Economy

Economy

By Ly Ly Cao

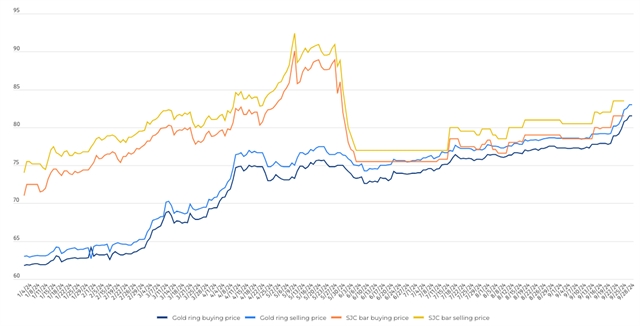

HÀ NỘI — The domestic gold market shone last week, with prices for gold rings breaking records and even surpassing the buying price of SJC gold bars. However, experts warn investors to avoid borrowing money to purchase gold.

At the close of the week, gold ring prices were quoted at up to VNĐ82.75 million (US$3,362) per tael for buyers and up to VNĐ83.45 million per tael for sellers. These represent all-time highs for both buying and selling prices for gold rings.

Throughout the week, gold ring prices continued to reach new record levels.

For SJC gold bars, prices remained stable after Tuesday’s hike, with a buying price at VNĐ81.5 million per tael and a selling price at VNĐ83.5 million per tael.

This marked the highest price level for SJC gold bullion since June 3, when the State Bank of Việt Nam (SBV) increased the supply of SJC gold bars through select commercial banks and Saigon Gems and Gold One Member Limited Liability Company.

|

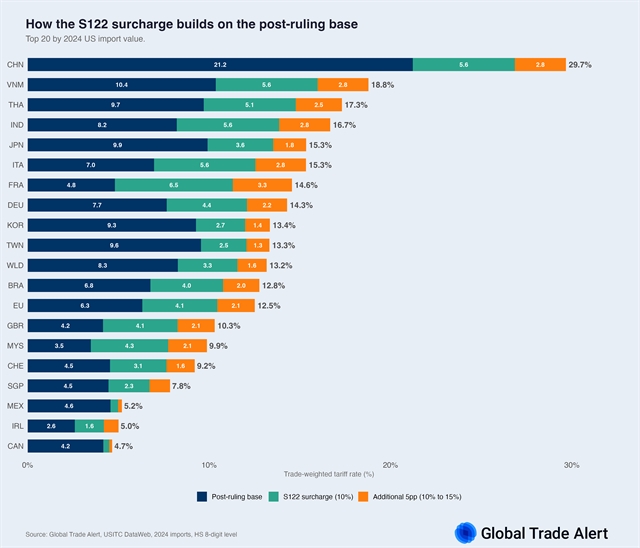

| Domestic gold bar and gold ring prices in 2024 (million per tael). -- Data & graphic Ly Ly Cao. |

As a result, the spread between SJC gold bars and gold rings narrowed to just VNĐ50,000 per tael, its lowest ever level.

The record rallies were driven by a similar trend of global gold prices, Nguyễn Đức Hùng Linh, Founder and Chief Advisor at Think Future Consultancy & Investment, told Việt Nam News.

Linh noted that global gold prices are influenced by a multitude of factors in the international financial landscape.

The US Federal Reserve (Fed) recently reduced interest rates by 0.5 percentage points after a prolonged period of rate hikes aimed at curbing inflation.

The rate cut has propelled the value of gold upwards.

At the same time, the US Dollar Index, which measures the performance of the dollar against a basket of five major currencies, remains stagnant. The depreciation of the US dollar has, in turn, increased the appeal of gold, pushing gold prices higher.

Beyond the Fed's monetary policy adjustments, several other factors are contributing to the rise in gold prices, Linh added. Geopolitical tensions and localised conflicts, particularly the ongoing conflict between Israel and Hezbollah, have heightened demand for gold as a safe-haven asset.

Additionally, central banks worldwide are actively acquiring gold, recognising it as a crucial national reserve asset.

Investor optimism about gold's upward trajectory is also prompting increased acquisition and hoarding of the precious metal.

These combined factors have pushed global gold prices above $2,600 per ounce (1 ounce = 0.83 tael). The spot gold price closed last Friday at $2,657.9 per ounce, after hitting a historic high of $2,685.42 on Thursday.

Giving further insights on domestic gold price trends, Linh said that global gold prices adhere to the principles of supply and demand, which are beyond absolute control. This contrasts with the dynamics of the gold market in Việt Nam.

Việt Nam’s gold market is divided into two key segments that draw investor attention: gold bars and gold rings. Gold bars ared aligned with the nation's price stabilisation policy. Recent efforts by the State Bank of Việt Nam have successfully driven down gold bar prices from approximately VNĐ92 million per tael to around VNĐ80 million per tael.

|

| Gold rings displayed at a gold store in Trần Nhân Tông Street, Hà Nội. — Photo Ly Ly Cao |

Meanwhile, gold rings, which are not subject to price stabilisation measures, continue to follow market forces of supply and demand.

Thus, despite rising global gold prices, the prices of domestic gold bars are unlikely to see significant increases due to controlled supply and regulated pricing.

However, gold ring prices are anticipated to continue their upward trend, as they operate more in line with the principles of supply and demand.

Gold prices to breach $3,000

Experts from Citi Research forecast that global gold could reach $3,000 per ounce by mid-2025 and $2,600 by the end of 2024, driven by US interest rate cuts, strong demand from exchange traded funds, and over-the-counter physical demand.

The upcoming US presidential election on November 5 could also boost gold prices, as potential market volatility may drive investors towards safe-haven assets like gold.

"Gold prices are forecast to potentially rise to $3,000 per ounce, equivalent to VNĐ90 million per tael, by 2025. With gold being viewed as a safe-haven asset, there are expectations for its price to increase," said Dr Nguyễn Trí Hiếu, a banking and finance expert.

“If that is the case, it is likely to affect the domestic gold market. However, as long as the gold price stabilisation programme persists, gold ring prices will likely soar at the end of this year and early next year.”

He also warns that amid the gold price frenzy, it is crucial to avoid borrowing money to purchase gold. If gold prices suddenly drop, borrowers could face heavy financial losses and debt repayment pressures simultaneously. — VNS