Opinion

Opinion

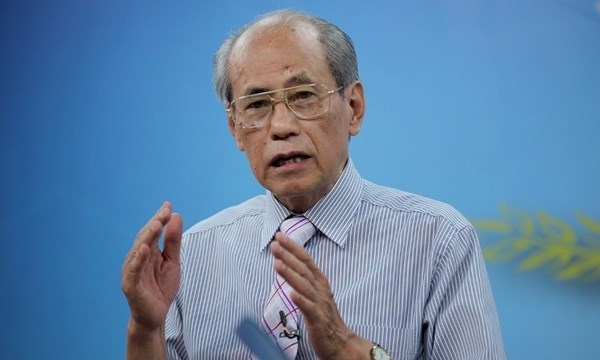

Lưu Bích Hồ, former director of the Development Strategy Institute under the Ministry of Planning and Investment, spoke to the newspaper Kinh tế & Đô thị (Economic and Urban Affairs) about opportunities and challenges that Việt Nam will face to increase its already high GDP.

|

Lưu Bích Hồ, former director of the Development Strategy Institute under the Ministry of Planning and Investment, spoke to the newspaper Kinh tế & Đô thị (Economic and Urban Affairs) about opportunities and challenges that Việt Nam will face to increase its already high GDP.

What are the positive and negative factors that Việt Nam is facing if it wants to achieve a GDP growth rate of 7 per cent for 2016 as suggested by Prime Minister Nguyễn Tấn Dũng in the February cabinet meeting, against the target of 6.7 per cent set earlier by the National Assembly?

Việt Nam’s GDP in 2015 was 6.68 per cent. This laid a firm foundation for the nation to enter 2016 with positive signals, including a low inflation rate and a quick economic recovery. However, in 2016, Việt Nam faces many potential risks from both the international and regional economies. These include the low price of crude oil, the world’s financial bubble, and various countries’ monetary policies among other risks. Việt Nam’s economy, particularly its import-export activities, exchange rates, and budget collection and spending, will depend very much on what is happening in the rest of the world.

At present, Việt Nam is facing a big problem in overspending, coupled with a hike in public debt, while many enterprises have declared bankruptcy and ceased operations.

In my opinion, the greatest challenge for Việt Nam in 2016 is how to optimise opportunities presented to us by the ASEAN Economic Community (AEC) and the Free Trade Agreements when they come into effect, particularly in the face of strong competition from other economies.

If the 7 per cent GDP growth rate is approved by the coming National Assembly, many previous socio-economic targets set for 2016 by the National Assembly will have to be adjusted. Is that right?

Of course!

There are three driving forces behind our GDP growth rate in the near future.

First, it is calculated that our exports in the next five years may increase by between 15-20 per cent per annum.

Second, in 2016, Việt Nam’s total social investment will be between 30-31 per cent of GDP.

And finally, deeper international integration will put pressure on the country to speed up reforms. This is the only way to reduce waste and increase the national economy’s effectiveness. These two elements will lay a firm ground for a higher economic growth rate in the future.

In 2015, the credit growth rate was 18 per cent, so the targeted credit growth rate of between 18-20 per cent for 2016 is totally achievable. More importantly, the high quality of our credit will help to limit bad debt while controlling inflation.

Tight budgets due to overspending and public debt has caused many difficulties for the nation. What policies should the Government adopt to stimulate national aggregated demand and promote private sector investment?

In my opinion, the most important policy at present is to tighten state budget spending, in particular public spending, to stabilise the macro economy.

Of course, in the context of reducing public spending, Việt Nam should encourage private sector investment. This is totally in line with the operation of a market economy and with the 2014 Law on Investment. The new investment law has been described as a historical milestone following the policy of đổi mới (renewal) and the implementation of Việt Nam’s WTO commitments.

In your opinion what opportunities and challenges will Việt Nam face in 2016 when many free trade agreements come into effect?

The productivity, quality, effectiveness and competitiveness of our economy remains low, while our production and exports, particularly the primary agricultural industry, are facing many difficulties and challenges. Coupled with this is the poor connectivity between foreign direct investment enterprises and Vietnamese enterprises.

Việt Nam has the potential to turn tourism into an industry to spearhead the economy, but as yet this remains underexploited.

All these things are limitations that are hindering our country’s development.

Việt Nam is in the process of deepening its international integration. If we want to lure more foreign direct investment to our country, we will need to create more demand for real estate, tourism and new services.

In 2016, the Government has laid emphasis on three main programmes: the national enterprises programme; helping enterprises to overcome their difficulties and challenges; and a start up programme.

In my opinion, the Government should also send out specific messages on a number of key issues, including lending rates, the fight against corruption, improving the investment climate, and restructuring the national economy, particularly in infrastructure development and human resources training. — VNS