.jpg) Economy

Economy

|

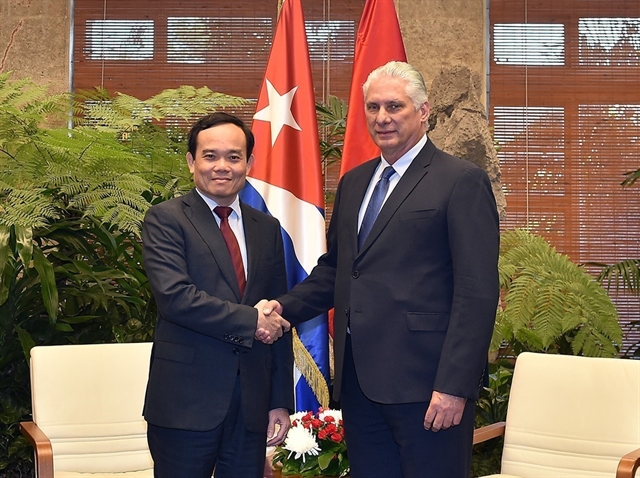

| Inside a BIDV office. Local commercial banks slashed lending rates by 0.5-1 per cent after the US Federal Reserve announced a rate cut on August 1. — Photo vietnamplus.vn |

HÀ NỘI — The US Federal Reserve’s latest rate cut will benefit commodity and equity markets in the short term, according to specialist Nguyễn Trí Hiếu.

The US central bank on Thursday announced its first rate cut since 2008 by 25 basis points to the range of 2-2.25 per cent.

The rate cut would increase the value of investment into equity and commodity assets as the US dollar was weakened, encouraging international investors to purchase more local assets, Hiếu said.

The rate cut was among reasons for US stocks to decline on Wednesday. However, the main reason was still worries about US-China trade tension, which has remained unsolvable, he added.

In the short term, the rate cut may benefit Việt Nam’s economy and equity assets, he said, adding gold would go up and the real estate market would be stabilised.

The Fed’s rate cut may allow Việt Nam’s banks to lower their interest rates in some priority sectors, but the average level may not decline further, analysts have said.

On August 1, commercial banks in Việt Nam cut interest rates on Vietnamese đồng loans in the Government’s priority sectors for the second time this year to support the business community.

Vietcombank, Bank for Investment and Development of Vietnam (BIDV), VietinBank and Techcombank reduced their short-term interest rates by 0.5-1 per cent and capped them at 5.5-7.5 per cent.

Lending rates in Việt Nam were high, therefore, the Fed’s small rate cut would not have a direct and immediate impact on the local credit market, Hiếu said.

In the long term, the Vietnamese đồng would not depreciate, he said. “Việt Nam depends on a weak Vietnamese đồng to support its exports. As the Fed’s rate cut weakens the US dollar, the đồng may not be devalued further so that it could stabilise.”

According to specialist Lê Xuân Nghĩa, the Fed’s rate cut helps increase the supply of the dollar to the market and devalue the greenback, making the đồng and other currencies weaken further accordingly. That means the VND/USD exchange rate is unchanged but Vietnamese exports may be hurt if the đồng weakens too much against other currencies.

If the Fed continues loosening its interest rates, other central banks can do the same to depreciate their currencies. In that case, the supply of cash increases and global long-term inflation occurs, requiring the Vietnamese Government to work on detailed solutions to deal with it.

Accordingly, the Vietnamese đồng is forecast to gain 1-3 per cent in value against the US dollar in the remaining months of 2019 given the unpredictability of the global markets.

As the Fed chairman Jerome Powell gave no clues about further rate cuts this year, central banks of emerging markets must be more cautious with their monetary and interest policies in the future, according to Bảo Việt Securities Co (BVSC).

A number of central banks, including Việt Nam’s, have lowered their lending rates to counter a worldwide economic slowdown since the beginning of the year when the Fed signalled it may lower interest rates. But after Thursday, those central banks have halted their monetary loosening plans until further announcements by the Fed instead of acting in advance.

Though Vietnamese banks recently cut rates to boost their lending volumes, the practical impact may not be enormous, BVSC report says.

Unlike other central banks, the State Bank of Vietnam (SBV) tries to control the total cash loaned to the market and the total savings and deposits. Meanwhile, the connection between interbank interest rates and market interest rates and the liquidity of the banking system, despite remaining high on low interbank interest rates, doesn’t mean lenders have sufficient cash on the market. Cash liquidity among banks is highly differentiated, making deposit and saving interest rates still high, thus lending rates will not be reduced much. — VNS

.jpg)