Việt Nam and the region's economy is expected to recover strongly from 2022

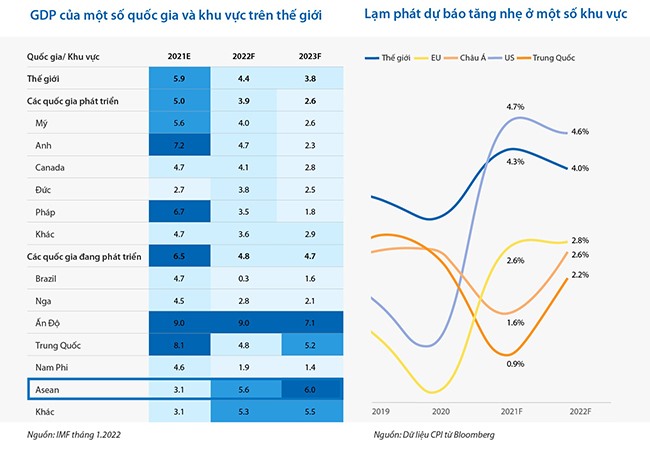

According to forecasts of the International Monetary Fund and Bloomberg, the growth of GDP in the ASEAN region will recover strongly and is estimated at 5.6-6 per cent in the next two years.

Meanwhile, inflation increased slightly but is well controlled at about 2.6 per cent. Việt Nam is forecast to be one of the countries with the highest level of recovery thanks to its solid economic foundation and appropriate macroeconomic policies.

|

The growth potential of the retail segment in Việt Nam looks promising

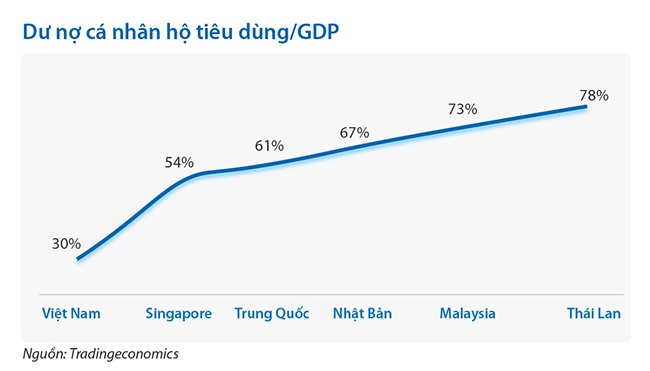

According to many foreign analysts in Asia, Việt Nam's retail banking market is only in its initial stage, and there are still many development opportunities.

|

The penetration rate of products for individual customers in Việt Nam such as home loans, credit cards, or life insurance through banking channels is currently not high. At the same time, the sharp growth of the young population and the middle class promises to bring huge opportunities for the retail segment.

The premise for VIB's growth goals and strategies

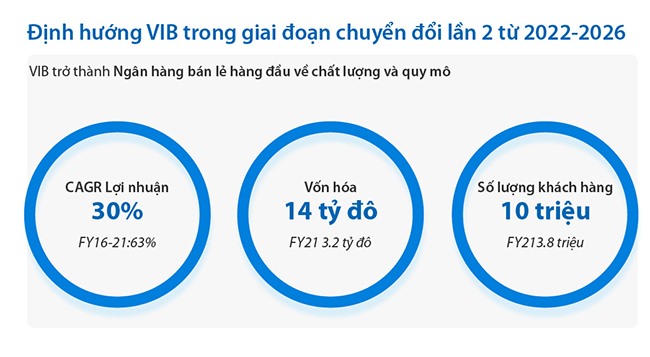

According to CEO Han Ngoc Vu, With a strong management foundation, high and sustainable growth momentum, and a considerable amount of leading business segments in the market for many years, VIB has also distinguished itself by successfully transforming to a professional and digital retail model over the past five years. These are important and solid premises for VIB to set an impressive growth target for the five years from 2022 to 2026.

|

VIB aims to CAGR of profit at 30 per cent per year and is expected to surpass the billion-dollar mark, bringing the bank's market capitalization a five-fold increase in value with an open customer bae nearly three times larger than it is today.

Tran Thu Huong – Head of Strategy cum Head of Retail Banking of VIB stated that VIB's lending rate and retail growth rate are currently among the highest in the market. On top of that, with a tight risk appetite and high-quality asset portfolio, VIB is in the leading group in terms of net profit margin (NIM) after adjusting for credit costs and the ratio of retail lending with guaranteed assets (over 90 per cent).

Regarding mobilized capital, VIB's demand deposit (CASA) in 2021 increased by 56 per cent, currently accounting for about 16 per cent of total deposits at the bank and is expected to exceed 30 per cent in the next five years. In addition, VIB also targets that more than 65 per cent of savings deposits will be mobilised from online channels.

As one of the pioneers in applying leading technologies, VIB currently has over half a million of card customers, of which 85% are interested and register to open cards from online channels with the support of AI and Big Data.

To achieve the goal of reaching five-fold growth of cards by 2026, VIB will continue to launch modern card products, leading in convenience, features, and technology to meet the ever-expanding demand of Vietnamese users.

An important point that brings VIB's fee-to-total operating income ratio to the top of the industry comes from the fact that VIB has continuously been at the top of the market share in the bancassurance business for many consecutive years.

By the end of 2021, VIB had served more than 3.8 million customers and targeted over 10 million customers for the next five years.

Breakthrough with technological advantages and innovation

Huong said: "The pioneering digitalization strategy is VIB's biggest advantage regarding the breakthroughs in service speed, innovation, and continuous delivery of good experiences in digital banking and personal products to meet the increasing demands of customers and markets. Additionally, the young customer segment (Millennials and Gen Z) is expected to account for 80-85 per cent of VIB's customer portfolio in the next five years."

In 2022, MyVIB version 2.0 will be launched with a series of features for the first time in Việt Nam. Simultaneously, the bank's other digital platforms for business will be launched in the second and third quarters of this year respectively.

|

VIB has and will always devote a lot of resources and focus on medium and long-term development in the field of digital banking and products with high technology. This is the foundation and motivation for VIB to pursue a sustainable business development strategy, maintaining its position as the market-leading retail bank in terms of scale and quality in the following years.