Economy

Economy

Recently the State Bank of Việt Nam (SBV) issued a licence to Malasyia’s second largest lender, CIMB Bank Berhad, to establish a bank in Việt Nam with a registered capital of over VNĐ3.2 trillion (nearly US$144 million).

|

Compiled by Thiên Lý

Recently the State Bank of Việt Nam (SBV) issued a licence to Malasyia’s second largest lender, CIMB Bank Berhad, to establish a bank in Việt Nam with a registered capital of over VNĐ3.2 trillion (nearly US$144 million).

Earlier, the central bank had also licensed the first Malaysian-owned lender, Public Bank Berhad, in March and South Korea’s biggest lender in terms of consolidated assets, Woori, to establish fully-owned banks in the country in August.

They take the number of fully foreign-owned banks to eight, the others being ANZ Việt Nam, Hong Leong Việt Nam, HSBC Việt Nam, Shinhan Việt Nam and Standard Chartered Việt Nam.

To enter the highly attractive Vietnamese financial market, many foreign investors have also started to buy stakes in domestic banks, particularly State-owned.

Vietcombank, ACB, Sacombank, OCB and SeABank all have foreign strategic shareholders.

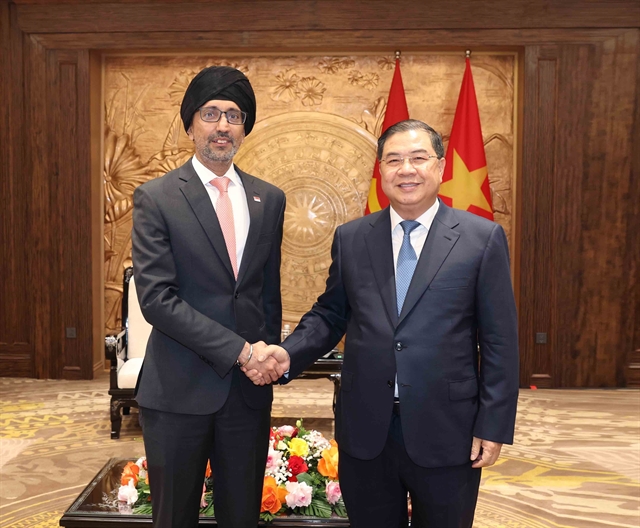

On August 29 Vietcombank,Việt Nam’s biggest commercial bank, signed a memorandum of understanding to sell a 7.73 per cent stake, equalling 305.8 million shares, to GIC Pte Ltd of Singapore.

Earlier the bank had sold a 15 per cent stake to Japan’s Mizuho Corporate Bank.

Also in August the International Finance Corporation, an arm of the World Bank, became a shareholder of Tiền Phong Commercial Joint Stock Bank (TPBank) after acquiring a 4.999 per cent stake for VNĐ403.1 billion ($18.3 million).

Foreign investors see high growth potential in emerging markets like Việt Nam, estimating it at to be two to two-and-a-half times higher than their GDP growth rate.

The Vietnamese banking market is expected to grow by around 15 per cent over the next 10 years. Demand for financial and banking services, especially credit cards, will rise in this new emerging market.

Realising these trends, Vietnamese credit institutions themselves have spared no efforts to drastically restructure their operations and strengthen their financial, administrative and human resource capabilities.

According to a survey by the central bank’s Monetary Statistics and Forecasting Department in July, many commercial banks were upbeat that credit growth would touch at levels that close to the quotas they had been given by the SBV for the entire year. The SBV had set a goal of 18-20 per cent.

They expected lending interest rates to decline slightly and bad debts to be settled significantly by year-end.

Banks are expected to rebound following the restructuring process, making the time right for foreign investors to enter the market.

Meanwhile, many domestic lenders have sought ways to expand into other countries in the region.

Earlier this month the Sài Gòn-Hà Nội Joint Stock Commercial Bank (SHB) opened a wholly-owned subsidiary in the Cambodian capital Phnom Penh.

SHB Cambodia Bank has a charter capital of $50 million and is the second subsidiary of SHB in Indochina after the first in Laos.

In July BIDV received a licence to open a branch in Myanmar. The Yangon branch, which has a capital of $85 million, is the outcome of the Việt Nam-Myanmar Joint Statement on co-operation in 12 priority areas including finance and banking.

Việt Nam has 10 banks operating in Laos and Cambodia, with the others including Sacombank, Agribank and MB.

Vietnamese banks also have a presence in many other countries.

BIDV has a representative office in Russia, Vietcombank has a representative office in Singapore and a subsidiary in Hong Kong.

VietinBank has branches in Germany, France, Singapore and Myanmar.

