The Sherpa - a subsidiary of Masan - has just announced its acquisition of 70% of Mobicast shares with a total cash consideration of VND295.5 billion. What advantages does this group offer to enter into telecommunications and digital services play which is dominated by a number of major telecom companies?

The Sherpa - a subsidiary of Masan - has just announced its acquisition of 70% of Mobicast shares with a total cash consideration of VND295.5 billion. What advantages does this group offer to enter into telecommunications and digital services play which is dominated by a number of major telecom companies?

|

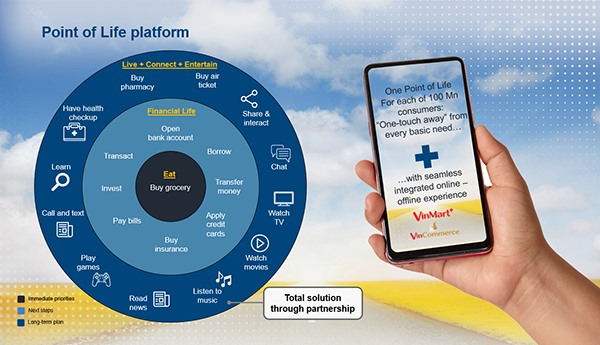

Telecommunications and digital services - a piece to its “Point of Life” strategy

The Sherpa - a subsidiary of Masan - has just announced its acquisition of 70% of Mobicast shares with a total cash consideration of VND295.5 billion. Operating under the brand Reddi, Mobicast is a Vietnamese start-up full-serviced Mobile Virtual Network Operator (“MVNO”).

MVNOs are wireless communication service providers that do not have their own frequency spectrum allocation or the wireless network infrastructure. MVNOs partner with traditional Mobile Network Operators (“MNO”) to use their wireless network infrastructure to provide telecom and data services to consumers. MVNOs have an asset-light business model by leveraging existing transmission and network infrastructure. MVNOs are a common business model in the telecom space globally. For example, MVNOs command a ~20% market share of the total United Kingdom mobile market.

When incorporated into "Point of Life", Reddi stands to benefit as it has exclusive access to Masan’s consumer base and physical and online nationwide touch points. Specifically, this will significantly lower Reddi’s consumer acquisition cost enabling it to reinvest the savings to develop unique digital consumer solutions, given that 44% of subscribers predominately use voice and SMS in Vietnam, and customer service experience platform.

Previously, in June 2021, Masan launched its first CVLife store that integrates financial services offered by Techcombank and Phuc Long Kiosk into WinMart+ supermarkets (formerly known as VinMart+). As shared by Masan, the current number of over 2,300 WinMart+ stores will be expanded to more than 3,001 stores, or around 700 new stores to be launched, by the end of 2021. Phuc Long Kiosk model will be integrated into 1,000 VinMart+ stores, thus boosting revenue and profit margins and bringing in more modern customers.

Investment in Mobicast is the next step taken by Masan to integrate its third piece - Digital services - into its ecosystem, after successful inclusion of two others, i.e. Grocery and Financial Services. This was carefully mapped out by Masan in 2019 when the Group revealed its plan to build a one-stop shop that satisfies consumers’ essential, financial, educational, social, entertainment, and healthcare needs. For Masan, this is a unified off to online platform, “Point of Life”. The entry into the telecommunication and essential services sectors on a digital platform will enable Masan to gain access to approximately 80% of the consumer wallet.

Why did Masan decide to enter into the telecommunication sector?

A mobile Internet boom in Vietnam has been recorded as, according to MIC’s Department of Telecommunications, Vietnam has nearly 133 million mobile subscribers as of the end of 2020, while its population is more than 97 million people. Of these 133 million subscribers, 56% have 3G, 4G and 5G coverage.

According to the We Are Social 2021 report, the most used mobile apps include: chat apps (94.7%), entertainment and video apps (83.4%), music apps (58%), game apps (57.2%), shopping apps (68.5%), banking and financial services apps (40.1%).

As can be seen, it is time for Masan to enter into the telecommunication sector. Masan Group CEO, Danny Le, said: “Reddi is the first step to digitalize our “Point of Life” platform and synchronize our products and services into a unified offering. While we are in the early innings, we have all the strategic components to develop the most cost effective consumer acquisition model thereby lowering the costs of our services and products for the benefit of our consumers – this is the definition of Point of Life”.

In fact, the entry of a retail company into the telecommunication sector has become a huge success in India, as in the case of Reliance Jio, the largest mobile network operator in the world's second-largest mobile market. Reliance Industries is India's largest retailer with nearly 11,000 points of sale, 23 distribution centers and a database with more than 110 million loyal customers.

In 2016, Reliance “stepped” into the digital services and electronics telecommunication sectors by launching Jio network operator. To date, Jio has raced past its competitors to become India's largest mobile operator thanks to its reasonable pricing, good signal quality and appealing, differentiating service plans. Jio currently has about 400 million paying subscribers for services in their ecosystem.

What competitive advantages does Masan have?

Similar to Reliance Jio, Masan has a wide distribution network as its first advantage, with nearly 2,400 VinMart/VinMart+ supermarkets and stores nationwide to serve more than 300 million customer visits annually. Added to this is Masan Consumer’s strong relationship with 300,000 general trade (GT) retailers. Masan's distribution network “weaves” across the country, offering a convenient and fast access to its services.

Masan also has a loyalty customer base of 9 million VinMart/VinMart+ members, including a large number of young and digital-savvy customers from Phuc Long, 5 million affluent consumers from Techcombank and millions of customers from other Masan’s strategic partners.

These two strategic factors allow Reddi to maximize its cost and time savings in building a distribution network, while optimizing its consumer acquisition and retention cost.

According to Masan, Reddi’s target market is modern consumers who present a need for digital services and big data. This group of customers is willing to change and try out new products and services to refresh their consumer experience.

.jpg)