Politics & Law

Politics & Law

|

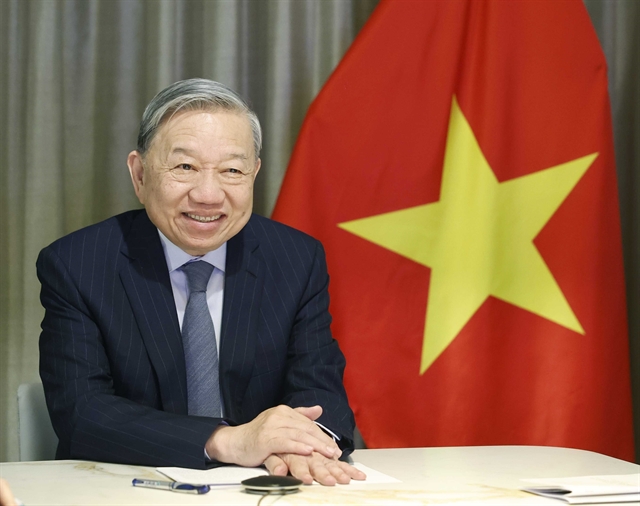

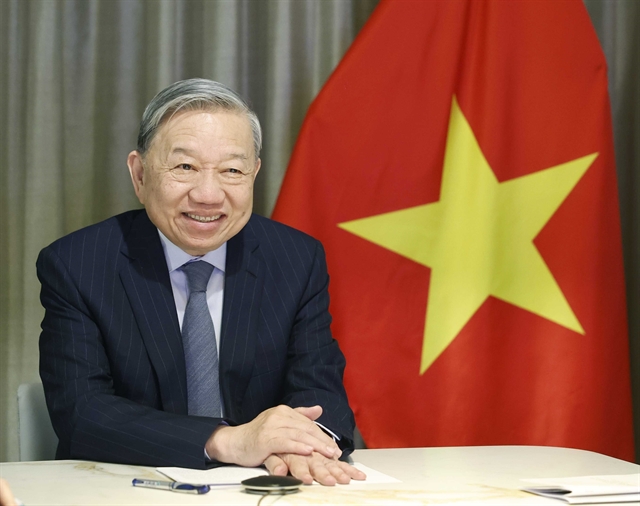

| Minister of Planning and Investment Nguyễn Chí Dũng reports at the NA meeting session on Friday. VNA/VNS Photo |

HÀ NỘI – The National Assembly’s draft resolution on piloting mechanisms and policies for HCM City's development would create conditions for the city to fulfil its role of leading the nation in the economic development, Minister of Planning and Investment Nguyễn Chí Dũng said at the NA meeting session on Friday.

Speaking at the National Assembly meeting on the draft resolution on piloting several mechanisms and policies for the development of HCM City, Dũng said the draft resolution aimed to establish exceptional and outstanding mechanisms and policies, creating a legal framework to unleash the potential of HCM City and addressing the city’s socio-economic development bottlenecks.

The drafting of the resolution was based on the principle of ensuring compliance with the provisions of the 2013 Constitution, the development orientation stated in Politburo Resolution No 24 on the socio-economic development of the southeast region, Politburo Resolution No 31 on the socio-economic development of HCM City, and the NA’s Resolution No 81 on the national master plan.

Dũng also mentioned that the resolution set out certain mechanisms and policies for the city’s development, which would benefit HCM City and create conditions for the city to fulfil its role as a leading force in the economic development of the entire country.

The draft resolution consisted of seven groups of mechanisms and policies with 44 specific provisions. In addition, there were four groups of new policies addressing investment, finance and budget, land management, planning, and organisational structure.

The city could use its public investment capital from its budget to entrust the Vietnam Social Policy Bank to provide loans for poverty reduction and employment solutions.

The city would be granted a pilot implementation of the Transit-Oriented Development (TOD) model for urban development. This involves using local budget funds to carry out independent public investment projects to implement in-place resettlement, establish land reserves and conduct auctions to select investors for urban development projects.

The city’s scope of applying public-private partnership (PPP) investment would be expanded, including sports and cultural projects. Regulating the minimum total investment scale for these PPP projects would be proactive.

It would get permission to apply Build-Operate-Transfer (BOT) contracts for existing road infrastructure projects and carry out investment projects through Build-Transfer (BT) contracts, with payment made from the city budget.

The city could utilise local budget funds to implement regional and inter-regional transportation projects.

The draft resolution also includes mechanisms and policies to attract strategic investors in chip production and the integrated circuit industry. It also specifies the conditions that strategic investors must meet, the procedures for project registration and selection of strategic investors, and provisions on tax exemptions or reductions for individuals and enterprises engaged in scientific and technological innovation and entrepreneurship in the city.

Presenting the inspection report, Chairman of the NA’s Finance and Budget Committee Lê Quang Mạnh emphasised the necessity of issuing the resolution.

However, the committee suggested that the impact assessment report should provide specific details on both positive aspects and challenges, particularly concerning policies that affect State budget revenues and expenditures, as well as the allocation of resources.

The resolution should promptly resolve institutional obstacles that hinder the city’s development. However, it is crucial not to exploit law-building to legitimise wrongdoings.

The committee said breakthrough policies should be added.

Regarding the comprehensiveness and rationality of the policies, according to the committee, the draft resolution primarily focused on expenditure policies. However, revenue-related policies were relatively restricted despite the city's significant advantages in revenue generation.

Therefore, in the long term, the committee suggested studying feasible revenue policies to balance the resources for expenditure policies.

The committee urged a review of policies, such as proposals for tax exemptions and reductions, to ensure their suitability in the current context, especially with the impending implementation of a global minimum tax.

It was necessary to assign specific tasks and responsibilities to organisations and individuals. – VNS