Finance ministers and central bankers from the G-7 kicked off meetings in Japan on Friday that could highlight a divide among the club of rich nations over currency policy and how to rev up global growth.

SENDAI, Japan - Finance ministers and central bankers from the G-7 kicked off meetings in Japan on Friday that could highlight a divide among the club of rich nations over currency policy and how to rev up global growth.

The two days of talks will see host Japan keen to win an endorsement for its position that fiscal stimulus is the way to kickstart the world economy, after a rally in the yen hit the country’s exporters and worsened a slowdown at home.

But Tokyo’s threat of a market intervention to reverse the rally could put it on a collision course with other G-7 nations, including the United States and Germany which have ruled out such moves.

French Finance Minister Michel Sapin, attending the talks at a famous hot spring resort in a region badly damaged by the 2011 quake-tsunami disaster, also waved off the idea of countries gaining a trade advantage by manipulating their own currencies.

"Today we are in a cooperation phase, and not in an intervention or a currency war phase," he said.

The G-7 group -- also including members from Britain, Canada, and Italy -- will try to hammer out a strategy for keeping a global recession at bay.

In April, the International Monetary Fund cut its forecast for world growth for the third time in less than a year, as a slowdown in China and other emerging economies raised fears that the worst was yet to come.

"Proactive financial policies and monetary easing are necessary, but not enough," said Ivan Tselichtchev, an economics professor at Japan’s Niigata University of Management.

"The G-7 has to do more to pursue structural reforms, to raise economic efficiency,...to boost investment, including investment from large emerging countries."

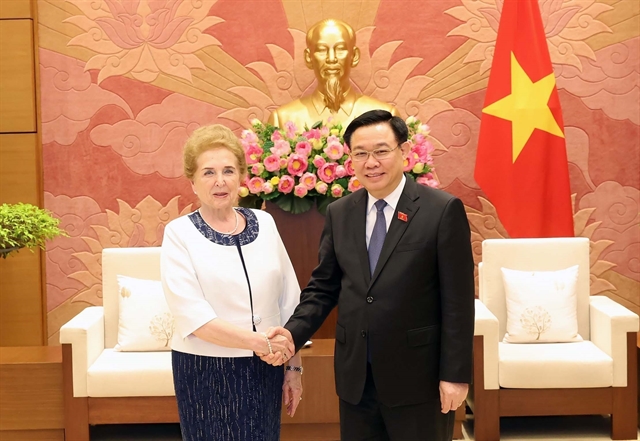

Among those attending the talks this week are US Treasury Secretary Jacob Lew, European Central Bank president Mario Draghi, and IMF chief Christine Lagarde.

The group will meet behind closed doors and tour an area hit by the quake-tsunami disaster on Friday afternoon.

Money laundering

Terrorist financing and offshore tax havens at the heart of the Panama Papers investigation will be discussed.

A debt relief deal for Greece and Britain’s referendum on its future in the European Union could also be on the agenda.

"As uncertainty about the world economy has increased, macroeconomic policies and structural reforms" will be discussed, Japanese Finance Minister Taro Aso told an opening reception on Thursday.

"And as we saw with the Panama Papers situation, we are keenly aware that there is a lot of attention focused on things such as tax avoidance and money laundering."

However, finding agreement on how the group can stimulate their own economies, and global growth, could be a challenge.

Premier Shinzo Abe’s pitch for large-scale stimulus spending got a cool response from German Chancellor Angela Merkel and British Prime Minister David Cameron this month.

Merkel suggested Germany was already doing its part to put the global economy back on track, pointing to the extra economic activity generated by the arrival of one million refugees and migrants last year.

Her Finance Minister Wolfgang Schaeuble this week pointed to reforms as the way forward, rather than focusing on more government spending and monetary policy.

The finance ministers’ meeting comes a week before a G-7 leaders’ summit in Ise-Shima, a region between Tokyo and Osaka. -- AFP