Economy

Economy

|

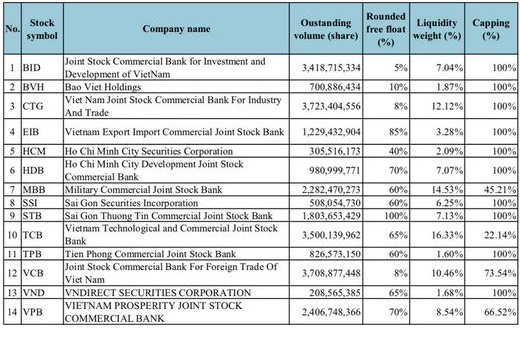

| The list of stocks in the VNFIN LEAD Index. — Source HOSE |

HCM CITY — SSI Asset Management Co., Ltd. (SSIAM) has launched an ETF called the SSIAM VNFIN LEAD based on the Vietnam Leading Financial Index (VNFin Lead).

It is the first ETF to simulate one of the three new indices launched recently by the HCM Stock Exchange and the first to target the largest stocks in the financial sector, and is expected to attract new ETF inflows into the Vietnamese stock market.

The SSIAM VNFIN LEAD ETF has been granted a certificate for initial public offering by the State Securities Commission and will have an initial scale of US$25-30 million. It will be managed by SSIAM together, the SSI Securities Corporation and Mirae Asset Securities Company Limited (Vietnam). Vietcombank will be the supervisory bank and transfer agent to the securities depository.

The IPO for the fund is being held between December 24 and January 15.

After the IPO, SSIAM VNFIN LEAD ETF will be listed on HOSE and trade like equity.

HOSE on November 18 introduced three new stock indices based on the investment requirements of local funds.

They are the Vietnam Leading Financial Index or VNFIN LEAD, Vietnam Financial Select Sector Index or VNFINSELECT and Vietnam Diamond Index or VN DIAMOND.

According to SSIAM, the financial sector is one of the two largest sectors in the VN-Index, accounting for 27 per cent of total market capitalisation.

It said investors in Asia are particularly interested in the financial sector, because it is the key beneficiary of the urbanisation process.

In addition, the number of people using financial services and the ratio of customers with a bank account are also low, meaning the sector has huge growth potential.

Nguyễn Minh Hạnh, managing director of ETF fund at SSIAM, said: “We think that ETFs that simulate financial index are highly attractive to investors, especially when investment institutions will always allocate a portion of their money to bank stocks. Investors buying ETF fund certificates simulating financial indexes will not have to pay higher than matching prices on the stock exchange.” — VNS