|

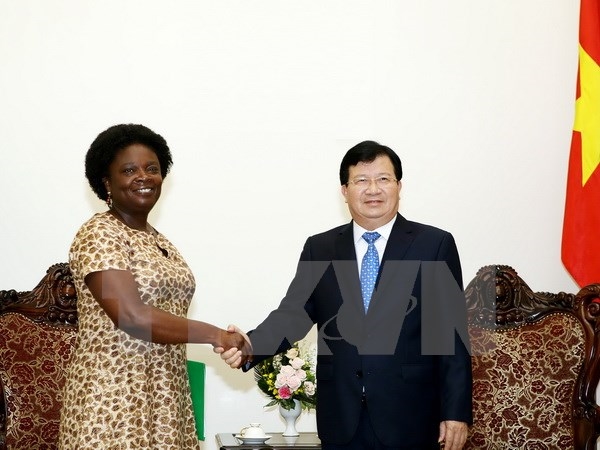

| Deputy Prime Minister Trịnh Đình Dũng (R) receives Victoria Kwakwa, World Bank Vice President for East Asia and the Pacific yesterday in Hà Nội. — VNA/VNS Photo Nguyễn Dân |

HÀ NỘI — Deputy Prime Minister Trịnh Đình Dũng asked the World Bank (WB) to continue offering preferential loans to Việt Nam so that the Government and private sector can build better infrastructure.

During a meeting with Victoria Kwakwa, World Bank Vice President for East Asia and the Pacific yesterday in Hà Nội , the Deputy PM said that Việt Nam is focusing on improving transport infrastructure, especially roads leading to border gates.

Hailing the Kwakwa’s contributions to Việt Nam during her tenure as WB Country Director in Việt Nam, the Deputy PM said Việt Nam is in need of investment for the development of infrastructure systems for socio-economic development, so the country hopes the WB will extend Việt Nam’s access to preferential lending in the form of Official Development Assistance and loans of the International Development Association.

He lauded the WB’s financial assistance to Việt Nam in infrastructure building, transport, energy, urban upgrades, waste water treatment, climate change response and other social fields, which he described as important resources for the socio-economic development of Việt Nam.

Việt Nam pays much attention to the effectiveness of loans from the international community and the WB, he said, adding that Việt Nam is tightening supervision and management of capital.

Victoria Kwakwa said the priorities that Việt Nam has set for the next five years, including macro-economic development, climate change response, transport and energy, will be the foundation for the country’s development.

She recommended that the Government pay more attention to attracting investment and mobilising capital resources amidst high public debts. — VNS