After experiencing a rapid and strong growth cycle in the past decade, Việt Nam’s insurance industry is inevitably facing a correction and decline that requires insurers to focus on restructuring and improving service quality to meet the increasing demands of the market in the coming time.

The SBV early this week also directed commercial banks to continually reduce lending interest rates by 1.5-2 percentage points per year at a minimum for both outstanding loans and new loans.

Despite the difference in policies of the State Bank of Vietnam (SBV) and the US Federal Reserve (Fed), the USD/VNĐ exchange rate has remained stable to date thanks to a trade surplus and a bright economic outlook of Việt Nam.

Total non-performing loans (NPLs) at many banks surged in the first half of this year due to the poor business performance of the whole economy, and experts forecast the trend will continue.

The Việt Nam International Logistics Exhibition (VILOG) 2023, the first of its kind, will be held in HCM City from August 10-12.

Many banks have been stepping up bond buybacks before maturity, but experts are concerned the work can affect the banks’ ability to supply capital for the economy and boost credit growth in the remaining months of this year.

The lifting of the ceiling on airfares would certainly help airlines better meet the needs of passengers, especially during the peak period because airlines could offset the cost of two-way flights.

Many banks missold life assurance policies, with some customers having their savings deducted to purchase agreements without their knowledge, a MoF investigation has found.

From August 15 people with Vietnamese e-visas can enter and exit the country any number of times for 90 days, a long-awaited and major overhaul of the country’s visa system that is expected to revive tourism and hospitality, according to industry insiders.

The period of strong volatility of the US dollar has ended, and the USD/VNĐ exchange rate in the last six months of 2023 will remain stable.

Entitled "Creating digital identities with national domain names .vn", the programme is to help local businesses and people build their digital identities and building brands on the internet.

By 2023, delayed refunds in the timber sector had amounted to over VNĐ6 trillion (US$255 million).

Statistics of financial data provider Fiin Group showed that in the fourth quarter of 2022, there were about 251 loss-making enterprises out of a total of about 1,000 enterprises that published financial statements.

The development of eco-industrial parks is considered an effective solution to contribute to completing the net zero emission target by 2050 in Việt Nam. However, there are still many problems with the mechanism.

The State Bank of Vietnam last week cut its policy rates for the third time this year to prop up economic growth. Accordingly, the bank cut its refinance rates from 5.5 to 5.0 per cent and its overnight electronic interbank rate from 6.0 to 5.5 per cent.

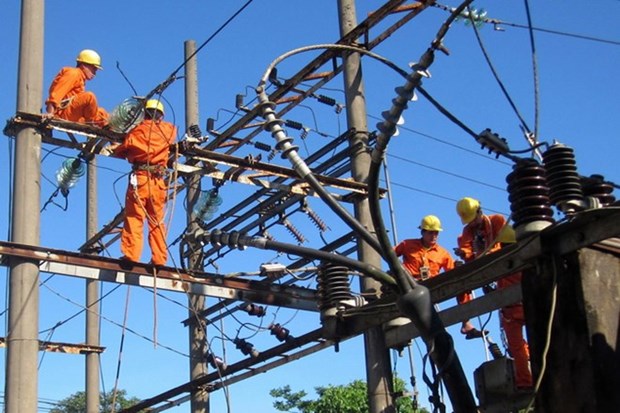

Recent electricity retail hike of 3 per cent will likely have a small effect on the country's CPI in the short run, according to the Ministry of Finance.

Though the global financial market has seen uncertainties this year, Việt Nam's currency and foreign exchange markets have remained stable.

The recent fever and subsequent decline of two Vietnamese shoe brands has prompted an inquiry: Will Vietnamese brands be able to capitalise on the trends and opportunities that emerge on social media?