Economy

Economy

|

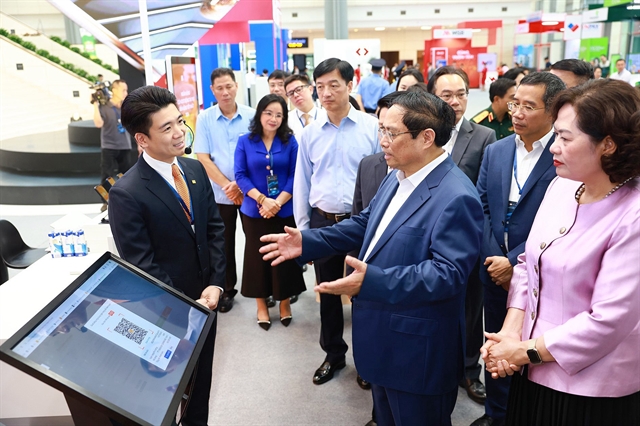

| Finance expert Dr. Đinh Trọng Thịnh |

In the context of a credit slowdown and net interest margin reduction, banks have been gradually shifting their traditional business model away from lending to financial service provision, in order to improve profits.

Việt Nam News asked finance expert Dr. Đinh Trọng Thịnh to explain.

Net interest margin in the banking system last year decreased to 3.4 per cent from 3.8 per cent. So what do you expect in terms of banks’ net interest margin this year?

Net interest margin is an important indicator in the business health of banks, so those with a high net interest margin show good profitability.

Net interest margin of banks last year declined because banks had to cut lending interest rates to support people and businesses in a difficult time, while savings interest rates could not decrease too sharply.

However, in 2024, the pressure from the world economy will ease. Besides, savings interest rates are adjusted to the low zone, while credit demand increases again and is forecast to continually recovery in the coming time. Therefore, the changes will help banks improve net interest margins, however we are not expecting it to be as good as it was in 2022 and there will be differences among banking groups.

How will net interest margin be different among banking groups?

The net interest margin of banks is not simply a subtraction between lending interest rates and savings interest rates, but the calculation will include all output costs from savings interest rates, mandatory reserve costs, deposit insurance and solvency reserve costs to risk reserve operating costs. Therefore, the ratio of net interest margin will also be different, depending on the costs that constitute the output costs of banks.

Currently, the Government and the State Bank of Vietnam still advocate stabilising lending interest rates to support people and businesses and stimulate demand. In fact, the group of State-owned banks with a large market share will always be at the forefront of responding and implementing the Government's incentive policies. Therefore, the recovery of net interest margin of the group of State-owned banks will not be as high, as this banking group can't increase lending interest rates, but continues to maintain preferential interest rate lending programmes for priority sectors.

For the group of private banks, the recovery of net interest margin can be higher when credit growth is better. This banking group focuses on the consumer lending segment, which has a higher average lending interest rate.

What should banks do to improve net interest margin?

Following the market, it can be seen that to cope with the risk of net interest margin declines, banks are shifting their loan portfolios from lending to financial services to increase revenue from the latter.

Currently, many banks have promoted the development of services, such as payments and insurance, that will help increase the proportion of non-interest income and increase profit.

When banks cannot increase lending interest rates and cannot further reduce savings interest rates, banks with a high non-term deposit ratio or a high Current Account Savings Account (CASA) ratio, which has an interest rate of only 0.1-0.5 per cent, will be able to withstand the shrinking net interest margin. Therefore, banks need to actively attract the cheap capital source CASA, or non-term deposits, to both minimise pressure on net interest margin and increase operating efficiency.

In recent times, there has been a fierce battle to attract CASA by actively digitising and reducing service fees. Banks are accelerating digital transformation to attract more non-term savings to help banks increase operating efficiency and optimise profits.

In addition, in the era of digitalisation, any bank that promotes technology investment, digital banking transformation and customer experience will reduce operating costs and increase business efficiency, contributing to improving net interest margin.

What do banks need to do to increase operational efficiency?

First of all, banks that want to maintain the growth rate need to continue to improve their financial capacity and management towards meeting the requirements of international standards on management, such as Basel II and Basel III. Good governance will help banks reduce operating costs and improve profit.

Along with that, they need to restructure products and services to increase revenue from this business segment.

Active digital transformation also brings long-term benefits as it helps banks optimise operating costs, another favourable factor for the recovery of net interest margin. — VNS