI Global to promote the development of PVI's corporate governance, risk management and compliance policies, and to adjust governance policies to ensure they are in line with international standards. HDI Global and IFC aim to strengthen PVI's position as the leading insurance company providing insurance solutions in the commercial and industrial sectors of Vietnam.

HDI Global SE is a company in the Industrial Lines Division of the Talanx Group.

Approximately 3.700 employees in this division generated gross written premiums of approx. EUR 6.7 billion in the year 2020.

The rating agency Standard & Poor’s has given the Talanx Primary Group a financial strength rating of A+/stable (strong). Talanx AG is listed on the Frankfurt Stock Ex-change in the SDAX. Since investing in PVI, HDI Global has played an important role in supporting PVI to expand its business operations in Southeast Asia.

Petro Vietnam is the second largest shareholder in PVI which holds 35% of shares. For the past 25 years, Petro Vietnam has always been a major investor and important partner of PVI in key industrial insurance sectors.

IFC – a member of the World Bank Group – is the largest global development institution focused on the private sector in developing countries. IFC advances economic development and improves the lives of people by encouraging growth of the private sector in developing countries. IFC Asset Management Company, a division of IFC, mobilizes and manages capital to invest in businesses in developing and frontier markets.