Society

Society

|

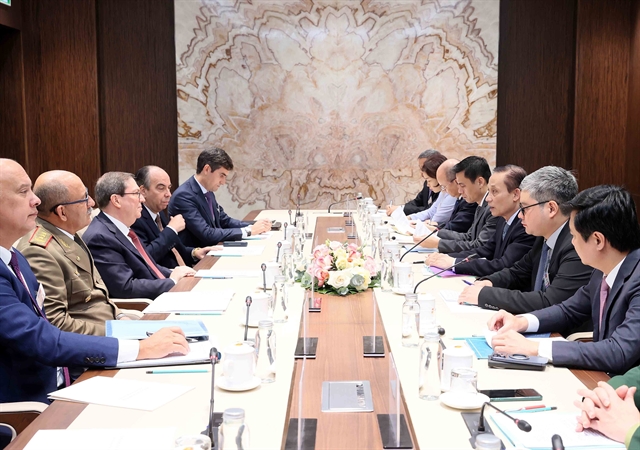

| HCM City is implementing tax exemption and reduction policies to further promote start-ups under Resolution 98. — VNA/VNS Photo |

HCM CITY — HCM City is implementing tax exemption and reduction policies to further promote start-ups and position itself as a hub for innovation and technological advancements.

The move comes as a response to a newly approved resolution by the National Assembly, which aims to create special policy mechanisms to foster start-ups.

Lê Thanh Minh, deputy director of the Department of Science and Technology, said the city has immense potential for economic growth and job creation that comes with a thriving start-up ecosystem.

HCM City is home to over 2,000 start-ups, accounting for about 50 per cent of such enterprises nationwide.

The department is working on drafting regulations and guidelines to support start-up activities in accordance with the resolution, he said.

The regulations aim to establish a legal framework for implementing tax exemption policies for innovative start-ups, he added.

Under the draft, start-up businesses would need to meet specific conditions and obtain certification to be eligible for tax benefits.

These conditions include operating in priority sectors, engaging in innovative activities, and possessing certification as criteria for tax consideration.

By setting these criteria, the city ensures that tax benefits are directed towards start-ups that truly contribute to the growth and development of innovative sectors.

Resolution 98, which took effect from early August, outlines several tax benefits for start-ups in HCM City.

Under the resolution, corporate income tax will be exempted for a period of five years, including income generated from innovative start-up activities conducted by businesses, scientific and technological organisations, and innovation centres.

In addition, personal income tax and corporate income tax for individuals and organisations with income from capital contributions to start-ups will also be exempted.

The implementation of tax benefits for start-ups in HCM City under Resolution 98 will further enhance the attractiveness of the city for foreign investors.

Resolution 98 grants HCM City increased autonomy to enable the city to tackle persistent challenges it faces.

This increased autonomy in institutional governance allows local authorities to streamline administrative procedures and improve public services.

The resolution also grants the city the authority to attract investment in strategic sectors such as chip manufacturing, new materials, and sports and culture through public-private partnerships.

In a related issue, HCM City is implementing a project aimed at attracting experts, scientists, and individuals with special qualifications.

The project focuses on two talent attraction groups: those with special qualifications and outstanding students or individuals with high qualifications.

Phan Văn Mãi, Chairman of the city People’s Committee, speaking at a recent meeting, said by providing tax benefits to start-up businesses and attracting top talent, the city aims to foster the development of a thriving start-up ecosystem and further contribute to its economic growth and job creation. — VNS