Opinion

Opinion

Nguyễn Trí Hiếu, an expert in banking, speaks to the Hải Quan (Customs) newspaper that the Vietnamese Government should appoint an agency to develop an official transaction floor for buying and selling debts.

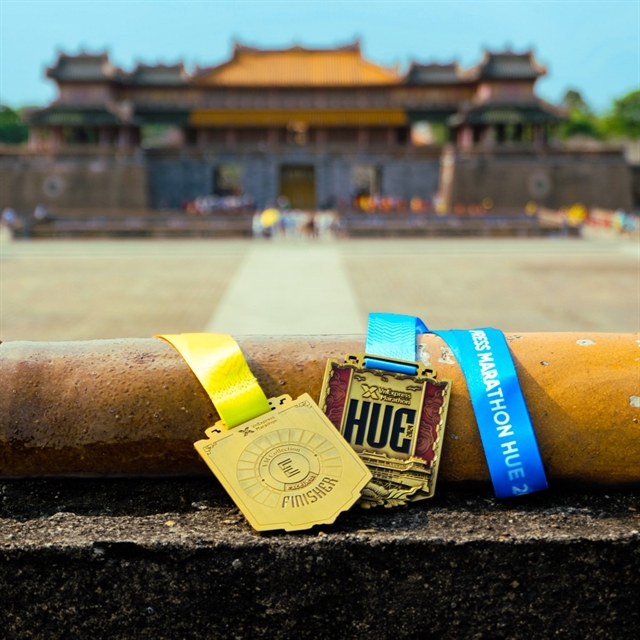

|

| Nguyễn Trí Hiếu. — Photo baohaiquan.vn |

Nguyễn Trí Hiếu, a banking expert, tells Hải Quan (Customs) newspaper that the Government should appoint an agency to develop an official transaction floor for buying and selling debt.

What’s your assessment of bad debt settlement in our banking system now?

According to the latest report, bad debt in our banking system has reduced to 2.18 per cent. This percentage indicates that banks have reduced their bad debt risks. This is a positive sign. However, over the last five years, just 1.4 per cent of the bad debt ratio was reduced. In my opinion, this result is not really optimistic. The problem here is that many banks still accept risks by lending money to real estate developers, to consumers or investors in stock exchange and others. These are the key reasons making the bad debt in the banking system to more than 2 per cent. It is a common sense that if the banking sector has a low risk level it should have a bad debt ratio less than 1 per cent.

In my opinion the 2.18 per cent of bad debt is not a common reflection of the whole system. Why? As at present the bad debt in our economic system is managed by the Việt Nam Asset Management Company (VAMC).

In your opinion what are the challenges that Việt Nam faces to settle bad debt?

The issuance of Decree 42 has introduced new measures on how to settle bad debt issues legally. However, not much progress has been achieved so far.

Decree 42 has allowed banks to confiscate collateral from debtors in all circumstances. But in the case of real estate, it is quite a problem. In certain projects, the real estate developers have sold the apartments or villas to their clients – the buyers. In such a case, the owners of these apartments or villas are the clients, how can the bank confiscate their apartments? This remains a big issue in the settlement of bad debt.

To establish a market for buying and selling bad debt, what do we need to pay attention to?

It is obvious the goods, the buyers and sellers in this type of market are plenty. Yet, until now, such a market has not been organised. In my opinion, even the State Bank of Việt Nam has not been really interested in sponsoring such a market. So I propose that a Government agency should act as a developer for that market floor and the VAMC will then become the first capable and competent candidate for the job of buying and selling debt.

But, I’m sorry to say until now we have not got a legal framework for forming a buying and selling debt market. Decree 42 is just simply an opener for the setting up of the selling and buying debt market. Such a market, just like the stock market, needs specific regulations governing its operation to make sure all activities are in line with Vietnamese laws and regulations. Adding to that, we should provide a good infrastructure for the market to operate.

A key mission of the VAMC is to buy and sell bad debts from the banks. Yet, the VAMC’s charter capital is VNĐ 2 trillion (US$86 million). With such small charter capital how can the VAMC carry out its tasks?

I can’t agree more, such charter capital of $86 million is too small for the VAMC to operate. In my opinion, the Government should raise the VAMC’s charter capital and give it the right to borrow money from the foreign banks or credit institutions if necessary. But in such a case, the State Bank of Việt Nam will act as the guarantor for the VAMC to borrow the money. I already mentioned this issue five years ago.

At present, VAMC buys bad debts through the issuance of special bonds. I don’t think such a practice is appropriate. In my opinion, VAMC’s charter capital should be raised to VNĐ 20 trillion ($860 million). The other option, in my opinion, is that the VAMC will become a joint stock company and the investors may include foreigners.

Last but not least, I think that the VAMC may play a key role in the market of buying or selling of debts or even create a transaction floor for selling and buying debts as a private company if Việt Nam really wants to have a market for buying and selling debts, as has been written in Government Decree 42. — VNS