Economy

Economy

|

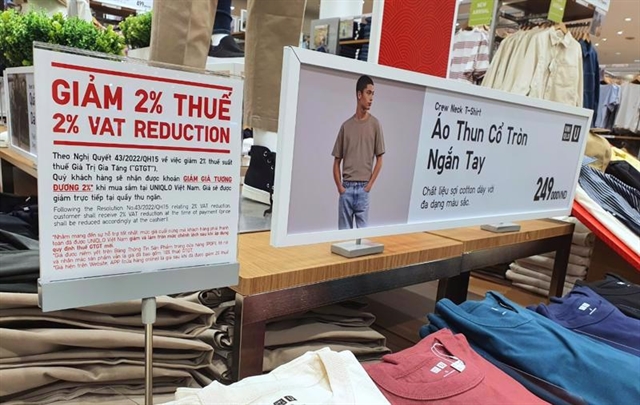

| Clothes subject to VAT cut of 2.0 per cent under Resolution No.43 on sale in a shop. Photo vneconomy.vn |

HÀ NỘI — The VAT cut bill introduced on May 6 has sparked heated debate in the National Assembly (NA).

Minister of Finance Hồ Đức Phớc said the bill, Resolution No.72, was intended to accelerate economic recovery through a tax-induced consumption boost. It would serve the same purpose as the Resolution No.43, which activated VAT cuts of 2 per cent on various categories of goods and services in 2022.

As the exclusion of certain items from Resolution No.43 caused higher compliance costs for taxpayers and administrative costs for tax authorities, the Government fixed the issue by drafting the bill with a broader scope, covering all categories of goods and services being subject to a VAT of 10 per cent.

"Regarding businesses that issue invoices on those goods and services, the Government in 2023 also pressed for a smaller portion of their revenues to be held VAT-taxable," said Phớc.

In his estimation, the State Budget would lose VNĐ35 trillion (US$1.5 billion) in the last six months of 2023 should the bill pass in the NA. However, its benefits would far outweigh its costs as the cuts would produce a significant effect on domestic consumption.

Nguyễn Vân Chi, deputy head of the NA Committee for Financial and Budgetary Affairs, was concerned about the steps which the Government had followed to get the bill on the NA agenda. Those steps did not comply with Resolution No.50 on law-making procedures, resulting in committees having to review the bill at very short notice.

The Committee also disagreed with the scope of the bill, which covers a wider range of items than Resolution No.43, including those in the banking, securities, and realty sectors. The Committee opines that the bill should be revised to target the same goods and services as the resolution to reduce its impact on the State Budget.

NA Secretary-General Bùi Văn Cường thinks differently. He said lawmakers should not exclude any items from the bill but rather expand it to cover the categories of goods and services being subject to a VAT of 5 per cent.

In his perspective, the fiscal stimulus should be all-inclusive to produce a broad-based effect on the economy. He requested the Government to make a report on the scenario in which 5-per-cent-taxed items come into play.

Meanwhile, NA Chairman Vương Đình Huệ shares Chi's view, saying that a wider range of items subject to tax cuts would not necessarily means a more favourable effect on the economy, because the situation in 2023 is different to last year.

The chairman calls for the bill to be revised to have the same scope as did Resolution No.43. The chairman also requests an additional clause to the bill, which holds the Government responsible for its timely implementation.

NA's Standing Committee requests the Government to implement the bill, if passed, in a manner that would not cause a shortfall in the projected fiscal budget. In other words, the increased domestic consumption must be sufficient to offset the loss in the State Budget.

Some MPs opine that an effective date in May would be relatively late for the bill to have its desired effect on the business sector. — VNS