According to a Fingroup report in the first nine months of 2019, FE CREDIT has increased its market share from 53% (2018) to 55% (9M2019). Effective restructuring of their loan portfolio, combined with new technology applications, are the primary contributors to the company's sustainable development.

All growth targets were achieved

The third quarter marks FE CREDIT's success in maintaining its sustained growth path while maximising in comparison with the benchmark. This achievement was largely due to the solid performance across all key products, channels and customer segments. Compared to the previous quarter, cross-sell and top-up to existing good customers grew by nearly 5%. Besides, the contributions from existing customers, new customers also contributed significantly to the portfolio’s growth in the third quarter.

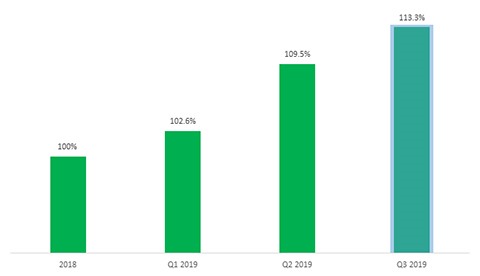

Overall, we are able to see FE CREDIT’s stable, multi-year growth plan being executed in a strategic and impactful manner. Quarterly net profit grew by 1.44%, whereas ENR’s growth in 9M2019 increased remarkably by 13.5% yoy.

Quarterly Growth Rate of FE CREDIT’s ENR

Source: FE CREDIT. Data as of 11/24/2019

|

The mission to improve quality of life

Products such as insurance and credit cards are designed by FE CREDIT to improve Vietnamese consumers’ quality of life.

For instance, instead of resorting to informal credit sources, cardholders may withdraw cash from their credit cards to pay for unexpected costs, such as hospital fees, tuitions and similar emergency needs. According to reported figures, new credit card issues increased by 100%, in which 2 million credit cards had been issued compared to yoy. The momentum of credit card growth in 2019 is predicted to match last year’s figure. Credit card spending has also increased by 10% quarter-on-quarter.

Insurance, a relatively new addition to the product line, recorded double-digit growth on a yearly basis. FE CREDIT’s long-term goal is to enable low- and middle-income Vietnamese access to insurance products. These customer segments are ignored by most insurance companies and banks; however, they carry massive potential for consumer finance companies’ future expansion because more than 80% of the Vietnamese population belongs to these groups.

The two-wheeler loans, another contributor in helping Vietnamese people improve their living standards, grew by 10% vs. Q3 2018.

In order to drive higher awareness of the benefits of personal insurance and concurrently deliver impactful CSR initiatives, FE CREDIT also actively engages in activities such as offering free insurance to families of low-income workers and awarding hundreds of scholarships to poor children each year. Additionally, the lender is one of the top taxpayers in Viet Nam.

Achieving financial results through technology

FE CREDIT strives to become Viet Nam’s leading high-tech consumer finance firm, who provides a wide range of financial services on demand, anytime, anywhere. The consumer lender’s agenda is to deliver its products and services as quickly as possible, with the best customer experience, and at the moment when the customer needs it. To do so, the roadmap for technology development and application involves focusing on digitising its lending activities and extensive big data analysis.

In the third quarter, cross-sell and top-up to existing customers grew significantly, thanks to increasing penetration of the $NAP app. This achievement can be traced back to FE’s unique ability to analyse and profile past customer behaviour patterns to predict similar behaviours in the future and deliver the right offer to the right customer at the right time through intelligent data-driven marketing via its app platforms. Application of new technologies in its risk models also now enables FEC to offer previously denied applicants, some low-risk loans under the new credit score regime.

Technology also contributes in terms of risk management by keeping bad debt levels in compliance with the SBV’s prudential ratio regulations. On a year-over-year basis, the non-performing loan (NPL) ratio continues to follow a downward trend, decreasing by 0.8% (according to VAS) due to two main factors: the successful cross-selling strategy on existing customers and advanced analytics.

In addition, the digitisation process not only reduces risk costs, but also helps to save on operating costs. As a result, the cost-to-income ratio (CIR) in Q3 decreased by 6.8% y/y. To note, this achievement is partially due to the increasing use of $NAP’s fully automated lending capability, which reduces manual operational costs dramatically.

Conclusion

FE CREDIT's growth in the third quarter reveals two important advancements: Firstly, the consumer lender has demonstrated the ability to manage growth effectively, in line with the SBV's credit growth target. Secondly, the strategy to achieve sustainable growth has proved to be working well, by focusing on improving services to existing customers and the extensive application of technology in business operations. With this growth momentum, by the end of the year, FE CREDIT's position as market leader will continue to strengthen further, as the ENR’s growth rate has already exceeded the industry average by a very safe distance in the first half of 2019.