Economy

Economy

.jpg)

Credit in the first five months of 2016 grew 5.48 per cent compared to the end of 2015, the highest for the past few years, according to the State Bank of Việt Nam’s Credit Department.

|

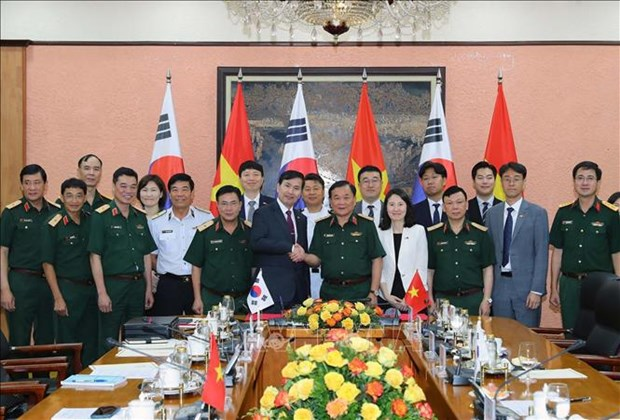

| A client makes transaction at the Agribank in Hà Nội. Credit in the first five months of 2016 grew 5.48 per cent compared to the end of 2015, the highest for the past few years. — VNA/VNS Photo Trần Việt |

HÀ NỘI — Credit in the first five months of 2016 grew 5.48 per cent compared to the end of 2015, the highest for the past few years, according to the State Bank of Việt Nam’s Credit Department.

Compared with the same period last year, the credit surged 17.59 per cent.

Given this increase, experts expect the banking industry to meet the 18 per cent credit growth target this year.

General director of Vietinbank Lê Đức Thọ said that lending growth in his bank, targeted at 18 per cent this year by the central bank, has been good so far, reaching 6 per cent by the end of May. Lending to small- and medium-sized enterprises (SMEs) was the best.

Many new SMEs have been set up and the economy has improved, helping boost the firms’ capital needs, he said.

Thọ believes Vietinbank could meet the lending quota set by the central bank as it often rises sharply in Q3 and Q4. However, Thọ said, depending on market demands, the bank could adjust the target after making a proposal to the central bank.

Trần Văn Tấn, head of the Agriculture and Rural Development Credit Division, said the credit growth was made possible by the robust health of SMEs and their access to credit.

While still requiring commercial banks to support businesses, the central bank has recently directed that monetary policies give top priority to ensuring the safety of the banking system and controlling inflation.

"Credit institutions must balance their capital mobilisation sources and lending to ensure liquidity. Credit growth rates must be controlled in accordance with capital mobilisation and lending quotas allocated by the central bank to ensure safe credit growth and to help businesses with easier access to credit," according to the central bank.

The central bank also asked commercial banks to be more careful with lending to industries that have witnessed high growth and high potential risks, such as real estate, Build-Operate-Transfer (BOT) and Build-Transfer (BT) projects.

Banks required to report month interest rates

State Bank of Việt Nam has ordered credit institutions and branches of foreign banks to report their lending, capital mobilisation and interest rates in Vietnamese đồng every month going forward.

The reports must be submitted to the central bank’s Monetary Policy Department on the 20th of every month, starting from June and lasting until the end of this year.

The move is aimed at cutting lending rates to support domestic businesses and production.

Many banks, such as ACB, Sacombank, VP Bank and Eximbank, have also lowered their deposit rates by roughly 0.1-0.2 per cent per year for the first time this year since the end of May.

This deposit interest rate reduction is expected to help banks further cut lending rates.

State Bank of Việt Nam Governor Lê Minh Hưng recently pledged that the banking system would try to cut the lending rate by roughly 1 per cent this year.

The central bank also affirmed it would regulate the inter-bank rates in accordance with the market interest rate. — VNS

.jpg)