Economy

Economy

|

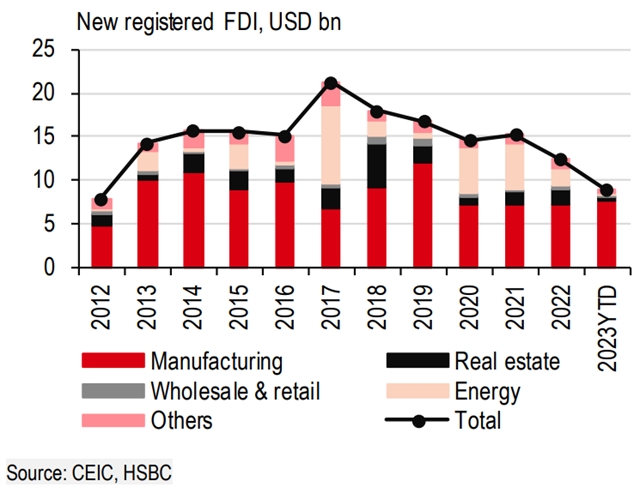

| Vietnam continues to see new FDI pouring into its manufacturing sector. — Photo courtesy of HSBC |

HÀ NỘI — Despite severe trade challenges, Việt Nam continues to be on the frontline to absorb quality FDI, according to research by HSBC released on Tuesday.

According to HSBC economists, ASEAN attracted a record high of almost 17 per cent of global FDI in 2022, nearly double from four years ago. This achievement is a clear reflection of ASEAN’s strong fundamentals, favourable demographics, and competitive supply chains.

That said, it is worth noting that not everyone benefits to the same extent. Over 65 per cent of the region’s FDI has poured into Singapore, equivalent to as much as 25 per cent of its GDP on average. But this is in part due to its strategic position as a key financial centre.

Malaysia and Việt Nam have gained substantial FDI. As an example, new FDI into Việt Nam’s manufacturing sector so far this year is already more than in each of the past three years. Indonesia’s FDI has not yet picked up notably, but its industrial transformation is gathering investor attention.

There are two obvious supply chains benefitting the most: the tech industry and electronic vehicles (EV). Singapore, Malaysia and Việt Nam are three outperformers in the former, while Indonesia and Thailand are key beneficiaries in the latter. To see the power of FDI, Malaysia now has a 45 per cent global market share in a semiconductor subsector. Outside of manufacturing, ASEAN’s financial services have gained momentum, but this is mostly geared to Singapore.

When thinking of FDI and the benefits it can deliver, Việt Nam naturally stands out. Since Việt Nam’s Đổi Mới reforms in 1986, the country has received substantial FDI inflows, turning itself into a rising star in the global manufacturing supply chain. While much of the investment initially entered the lower value-add textile and footwear space, Việt Nam has quickly climbed up the value chain, growing into a key hub for electronics assembly. Much of the success in tech is thanks to Samsung’s multi-year FDI roadmap in Việt Nam: with an investment of US$18 billion over the last two decades, half of Samsung’s global smartphone production is from Việt Nam. This has also incentivised other tech giants, particularly Apple, to expand their operations.

Despite severe trade challenges, Việt Nam continues to be on the frontline to absorb quality FDI. Greenfield FDI rose 40 per cent year-on-year in the first eight months of 2023, with manufacturing alone accounting for 85 per cent of new FDI. In particular, new FDI into manufacturing YTD has surprisingly exceeded that for the whole year in each of the past three years. Despite a trade downturn, the trend provides hope for Viet Nam to see a strong rebound when the cycle turns.

Traditionally, intra-ASEAN, the US and the EU have been early movers of investing in ASEAN. In the manufacturing space, ASEAN’s backbone of FDI, has seen heavy influence from Japanese and Korea investors. The former has turned Thailand into a regional hub for automobiles, and the latter has transformed Viet Nam into an emerging centre for consumer electronics. China, compared to others, is no doubt a late comer. That said, China has been expanding its investment footprint to ASEAN and catching up with peers swiftly. While the US and the EU remain two sizeable investors, they are largely important sources for the financial sector and manufacturing, typically geared towards advanced manufacturing. — VNS