Economy

Economy

|

| Vinhomes Smart City in Hà Nội. Việt Nam’s corporate sector will likely face a tougher year in 2023. — VNA/VNS Photo |

HÀ NỘI — Việt Nam’s corporate sector will likely face a tougher year in 2023 due to rising financing costs while consumer and creditor sentiments are eroding in sectors such as real estate, the latest report of S&P Global Ratings on Việt Nam’s 25 biggest listed firms has revealed.

The report, titled “Việt Nam Corporate Primer: Leverage, Liquidity and Governance Trends After COVID”, surveyed financial structure, liquidity and governance of 25 biggest listed companies by market capitalisation or asset base on the two national stock exchanges.

"Structural credit weaknesses of the Vietnamese corporate sector are likely to crystalise in 2023 as yet more debt-funded investments fuelled the post-COVID recovery," said S&P credit analyst Xavier Jean.

"These include reliance on short-term funding, relatively narrow financing channels even for the large companies, rising funding costs and refinancing risk, and headline risks related to governance and transparency."

According to the report, Vietnamese companies have been relatively resilient during the pandemic. Median profits grew a compounded 17 per cent between 2017 and 2022, about 40 per cent faster than their large counterparts in Southeast Asia.

Vietnamese firms have also recovered faster post-pandemic than regional peers with EBITDA (earnings before interest, taxes, depreciation and amortisation) growing nearly 40 per cent in 2021 over 2020.

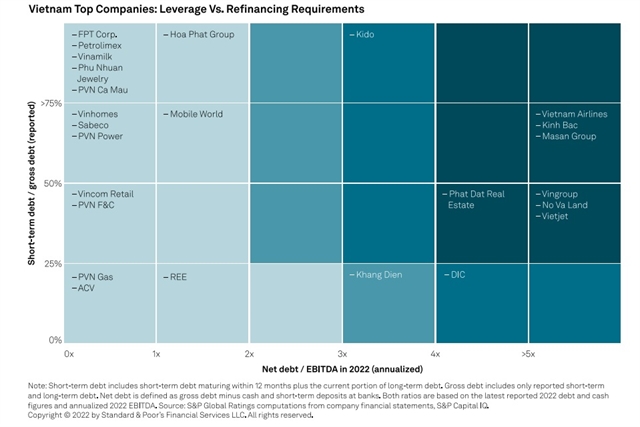

However, regarding the financial structure, large Vietnamese companies often rely on short-dated funding and domestic financing channels. As of September 30, more than half of the total debt of the reviewed 25 companies was due within 12 months. The weighted average debt tenor for the 25 companies is estimated between one and two years, about half of the tenor of the large companies in other emerging markets in Southeast Asia.

Nearly two-thirds of the 25 companies fund themselves exclusively domestically. Very few have tapped international bank and capital markets, except large state-owned companies and the largest conglomerates such as Vingroup and Masan.

"Large Vietnamese companies have not yet substantially diversified their funding sources outside of domestic borders, unlike their peers in most Southeast Asian countries," Jean said.

|

Việt Nam's domestic banking system has a history of lending booms and busts, weak asset quality, and high sector concentration in volatile segments such as real estate. Narrow funding channels exacerbate refinancing risk in a downturn as refinancing becomes dependent on creditor sentiment, according to the report.

The domestic bond markets have expanded. Outstanding domestic bond issuances to GDP nearly doubled to about 40 per cent from 22 per cent in 2017, according to data from the Asian Development Bank. But these issuances remain concentrated in the government, real estate, construction, and financial sectors.

"We believe there is a real opportunity for Vietnamese companies with established business models and adequate governance, or the less leveraged state-owned enterprises, to widen their funding sources beyond domestic borders," Jean said, adding many large Indonesian, Malaysian, and Thai companies have done the shift successfully, and international investors are keen to diversify, especially in these times of selective lending.

However large Vietnamese companies tend to hold significantly more cash than their regional counterparts. Some 60 per cent of them held cash and bank deposits well in excess of their short-term debt which to an extent helps mitigate their short-dated debt tenors.

The report also highlights the growing wedge in credit quality among Việt Nam's large corporate sector over the past five years. Investments in working capital and capital spending have been the main drags on cash flows, while cash deficits were generally funded with debt.

According to the report, governance and transparency considerations are likely to become key focus points for creditors amid rising refinancing requirements. These may have taken a back seat as revenues and profits flew in. Aggressive growth strategies, debt-funded business models, transparency, or governance issues, hidden or forgotten, are resurfacing. — VNS