Economy

Economy

|

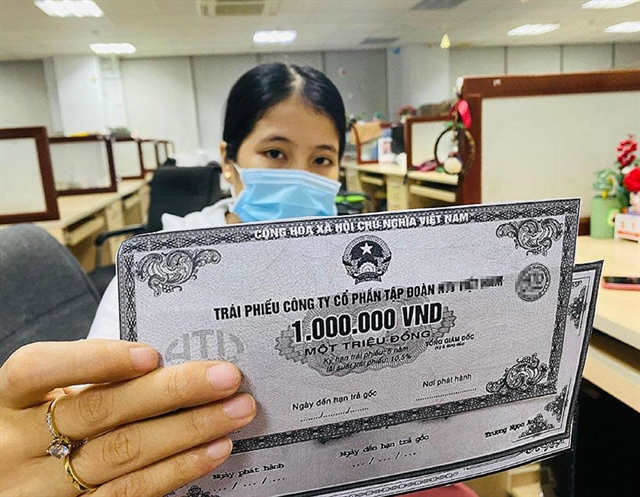

| Corporate bonds with a par value of VNĐ1 million. Bond issuers are required by the draft to have mandatory credit scores in 2023. Photo plo.vn |

HÀ NỘI — In response to lawmakers' invitation to comment, the Vietnam Chamber of Commerce and Industry (VCCI) has recently presented its views and suggestions to the draft amending Decree No 65 on corporate bonds.

VCCI said that the draft is well formulated, successfully repairing the cracks that had appeared in Decree No 153. More importantly, it helps mitigate the problem of information asymmetry between bondholders and issuers.

But the good news goes only so far. VCCI said the draft gives little time for stakeholders to prepare for the big changes that it is going to bring about. With such a short window, they would be struggling to adapt to the new legal document.

VCCI took credit rating as an example, which would be mandatory for bond issuers on January 1, 2023. VCCI said the date is too tight for credit rating agencies to service a large number of clients that would flock to them by the deadline.

"It is not easy to make credit rating compulsory for bond issuers, given that there are just a few credit rating agencies in the country," said VCCI.

VCCI also said the proposal to push the date back to January 1, 2024, would make no difference to the situation because bond issuers are likely to leave their application for credit rating to the last minute.

To prevent the bottleneck, VCCI suggested certain bond issuers be picked out and assessed for creditworthiness in 2023. Once the issuers are assigned credit scores, the authorities then proceed to make credit rating obligatory for all bond issuers in 2024.

VCCI also called on commercial banks to ensure that bondholders are fully aware of the financial risks associated with corporate bonds when they purchase the bonds via banking channels.

Trương Thanh Đức, director of the law firm ANVI, stressed the importance of mandatory credit rating for bond issuers and reckoned that the credit rating market would need a couple of years to take hold.

"If credit rating wasn't made mandatory for bond issuers just because of few credit rating agencies, then the corporate bond market would not make any progress in the next 20 years," said Đức.

A recent report by the Vietnam Bond Market Association shows that total corporate bonds issued via public offerings in the first 11 months of 2022 dropped by 60 per cent compared to the same period last year.

Meanwhile, corporate bonds issued via private placement witnessed a drop of 56 per cent. Remarkably, bond issuers bought back roughly VNĐ164 trillion worth of bonds during the period, up 32 per cent year-on-year. — VNS