Economy

Economy

The Bank for Agriculture and Rural Development of Vietnam (Agribank) and the Việt Nam Asset Management Company (VAMC) late last week signed a co-operation agreement to resolve non-performing loans.

|

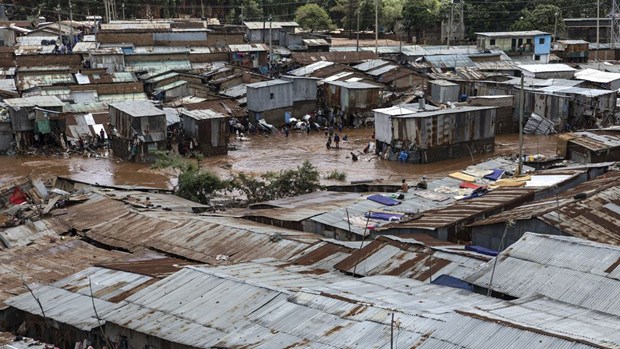

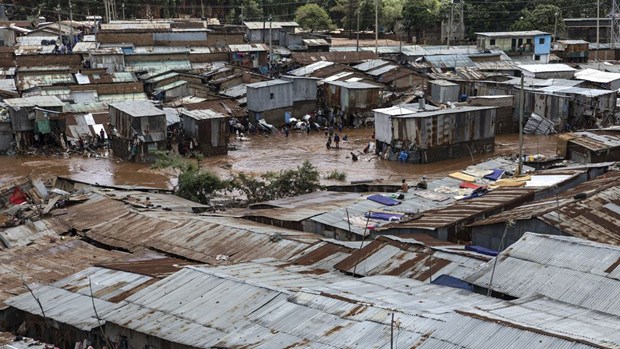

| Agribank and VAMC will collaborate closely in the development of a roadmap for bad debt settlement for every single year in the 2017-22 period. - Photo thoibaonganhang.vn |

HÀ NỘI — The Bank for Agriculture and Rural Development of Vietnam (Agribank) and the Việt Nam Asset Management Company (VAMC) late last week signed a co-operation agreement to resolve non-performing loans.

Under the agreement, the two sides will co-operate to settle non-performing loans (NPLs) of Agribank that were sold to VAMC in accordance with legal regulations stated in National Assembly’s Resolution No. 42/2017/QH14, which came into effect on August 15 this year and is designed to quickly and definitely settle NPLs and collaterals.

Agribank and VAMC will collaborate closely in the development of a roadmap for bad debt settlement for every single year in the 2017-22 period.

For NPLs that VAMC bought by special bonds, the two sides will evaluate and classify the debts to propose the most appropriate and effective solutions.

The State Bank of Việt Nam has selected six credit institutions -- Sacombank, ACB, BIDV and Vietcombank, as well as VietinBank and Agribank -- to pioneer the implementation of Resolution No. 42, aimed at speeding up bad debt settlement.

VAMC bought more than VNĐ25.53 trillion (US$1.12 billion) of NPLs from 14 credit institutions in the first nine months of this year.

Since its establishment in 2013 until the end of September this year, the company has bought a NPLs worth a total or more than VNĐ301 trillion from 42 credit institutions at VNĐ270.92 trillion. — VNS