A spokesperson for the Department of Licence for Credit Institutions said expanding their operations abroad is one of several ways that banks are deploying to improve their competitiveness, especially when more and more foreign banks are entering the Vietnamese market.

Analysts said developing abroad would help Vietnamese banks not only expand their markets and find new customers but also enable them to spread their risk and improve their influence in the region.

But they warned there are also downsides to investing abroad.

For instance, they would face financial risks and the threat of bad debts since most of the overseas markets they are investing in are less developed.

The question is why Vietnamese lenders are not investing in developed countries.

The analysts said most of them have modest financial capabilities, poor management and lack of skilled human resources, making it difficult for them to penetrate developed markets.

They suggested that the central bank should loosen foreign ownership rules in order to make Vietnamese banks more attractive to foreign investors, who can help them improve their ability to go abroad.

Banking credit growth target elusive

As of late August the banking sector’s credit growth for the year was estimated at just 9.09 per cent, making the year’s target of 18-20 per cent seem out of reach.

The slow credit growth has been accompanied by excess rather than low liquidity in the banking sector.

As a result, many credit institutions have pumped more money into Government bonds enabling the State Treasury to mobilise nearly VNĐ240 trillion ($10.67 billion), or 96.7 per cent of the full-year target.

Also because of the plentiful liquidity, the inter-bank interest rate has decreased by 0.3-0.5 percentage points while the number of transactions dropped by 24 per cent from the previous month.

To increase lending, banks have been constantly launching preferential loan packages, and the central bank has also co-operated with local authorities in many places to carry out banking-corporate linkage programmes under which more than 540 meetings have been organised between credit institutions and businesses.

As a result banks were able to provide new loans totally worth VNĐ800 trillion ($35.56 billion), four times higher than the figure in late 2014.

But, considering the plentiful liquidity in the system, the figure is very modest.

Analysts pointed out that bank lending usually spikes at the fag end of the year when it is the peak business season.

But they said even with strong credit growth in the last four months it would be difficult to achieve the year’s target.

They blamed the low credit growth on certain factors, including banks’ wariness of increasing bad debts.

Data from the SBV shows that as of late June the banking sector’s bad debt ratio stood at 2.58 per cent, representing a slight year-on-year decrease of 0.2 percentage points.

However, bad debts were sharply up at certain banks.

As of the end of the second quarter nine listed banks had cumulative bad debts of VNĐ43 trillion, 28 per cent up since the end of last year.

Many financial experts are happy that the credit growth target is expected to be hard to achieve.

They said the current growth rate is rational given the current difficult economic situation and the fact there is no reckless lending, meaning banks can ensure credit quality.

Loans have been used more wisely, mainly for production and business activities, especially in prioritised sectors. Meanwhile, lending in high-risk areas such as real estate and build-operate-transfer projects were reduced significantly.

For instance, by August credits injected in the agricultural area were estimated at VNĐ900 trillion ($40 billion), up 6.64 per cent as compared with the entire last year’s figure. Meanwhile, lending in exports rose over 3 per cent, and those for small- and medium-sized enterprises was up 3.3 per cent.

An SBV spokesperson admitted that banks’ credit structure has changed significantly to give priority to production and trading activities and other prioritised sectors to effectively support the economy.

Meanwhile, loans to high-risk areas like real estate have been closely controlled but in ways that did not affect financial support for social housing projects to meet actual demand for housing.

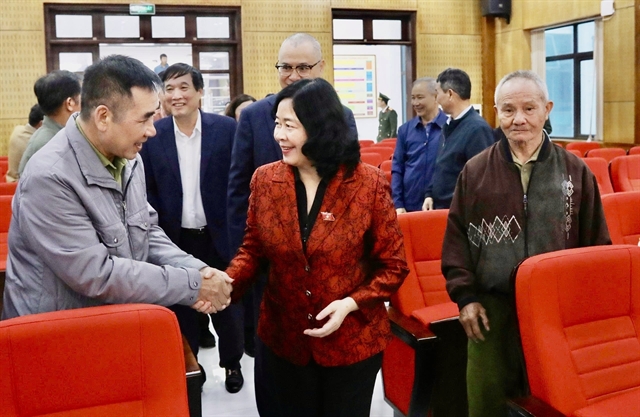

Nguyễn Thị Mùi, a member of the National Financial Supervisory Committee, said the credit growth figure is of no great significance but credit quality is vital to the development of the economy in general and the banking sector in particular.

To improve the credit quality, it is necessary to carefully check borrowers to ensure that financial support is given to the right beneficiaries such as small- and medium-sized enterprises, including those in the private sector, she said.

The central bank needs to maintain a balance between credit growth and the firmness of this growth in future, she suggested. — VNS